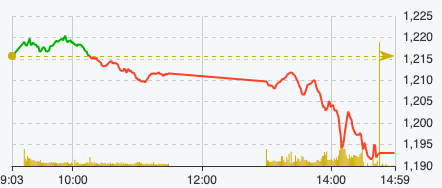

The market opened slightly higher but quickly reversed to decrease after only 1 hour of trading due to investors' hesitation. The buyers failed to push the index above the 1,220 point mark in the first half of the morning session.

VIC contributed the largest decrease in the market with more than 1 point, closely followed by CTG as the second largest negative impact on the market, followed by GVR, HDB, MBB... On the contrary, codes VCB, MSN, VNM or GMD still tried to increase in price, creating support for the market.

At the end of the morning session on April 17, VN-Index decreased by 4.05 points, equivalent to 0.33% to 1,211.63 points. The entire floor had 191 stocks increasing and 227 stocks decreasing.

VN-Index performance on April 17 (Source: FireAnt).

Entering the afternoon session, the selling side dominated, causing the market to plummet, the electronic board was filled with red and the VN-Index officially "broke" the 1,200 point mark.

At the end of the trading session on April 17, VN-Index decreased by 22.67 points, equivalent to 1.86% to 1,193.01 points. The entire floor had only 137 stocks increasing but 348 stocks decreasing, 57 stocks remaining unchanged.

HNX-Index decreased by 2.63 points to 226.2 points. The entire floor had 73 stocks increasing, 98 stocks decreasing and 62 stocks remaining unchanged. UPCoM-Index decreased by 0.48 points to 88.15 points. In the VN30 basket alone, 26 stocks decreased in price.

The large-cap group was the burden of the market when the top 10 stocks that negatively affected the index alone took away nearly 13 points, including 7 banking stocks. BID and CTG led the pull when they took away nearly 3.1 points and 1.8 points, respectively. Following them were VPB, MBB, VCB, VIB, and TCB in the banking group, respectively, and reduced the index by a total of 4.2 points.

After a session of trying to "carry" the market, the chemical group also reversed, with the largest GVR falling 5.6% and taking away nearly 1.7 points from the general index. Other codes in the industry were also negative, such as DGC, DCM, DPM, LAS. The bright spot was QBS going against the trend and maintaining its ceiling price.

Although there were still some stocks hitting the ceiling price such as QCG, AAV, OGC, CCI and a few stocks gaining points, the two stocks VIC and VHM of Vingroup pulled the real estate group down deeply. These two stocks took away a total of 2.3 points from the general market, in addition, some stocks that decreased in points include NVL, DIG, DXG, PDR, CEO, VRE, KBC, HQC, ...

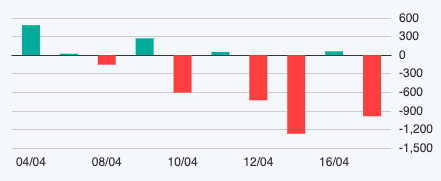

Foreign block transaction developments.

The total order matching value in today's session was VND21,431 billion, down 37% compared to yesterday, of which the order matching value on the HoSE floor reached VND19,106 billion. In the VN30 group, liquidity reached VND7,835 billion.

Foreign investors returned to net selling with a value of 987.5 billion VND today, of which this group disbursed 1,649 billion VND and sold 2,636 billion VND.

The codes that were sold heavily were FUEVFVND fund 340 billion VND, VHM 146 VND, SHB 95 billion VND, MSN 67 VND, MSN 67 billion VND,... On the contrary, the codes that were mainly bought were VNM 106 billion VND, GMD 62 billion VND, MWG 28 billion VND, SSI 23 billion VND, ACV 18 billion VND,... .

Source

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)