ANTD.VN - The real estate market is receiving a series of new impulses, both from macro management policies as well as stimulus levers from investors. The most prominent is the Vinhomes low-rise product line with a minimum compound profit of 16%/year - far exceeding savings interest rates and safer than gold investment.

Supply decreases, prices increase

According to the 2023 Law on Real Estate Business, from August 1, 2024, land use rights will not be transferred to individuals who build houses or divide and sell plots of land in wards, districts, and cities of special-class, type I, II, and III urban areas.

Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, said that the new regulation is like a "filter" to help eliminate cases of applying for land for projects and then dividing and selling plots, which do not bring economic efficiency.

Meanwhile, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, commented that the tightening of land subdivision and sale may affect both the supply and the selling price of real estate. Specifically, the new regulation will cause the supply to the market to "shrink".

Notably, the real estate market will also pivot strongly when the 2024 Land Law stipulates the determination of land prices according to market principles.

“Housing prices will continue to increase, because the components of the product will be higher when the new law comes into effect,” Mr. Tuan predicted.

According to experts, the new land price list will increase land-related costs such as site clearance, land recovery compensation, land-related taxes and fees... In particular, the strongest increase will be in the low-rise segment because land use fees account for a large proportion, ranging from 25 - 50%.

"The land price list will have a chain reaction, triggering a 15-20% increase in real estate and housing prices compared to before," said the Ministry of Construction.

|

| New regulations give ready-to-handover projects an advantage in selling price |

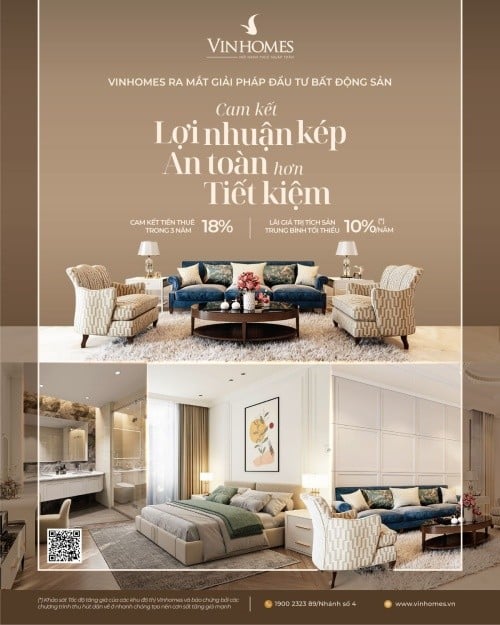

In the context of decreasing supply and increasing prices, projects that have completed licensing procedures for construction, especially projects that are ready for handover, will have an absolute advantage. This explains why Vinhomes' completed projects dominate the market. In particular, the investment capital flowing into the "Vin family" product basket is even stronger when there is an additional push from the program "Commitment to double profits - Safer than saving".

“Sleep well” with guaranteed profits from 16%/year

Considered a blockbuster in the real estate market at the end of the year, the program "Commitment to double profits - Safer than saving" is reserved for low-rise products with completed interiors in Vinhomes' major projects. Accordingly, as soon as they put down their money, investors will be assured of a profit of 6%/year when Vinhomes commits to a rental fee of 18% of the investment value for 36 months.

|

| Vinhomes' blockbuster policy brings practical and certain benefits to investors. |

Economist Dinh The Hien assessed that the 6%/year profit as committed by Vinhomes is higher and more certain than savings, when most banks currently only apply mobilization interest rates below 5 - 6%/year. Not to mention, that interest rate is also "eroded" by inflation, making the actual amount received by depositors insignificant.

Sharing the same view, Associate Professor Dr. Dinh Trong Thinh, Academy of Finance, said that the rental commitment level is really attractive, opening up great opportunities for investors. In addition, with Vinhomes' completed low-rise real estate, investors can see it in person before paying. Investors can even measure the potential for price increases of the product through the massive utility ecosystem and bustling business and commercial space that the investor creates in each project.

In particular, unlike the practice of “buying and selling” in the market, Vinhomes always accompanies customers and investors in increasing the value of real estate, through continuously adding amenities and creating attractive destinations to attract residents and tourists.

“Customers trust because in reality, they always see Vinhomes as it promises, from creating utilities, a complete ecosystem to management. The reputation of the Vinhomes brand is very high, helping Vinhomes real estate always increase in price well and sustainably. Compared to projects of other investors, buyers find the safety and certainty of Vinhomes real estate much higher,” Associate Professor, Dr. Dinh Trong Thinh assessed.

Data from Batdongsan.com.vn also shows that in the past 5-6 years, although the real estate market had to go through the Covid-19 pandemic and a long period of stagnation, Vinhomes real estate prices have steadily increased, commonly from 10% - 70% per year. For example, Vinhomes Ocean Park 1 and Vinhomes Green Bay projects (Hanoi) increased by 20% per year and 28.5% per year, respectively. Vinhomes Imperia (Hai Phong) increased by up to 50% per year. In particular, Vinhomes Riverside (Hanoi) increased by up to 70% per year.

|

| Vinhomes low-rise real estate in many projects recorded impressive price increases from 10% - 70% price/year |

From the above reality, Dr. Dinh The Hien believes that by owning Vinhomes low-rise real estate, investors will be sure to have in hand a compound profit many times higher than savings, and safer than gold investment channel.

In particular, in the last month of the year, low savings interest rates caused thousands of billions of VND to mature and “flow” out of the banking system. Combined with the real estate market pivoting after the new law, investors are directing cash flow to Vinhomes low-rise projects, which bring attractive and certain profits to investors.

Source: https://www.anninhthudo.vn/thi-truong-xoao-truc-sau-luat-moi-bds-thap-tang-vinhomes-chiem-song-voi-loi-nhuan-kep-tu-16nam-post598340.antd

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)