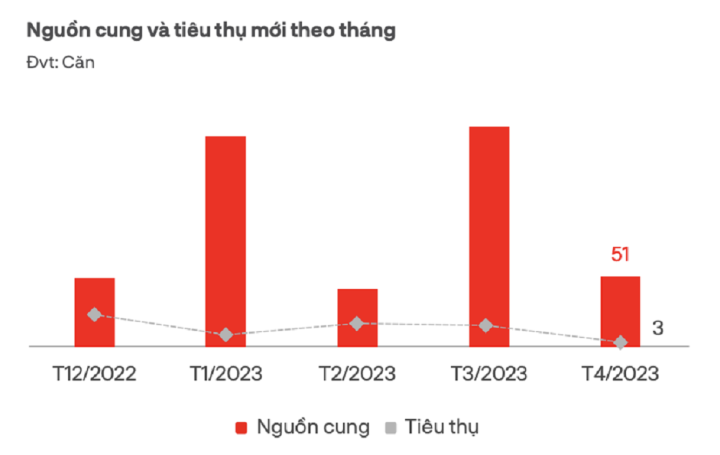

According to DKRA's report, the townhouse and villa market in Ho Chi Minh City and surrounding areas (Binh Duong, Dong Nai, Ba Ria - Vung Tau, Long An and Tay Ninh) recorded only 4 projects opening for sale in April, equivalent to 51 units, down 97% compared to the same period last year.

Of which, the market has only one new project, the rest are projects opening for sale in the next phase. Long An is the area that accounts for the majority of new supply with 25 units, accounting for up to 49%. Following are Binh Duong (39.2%) and Ho Chi Minh City (11.8%).

New supply and consumption for townhouses and villas in Ho Chi Minh City and surrounding areas in April. Photo: DKRA.

In particular, many investors have launched discount policies of up to 20% and committed to re-leasing within 1 year to stimulate the market. The primary price level also recorded a decrease of 8-10% compared to the opening sale 6 months ago.

In terms of selling prices of new supply, Ho Chi Minh City continues to lead with prices ranging from VND13.9-50.1 million/m2. Followed by Long An (VND3.8-7.7 million/m2) and Binh Duong (VND1.5-1.8 million/m2).

On the other hand, secondary selling prices did not show much improvement compared to last month. The market still saw a large number of “break-even, profit-cutting” transactions among investors who borrowed money from banks.

Although the prices of many townhouse and villa projects have decreased, market demand remains very low with only 3 new units sold, down 99.7% compared to the same period last year. The absorption rate is only 6%. Of which, all the products sold are concentrated in Long An.

This result shows that the situation is less positive than in the first 3 months of this year. DKRA's report said that the market recorded 54 successful transactions in the first quarter. The absorption rate was at 14%. Notably, the consumption was mainly concentrated in projects with prices under 3 billion VND/unit.

Assessing the situation in the second quarter, this unit forecasts that new supply will continue to trend sideways compared to the first quarter, fluctuating around 350-400 units. In particular, Binh Duong will continue to be a bright spot in the market as this province is expected to lead in supply.

Not only that, market demand may not fluctuate much due to general economic difficulties. The secondary market will also not have many sudden changes in liquidity. In addition, the primary selling price level is forecast to increase slightly compared to the first quarter due to the impact of input costs.

(Source: Zing News)

Useful

Emotion

Creative

Unique

Wrath

Source

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)