The Board of Directors of An Binh Commercial Joint Stock Bank (ABBank - UPCoM: ABB) has just approved the plan to issue private bonds for the second time in 2023.

Specifically, ABBank plans to issue VND5,000 billion in private bonds with a face value of VND100 million/bond. The bond term is from 1-5 years, the specific term is decided by the General Director at each issuance.

Bonds are issued in book-entry form with nominal interest rates also decided by the General Director and equivalent positions, ensuring compliance with market interest rates and regulations.

This is a non-convertible bond, without warrants and is not secured by the assets of the Issuer. The bond buyers are professional securities investors including Vietnamese organizations (including credit institutions, foreign bank branches), and foreign organizations according to the law.

The issuance method is to sell directly to investors and/or through an issuing agent. The bond principal is paid once on the maturity date or on the date ABBank buys back the bond. Interest is paid periodically every year, once a year.

The maximum number of bond issuances is expected to be 10, with the expected issuance volume of each issuance being a maximum of VND 2,000 billion. The specific issuance quantity, volume and timing will be decided by the General Director. The expected issuance period is from November 1 to December 31, 2023.

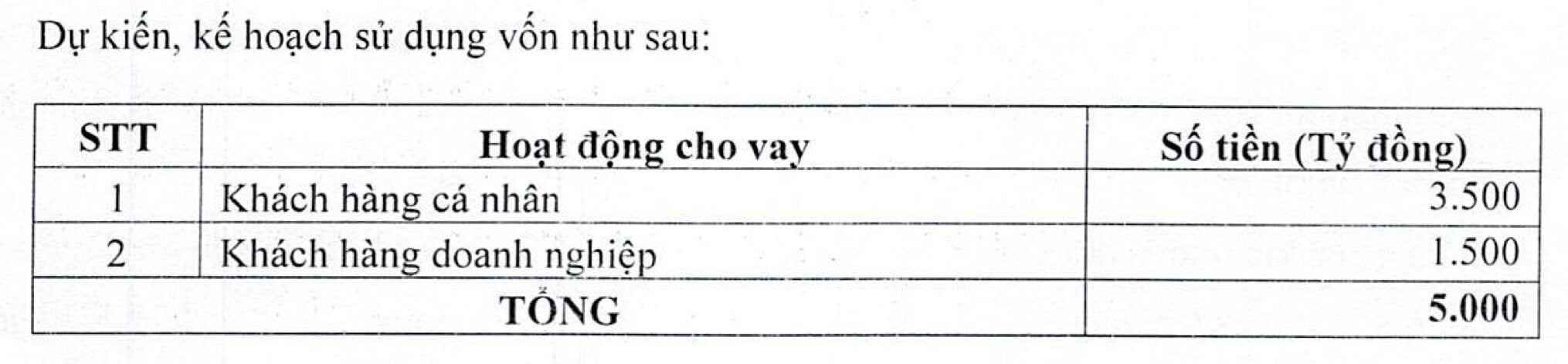

The proceeds from the bond issuance will be used by ABBank to lend to individual and corporate customers. The capital raised from the bond issuance will be used before March 31, 2024.

Of which, ABBank plans to use 3,500 billion VND for lending to individual customers and 1,500 billion VND for lending to corporate customers.

In case of disbursement according to schedule, the capital collected from the issuance of temporarily idle bonds will be used to deposit at the State Bank and other credit institutions.

Previously, in August, ABBank's Board of Directors also approved the plan to issue individual bonds in the first phase in 2023 with a total issuance value of VND 6,000 billion. ABBank will use VND 4,500 billion of the capital raised for customer lending activities and VND 1,500 billion for corporate lending .

Thu Huong

Source

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)