Personal income tax is the amount of money that income earners must pay from a portion of their salary, or from other sources of income, into the state budget after deductions. Personal income tax is not levied on low-income individuals, so this tax will be fair to all, contributing to reducing the gap between social classes.

There are two types of individuals who must pay personal income tax: Residents and non-residents in Vietnam with taxable income. Specifically, for residents, taxable income is income generated within and outside the territory of Vietnam (regardless of where the income is paid). For non-residents, taxable income is income generated in Vietnam (regardless of where the income is paid and received).

In many cases, selling a house to a relative does not require paying personal income tax. (Illustration: Minh Duc)

Pursuant to Clause 1, Article 4 of the current Law on Personal Income Tax, income from real estate transfer of the following subjects will be exempt from personal income tax:

1. Husband and wife.

2. Biological father, biological mother and biological child.

3. Foster father, foster mother with foster child.

4. Father-in-law, mother-in-law and daughter-in-law.

5. Father-in-law, mother-in-law and son-in-law.

6. Grandfather, grandmother with grandchildren.

7. Grandparents with grandchildren.

8. Brothers and sisters.

Pursuant to Clause 1, Article 4 of Decree 65/2013/ND-CP, the real estate mentioned above includes houses and construction works formed in the future according to the provisions of the law on real estate business. Thus, if you sell real estate to relatives (in the above cases), you will not have to pay personal income tax.

In addition, according to Clause 2, Article 4 of Decree 65/2013/ND-CP, income from the transfer of housing, land use rights and assets attached to land of individuals in cases where the transferor has only one house or land use rights in Vietnam is exempt from personal income tax.

Individuals transferring only one house and land use rights in Vietnam as prescribed in this clause must satisfy the following conditions:

- At the time of transfer, an individual only has the right to own and use one house or one plot of land (including cases where there is a house or construction attached to that plot of land).

- The time an individual has the right to own and use a house or land up to the time of transfer is at least 183 days.

- Housing and land use rights are transferred in full.

The determination of ownership and right to use houses and land is based on the certificate of ownership and right to use houses and land. Individuals who have transferred houses and land are responsible for declaring and are responsible before the law for the accuracy of the declaration. In case the competent authority discovers an incorrect declaration, they will not be exempted from tax and will be handled according to the provisions of law.

Selling a house to a relative also brings certain benefits and risks. The benefit is that the transaction often has an easy agreement on price, sometimes preferential or not according to market price. Because of the close relationship, the parties often have an easier time preparing documents and carrying out procedures.

The risk, although rare, is that disputes may arise later if the rights and obligations of each party are not clear. Regardless of whether you are a relative, if you are not exempt from tax under the law, you still have to fulfill your tax obligations.

Therefore, when selling a house to relatives, you need to pay attention to keeping all agreements and contract terms clear. Make sure you understand the relevant legal regulations to avoid unwanted legal consequences. You can consult a lawyer or tax expert for more detailed advice on tax rights and obligations.

Although selling a house to relatives can bring certain benefits, it is still necessary to comply with the provisions of personal income tax law. This not only helps you avoid legal troubles but also protects the rights of all parties involved in the best way. Always be careful and transparent in all transactions to maintain good relationships with relatives.

Source: https://vtcnews.vn/co-phai-ban-nha-cho-nguoi-than-se-khong-phai-dong-thue-thu-nhap-ar909508.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

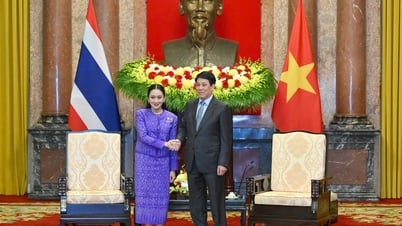

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)