An Binh Commercial Joint Stock Bank (ABBank - UPCoM: ABB) has just announced information on the results of early bond buyback.

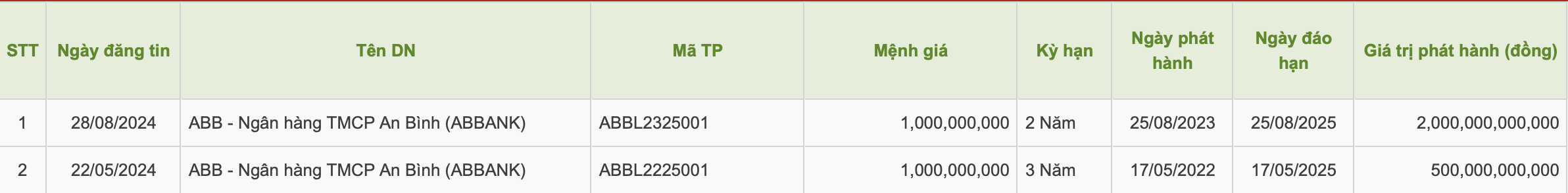

Accordingly, the bank has purchased back the bond lot ABBL2325001 with a total value of VND 2,000 billion, issued on August 25, 2023, with a term of 2 years, expected to mature in 2025. The issuance interest rate is 6.4%/year.

This is the second batch of bonds that ABBank has bought back before maturity in 2024. In May, the bank bought back bond code ABBL2225001 with a total value of VND500 billion. The bond was issued on May 17, 2022, with a term of 3 years and is expected to mature in 2025. The issuance interest rate is 4.4%/year.

Thus, this year, ABBank spent 2,500 billion VND to buy back bonds before maturity. The bank did not mobilize any more bond codes from the market.

Information on ABBank bonds bought back before maturity.

According to information from the Hanoi Stock Exchange, ABBank currently has a total of 9 bond lots still circulating normally on the market.

Of which, the bond lot with the largest value still in circulation is ABBL2325005 with a total value of VND 1,300 billion, issued on November 27, 2023, with a term of 2 years, expected to mature in 2025.

At the end of 2023, ABBank's Board of Directors approved the private issuance of VND 5,000 billion in bonds with a face value of VND 100 million/bond. The bond term is from 1-5 years, the specific term is decided by the General Director at each issuance.

This is a non-convertible bond, without warrants and is not secured by the assets of the Issuer.

Bond buyers are professional securities investors including Vietnamese organizations (including credit institutions, foreign bank branches), and foreign organizations as prescribed by law.

The proceeds from the bond issuance will be used by ABBank to lend to individual and corporate customers.

Of which, ABBank plans to use 3,500 billion VND for lending to individual customers and 1,500 billion VND for lending to corporate customers.

Regarding business performance, at the end of the first 6 months of 2024, ABBank recorded a 7% decrease in net interest income to VND 1,455 billion. The bank reported pre-tax net profit of VND 582 billion and after-tax profit of VND 465 billion, down 14% compared to the first 6 months of 2023.

As of June 30, 2024, ABBank's total assets were recorded at VND 152,145 billion, down 6% compared to the end of 2023.

Of which, customer loans reached VND89,613 billion, down 7.4% compared to the end of last year. Customer deposits reached VND85,516 billion, down 14.5%.

Source: https://www.nguoiduatin.vn/abbank-chi-2000-ty-dong-mua-lai-trai-phieu-truoc-han-204240828184746658.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)