Dat Xanh Services Economic - Financial - Real Estate Research Institute (DXS FERI) has just released the Market Research Report for the second quarter and the first 6 months of 2023, showing that the picture of the real estate market continues to stagnate.

In the first 6 months of 2023, the Vietnamese real estate market faced major challenges, from the adverse impacts of the global and domestic economic, political and financial situation, to the fact that real estate law is still being tightened, with no specific measures to remove legal obstacles. Market confidence has not yet recovered strongly, causing difficulties for all market participants.

New real estate supply is almost non-existent.

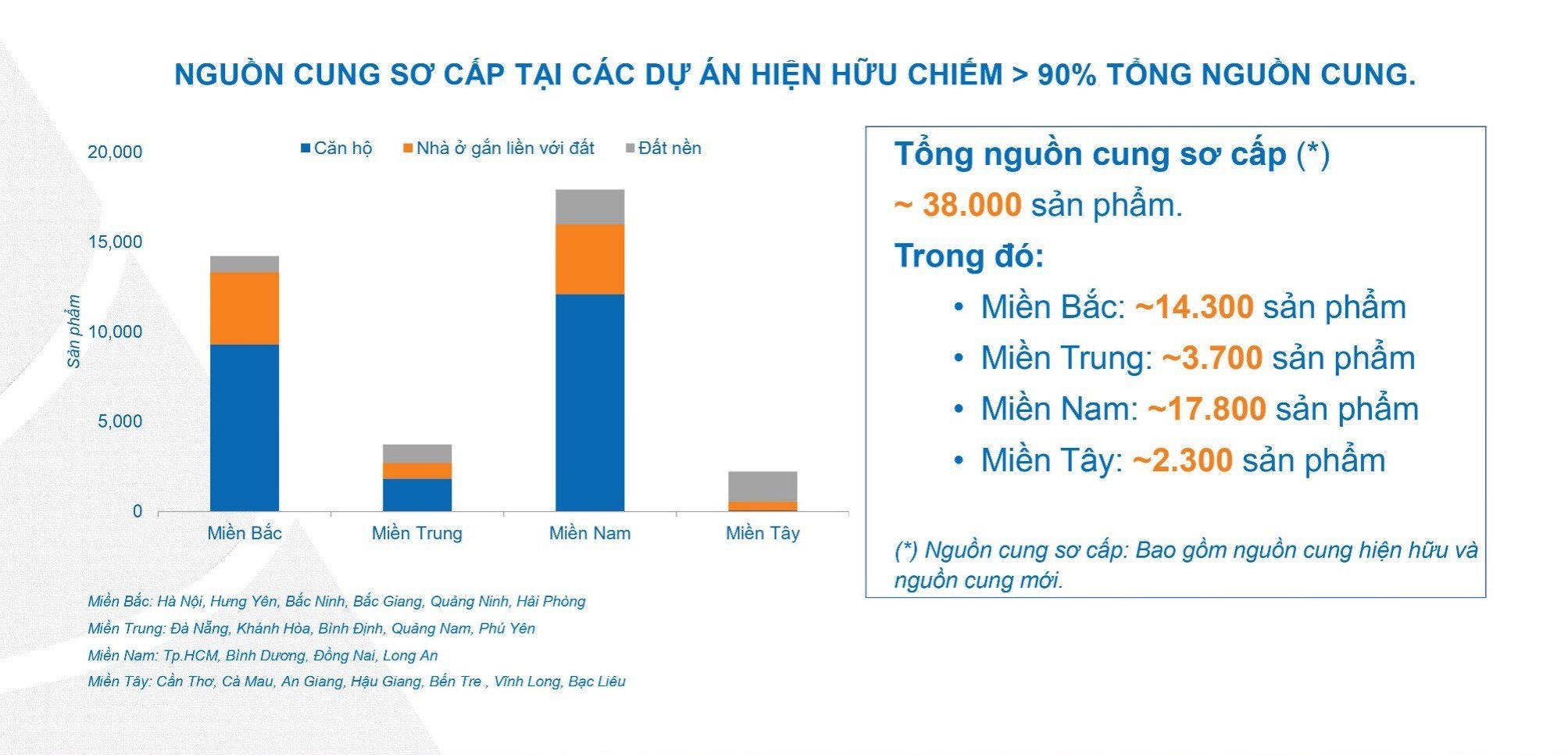

In terms of real estate supply, new supply in Hanoi and Ho Chi Minh City decreased by 89% in Ho Chi Minh City and 91% in Hanoi compared to the previous year. Accordingly, the number of new projects launched for sale also decreased sharply. Existing supply mainly comes from projects implemented many years ago, accounting for about 90% of total primary supply in key areas.

