Eximbank welcomes "new wind"

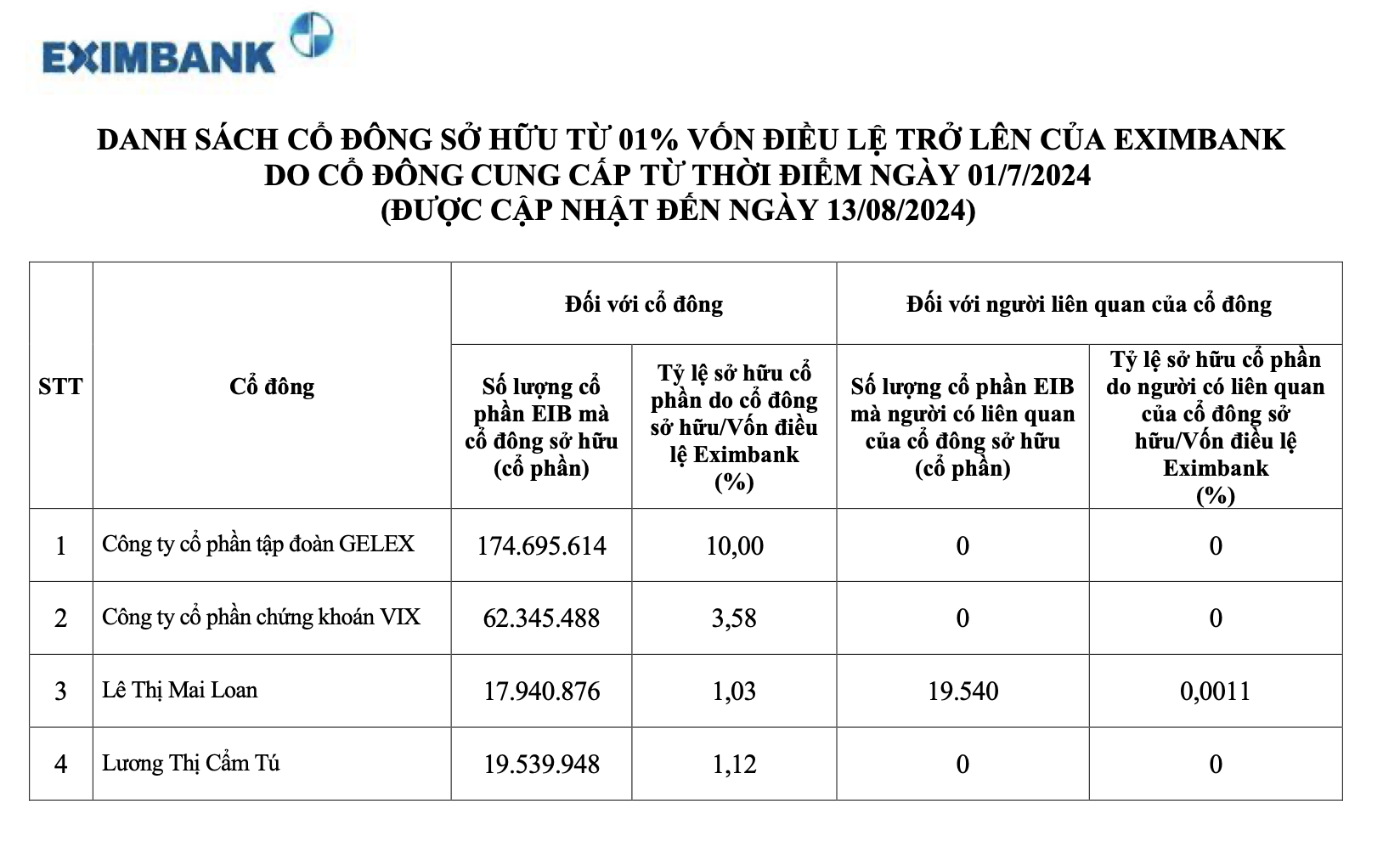

Vietnam Export Import Commercial Joint Stock Bank (Eximbank - HoSE: EIB) has just updated the list of shareholders owning 1% or more of the bank's charter capital.

Accordingly, Gelex Group Corporation currently owns nearly 174.7 million EIB shares, equivalent to 10% of the bank's capital. This is also the maximum amount that institutional shareholders are allowed to own according to the Law on Credit Institutions 2024.

Previously, on August 7-8, 2024, Gelex bought 50 million and 39 million EIB shares respectively through trading on the Ho Chi Minh City Stock Exchange.

After completing the transaction, Gelex's ownership increased from 85.5 million shares, accounting for 4.9% to 174.6 million shares, equivalent to 10% of the bank's charter capital.

Before Gelex's presence at Eximbank, Sumitomo Mitsui Banking (SMBC) was a strategic shareholder of the bank with a 15% ownership ratio.

List of Eximbank shareholders owning 1% or more of capital.

Established in 1990, Gelex Group owns companies such as: Viglacera, CADIVI Electric Cable, EMIC Electrical Measuring Equipment, THIBIDI Transformer... As of the end of June 2024, the company has a charter capital of VND 8,515 billion, equity of nearly VND 22,300 billion and total assets of more than VND 52,400 billion.

