VN-Index has been in the green for 14 out of 23 years in the 5 sessions after Tet holiday, with expectations that this year the index could surpass 1,200 points when individual investors return.

In its 23-year history, the VN-Index has often had a positive start when trading resumed after the Lunar New Year holiday. According to VNDirect statistics, if calculated in the first trading week (the first 5 sessions after the Tet holiday), the HoSE index increased in 14/23 years.

If we consider the period 2015-2023, only in 2020 and 2022 did the VN-Index start the new year in red, the remaining 7 years the index increased points. In the first month after the Tet holiday, green also dominated 13/23 years.

Before the Tet holiday, individual investors tend to take profits to protect their achievements, withdrawing money from the market to rest assured. This cash flow will usually return after the holiday ends, helping the market trade more actively.

"The market tends to decrease in the month before the holiday, but in the month after the holiday, the main trend is positive," VNDirect's report said.

In the last trading session of the Year of the Cat, the HoSE index increased by more than 10 points, approaching the threshold of 1,200 points. The pulling force of the banking group, real estate, and the mid-cap segment helped the market to flourish.

Assessing the market after the holiday, Saigon - Hanoi Securities Company (SHS) said that VN-Index may fluctuate around the 1,200-point resistance level and accumulate more to increase internal strength before being able to overcome this resistance level.

"The market's medium-term trend is to accumulate and move towards a new balance before needing more macro signals and cash flow to support a new growth phase. However, the accumulation period is expected to be long and the medium-term accumulation channel of the VN-Index will be in a wide range from 1,150 points to 1,250 points," said the SHS report.

According to VNDirect, the VN-Index has surpassed the important resistance level of 1,150 points, thereby ending the previously formed correction. However, market liquidity has not improved much, indicating that the index has not yet formed a strong upward momentum.

Liquidity may be positive in the second half of February, when individual investors gradually return to the stock market after the Lunar New Year holiday. Increased domestic capital inflows may boost the index's upward momentum, towards the psychological resistance zone of 1,200-1,220 points this month.

Minh Son

Source link

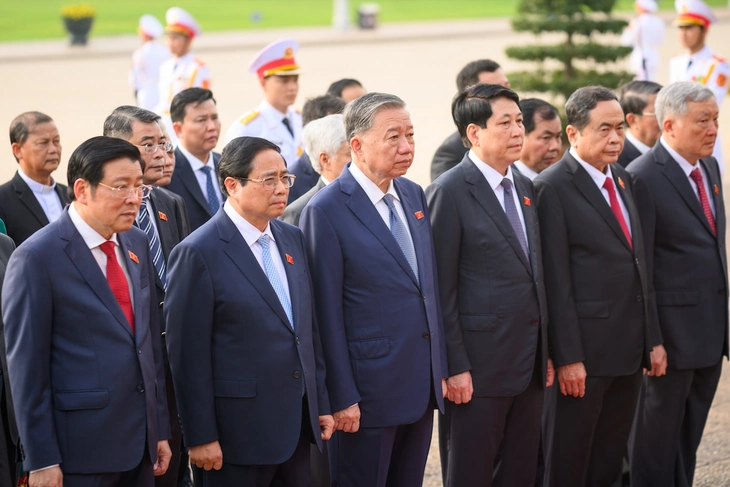

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)