In Hanoi and neighboring areas, there are not many projects that can be launched. Apartments dominate the Hanoi market, mostly from small projects and projects that have delivered existing houses. In the first 6 months of 2023, the whole market generally had slow transactions.

In Ho Chi Minh City, the primary market mainly comes from apartments in the East of Ho Chi Minh City, down 70% compared to the same period last year. In Ho Chi Minh City, Binh Duong, Dong Nai, and Long An, the supply of apartments is limited, mainly coming from the next phase of old projects.

Real estate supply on the market.

Comparing the two major markets of Hanoi and Ho Chi Minh City, the new supply of apartments recorded a sharp decrease. In Hanoi, only about 500 products were available, down 91% year-on-year, mainly from small projects to explore the market. Ho Chi Minh City reached about 1,800 products, down 89% year-on-year.

Both regions recorded an increase in the average primary selling price of apartments, with Hanoi ranging from 42-55 million VND/m2, up 3-5% year-on-year; with Ho Chi Minh City ranging from 60-80 million VND/m2, up 2-3% year-on-year. The absorption rate of apartment products in Hanoi reached about 15%, highlighted by the interest of foreign customers.

The absorption rate of apartment products in Ho Chi Minh City is about 20%, in which new projects such as Elysian, The Avatar, 9x An Suong have an absorption rate of 50% - 60%.

In the Central market, there are also not many positive signals when the supply mainly comes from existing projects, there are no new projects.

The Western region is currently experiencing limited supply of commercial apartments, however, it is expected that there will be a supply of commercial apartments in this region from the end of 2023.

