Apartment supply increases in high-end segment

According to the real estate market report for the third quarter of 2023 recently released by CBRE, the number of new apartments for sale in Ho Chi Minh City reached 3,600 units, nearly 90% of the total new supply in the first 6 months of 2023, an increase of 27% over the same period last year.

This supply mostly comes from the next phase of existing projects. Notably, 60% of the new supply in the first 9 months of 2023 comes from an urban area project in the East. Therefore, the East of the City is still a bright spot in terms of new apartment supply.

According to the report, 96% of new supply in Q3/2023 will come from the high-end segment and the remaining 4% of new supply will be in the luxury segment, from the next phase of a project in Thu Thiem New Urban Area.

The report also noted that the primary selling price of the HCMC apartment market reached VND60.6 million/m2 (equivalent to more than USD2,500/m2) in the quarter, up 4% quarter-on-quarter and 1.9% year-on-year, mainly due to new supply in the luxury and high-end segments with price adjustments.

Apartment supply in the third quarter of 2023 is equal to 90% of the total supply in the first 6 months of the year.

Of which, the new supply in the luxury segment, with a limited number of units for sale, transparent legal status and prime location, has a primary price increase of 6% compared to the previous opening phase in 2022.

Similarly, investors in the high-end segment also adjusted prices up by an average of 3-4% compared to the opening sale period last year, along with product upgrades, home loan interest rate support, extended payment schedules, and rental commitments.

During this period, many investors have introduced different policies to attract customers, thus helping the market regain liquidity. This shows that although the market has not recorded a direct price reduction, the presence of sales policies with many incentives is indispensable in newly launched projects to ensure good absorption for the project.

In fact, attractive sales policies helped improve the absorption rate of new supply in the third quarter, reaching more than 2,600 units sold, equivalent to 55% of newly launched units and nearly double the absorption rate of the previous quarter.

In the secondary market, the average price reached VND45 million/m2, up 2.6% compared to the previous quarter but still 4% lower than the same period last year. Meanwhile, secondary prices in the luxury and affordable segments remained almost the same compared to the previous quarter.

Supply mainly comes from luxury apartment projects.

The quarterly increase was mainly due to the increase in secondary prices in the high-end and mid-end segments, as buyers sought delivered products at more reasonable prices compared to the primary market price. This was especially true for projects near the center such as Binh Thanh District and Thu Duc City, which benefited from the upcoming metro line.

According to Ms. Duong Thuy Dung - CEO of CBRE Vietnam, "Only entering the third month of the second half of 2023, the apartment market in Ho Chi Minh City has really had more positive changes in liquidity compared to the first half of the year. Typically, an urban area project with about 3,000 newly opened units in the third quarter of 2023 recorded a sales rate of over 50%, while another project next to the metro line sold out 20 shophouses in the podium within one morning."

Low-rise housing prices remain stable

CBRE's report also shows that primary prices of low-rise ready-built housing products remain stable at an average of VND255 million/m2 of land, due to limited new supply.

However, transactions and demand in the secondary market remain low, as there has been no significant change in average selling prices during the first 9 months of 2023 and investors remain in a "wait and see" mode amid continued financial pressure.

CBRE commented that the low-rise real estate segment is expected to improve in new supply from the fourth quarter of 2023 to 2024, mainly coming from urban areas in the East and South of Ho Chi Minh City such as An Hung Residential Area (Nha Be) or the next phase of The Global City (Thu Duc City).

In particular, mergers and acquisitions (M&A) deals this quarter have become more active, showing increasing interest from foreign investors in the Ho Chi Minh City real estate market.

The low-rise housing market alone has not seen many changes.

In addition, support from local authorities continues to be a driving force for the housing market. In particular, in the first 8 months of 2023, 67 projects in Ho Chi Minh City (37.2% of the total 180 projects with legal problems) have had their legal problems resolved.

In addition, regarding the VND120 trillion credit package to develop social housing, worker housing and renovate old apartment projects, one project has been approved to borrow capital from this package, out of six eligible projects in Ho Chi Minh City.

“Although in 2023 the housing market still has a large gap in supply and absorption rate compared to previous years, investors cannot ignore the positive signals of the market. Buyers are now having easier access to home loans as many banks have announced lower interest rates in the third quarter. Meanwhile, M&A and calling for investment from investment funds are helping investors find a way out for projects that are behind schedule due to lack of capital,” said Ms. Duong Thuy Dung, Managing Director of CBRE Vietnam.

Talking about future market trends, this expert also said that market difficulties are expected to last at least until the first half of 2024 and transactions will recover when macroeconomic, legal factors and homebuyer confidence improve.

Source

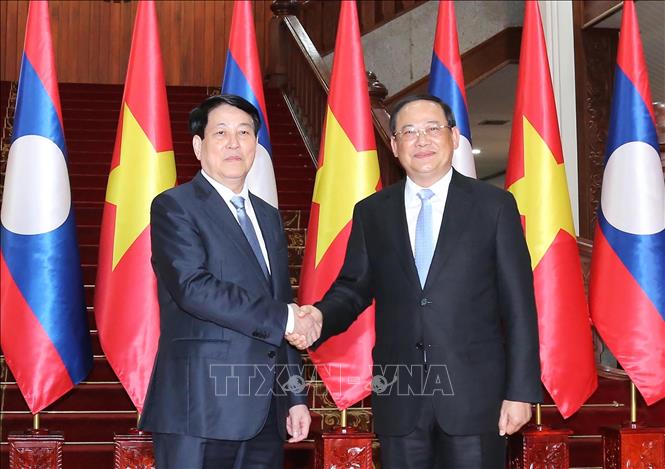

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)