In addition to the presence of Gelex, another notable name appearing at Eximbank is Mr. Nguyen Ho Nam, who was appointed as Vice Chairman of the Board of Directors of this bank. Mr. Nam was previously Chairman of the Board of Directors of Bamboo Capital.

Bamboo Capital is a multi-industry corporation with more than 60 affiliated companies (focusing on renewable energy, real estate, construction and finance. As of June 2024, Bamboo Capital has equity of VND 21,300 billion and total assets of more than VND 45,300 billion.

Eximbank welcomes new major shareholder amid positive signals in business performance. At the end of the first 6 months of 2024, Eximbank recorded net interest income of VND 2,870 billion, up 23%. The bank reported after-tax profit of nearly VND 1,119 billion, up 4.6% compared to the first 6 months of 2023.

At the same time, Eximbank also plans to pay cash dividends from accumulated undistributed profits until 2023 after setting aside funds of VND552 billion.

Since 2014, after a decade, Eximbank shareholders have received cash dividends again. After paying a cash dividend of 4% in 2024, during the period from 2015 to 2023, Eximbank did not pay any cash dividends.

What is the chance for "rebirth"?

However, the question is whether the above group of shareholders can help Eximbank return to its "golden" period?

Eximbank was established in 1989, originally named Vietnam Export Import Bank with registered charter capital of 50 billion VND, and is one of the first joint stock commercial banks in Vietnam.

Going forward, after more than 3 decades, the bank's charter capital has only stopped at a medium level with nearly 17,470 billion VND.

However, there was a time when Eximbank showed its strong resilience. Specifically, in the period from 2007 to 2011, this bank had impressive growth results when total assets increased from 33,710 billion VND at the end of 2007 to 183,567 billion VND at the end of 2011. Within 5 years, the bank's asset size increased nearly 5.5 times.

At the same time, Eximbank's profit also increased sharply, from pre-tax profit of VND629 billion in 2007 to VND4,056 billion in 2011.

However, by 2012, the above profit level decreased to 2,851 billion VND and gradually declined. In 2014 and 2015, Eximbank even reported pre-tax profit of less than 100 billion VND.

During the period from 2015 to 2021, Eximbank's total assets and profits gradually recovered but still could not return to the previous period.

There was a time when there was a dispute between groups of shareholders to gain control of the bank. This was demonstrated by the constant changes in the upper echelons at Eximbank.

From April 2019 to September 2021, Eximbank even left the position of General Director vacant. In September 2021, after 2 years, Eximbank's Board of Directors officially appointed Mr. Tran Tan Loc to the position of General Director. Currently, Mr. Nguyen Hoang Hai is holding the position of Acting General Director of the bank.

From 2019 to 2022, Eximbank repeatedly failed to organize the General Meeting of Shareholders, leading to the inability to pass decisions under the authority of the General Meeting of Shareholders, documents related to the bank's business activities and development strategies.

In the 2019 extraordinary shareholders' meeting document, in the petition letter requesting Eximbank to seek the State Bank's opinion on organizing the bank's extraordinary shareholders' meeting and recommending adding a member to the Board of Directors, Eximbank's shareholders also said they felt worried and insecure when the bank's shareholders' meetings were consecutively unsuccessful and could not pass any content.

This shows that Eximbank's shareholders do not share the same views, are not unanimous, and the conflicts and contradictions that exist between shareholders are getting deeper and deeper, leading to unsuccessful bank meetings, causing waste of money, time, human resources, affecting the rights of genuine shareholders.

Over the past 9 years, the "hot seat" of Eximbank's Board of Directors has also been constantly changing. From Mr. Le Hung Dung to Mr. Le Minh Quoc, Ms. Luong Thi Cam Tu. Then back to Mr. Le Minh Quoc, to Mr. Cao Xuan Ninh, Mr. Yasuhiro Saitoh, Mr. Nguyen Quang Thong. The cycle continued when Mr. Yasuhiro Saitoh once again took over the position of Chairman. Next were Ms. Luong Thi Cam Tu, Ms. Do Ha Phuong.

On April 27, Eximbank officially dismissed Ms. Do Ha Phuong from her position as Chairman of the Board of Directors, which was approved by the Board of Directors on April 26, 2024. At the same time, Mr. Nguyen Canh Anh was appointed as Chairman of the Board of Directors for the 7th term (2020-2025).

Welcoming the new Chairman and new major shareholder, the above two factors are expected to create big changes in the near future at Eximbank.

In the latest analysis, MB Securities forecasts that Eximbank's credit growth in the 2024 - 2025 period will be positive, with the main growth driver coming from wholesale and retail lending (accounting for 36% of the bank's loan structure in 2023).

MB Securities assesses that Eximbank's asset quality will gradually improve over the quarters. Eximbank's bad debt coverage ratio will increase sharply in 2025.

Source: https://www.nguoiduatin.vn/chuong-moi-ky-vong-moi-o-eximbank-204240814203432195.htm

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)