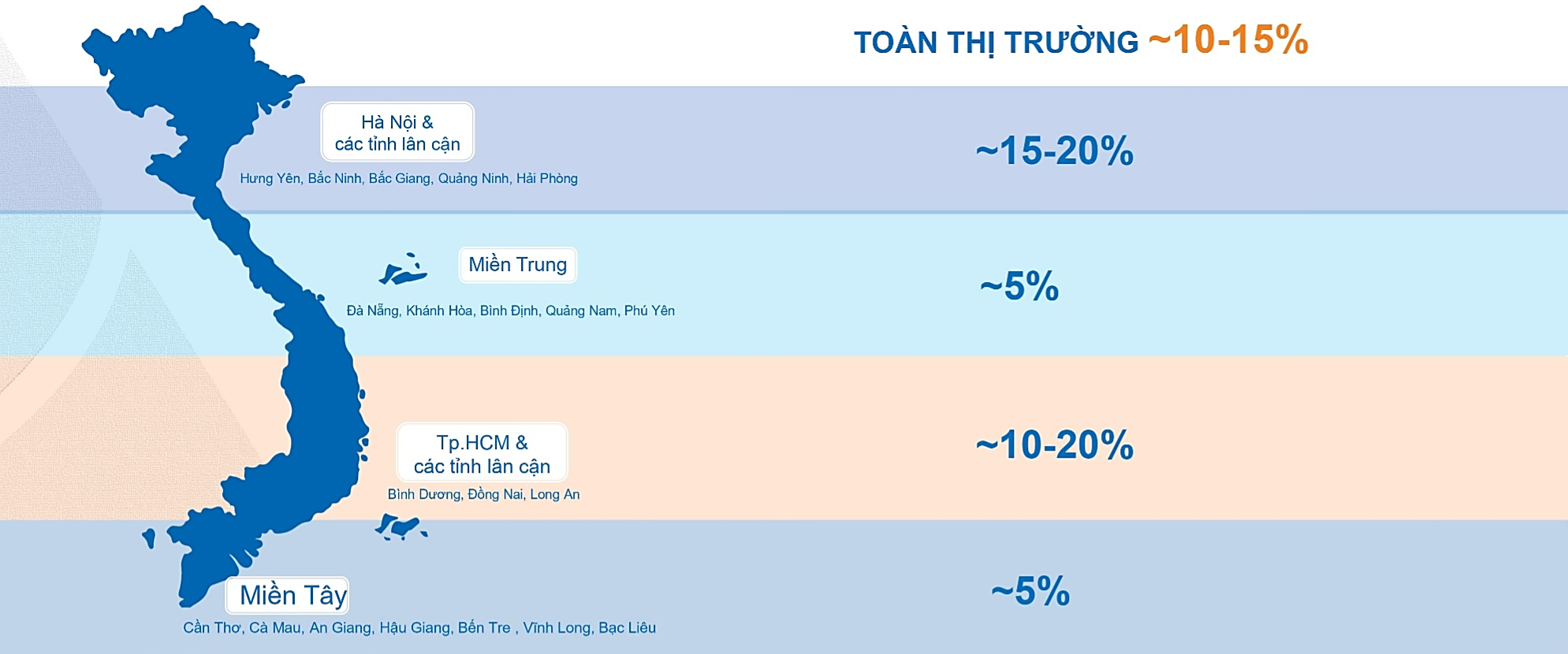

Total real estate market absorption rate.

Considering the whole market, the general absorption rate is around 10 - 15%, in which: the North has the highest absorption rate, at 15 - 20%; the Central and Western regions have very low absorption rates, only about 5%; and the absorption rate in Ho Chi Minh City and neighboring provinces fluctuates around 10 - 20%.

“The difficulties that lasted from the end of 2022 to the first half of 2023 are clearly reflected in indicators of scarce new supply and very low absorption rates. Specifically, after the first 6 months of the year, the overall supply still decreased by 50-60%, the average selling price decreased by 20-30%, and the absorption rate of the whole market reached 10% - 15%,” DXS FERI commented.

The number of dissolved real estate businesses has increased sharply.

In the first 6 months of the year, the real estate business group was among the group with the highest rate of dissolved businesses, increasing by 30.4%, but had the lowest number of newly established businesses in the country (61.4% year-on-year).

According to DXS FERI, the real estate market in the first 6 months of 2023 continues to face major challenges, in which legal problems are considered a bottleneck of the market for many years and there are still no specific measures to resolve.

The sluggish sales have put both investors and trading floors in a very difficult situation. By the end of June 2023, the number of brokers in the real estate market had decreased by 60% - 70% compared to the end of 2023.

According to a survey by DXS FERI on individual brokers working at brokerage floors, the results showed that 71% of brokers will continue to stick with the profession, 19% of respondents answered that they will work as real estate brokers while finding another job to stabilize their lives, and 10% of brokers plan to switch to another industry.

Real estate business dissolution is increasing, the number of brokers is decreasing.

Of the 480 real estate agents surveyed who had quit their jobs, only 52% had no intention of returning to the real estate industry in 2023, while 36% would return when the market recovered.

FERI said that when a large number of brokers leave the market, it is also the time when investors have to "launch tricks" to find sellers. The way investors do this is to launch special policies to attract brokers such as increasing brokerage fees, increasing hot bonuses, expanding bonus conditions, increasing marketing and customer care costs, paying brokerage service fees weekly or immediately within 48 hours of checking transactions.

Scenario for the last 6 months of the year

Commenting on the market in the last 6 months of the year, DXS - FERI continues to present 3 scenarios, including: Ideal scenario (Supply increases, interest rates decrease sharply to below 10 - 12%, selling prices increase slightly, absorption rate increases quite well from 40 - 50%);

Expected scenario (Supply increases slightly, interest rates decrease slightly to around 11-13%, selling prices remain stable, while absorption rate increases by 20-30%) and challenging scenario (Supply will continue to decrease by 20-30%, interest rates continue to remain high >14%, selling prices decrease by 10-20%).

However, Dat Xanh's research institute has also ruled out the ideal scenario from the beginning because it is not feasible in the near future. The market can only expect a gradual shift from the challenging scenario to the expected scenario and clearer results are expected to be seen in the first half of 2024.

“There are many indicators showing that market confidence will gradually return from late 2023 and early 2024 when government policies will begin to take effect, which will also be the driving force for the next phase of the market,” said DXS – FERI experts .

Source

![[Photo] General Secretary To Lam receives First Deputy Secretary General of the African National Congress (ANC) of South Africa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/bb2999907e1245d5b4c7310a890d8201)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

Comment (0)