On December 25, the Editorial Board of Economic News - Vietnam News Agency - announced 10 outstanding events of the world economy in 2023, in which the world gold price breaking an all-time high and the COP28 reaching a historic agreement on limiting fossil fuels are two of the events on this list. [caption id="attachment_604775" align="aligncenter" width="1280"]

Vietnamese trainees at the Sumitomo shipyard (Japan). Photo: Thanh Tung/VNS[/caption] Vietnam.vn would like to introduce 10 outstanding events of the world economy in 2023 as voted by the Editorial Board of Economic News - Vietnam News Agency.

- Global economic recovery slows down

The world's leading financial institutions believe that the world economy will grow lower than the 3.3-3.5% growth rate of 2022. The reason is the global financial "earthquake" originating from the US and Swiss banking crisis, along with the energy crisis, conflicts in Ukraine and the Middle East. Central banks in many countries must consider between raising interest rates to control inflation and stopping increases to support economic recovery.

- An "earthquake" in the global financial market

In just three days, March 10-12, two major US banks, Silicon Valley Bank and Signature Bank, ceased operations due to liquidity shortages as customers withdrew money en masse. On May 1, First Republic Bank became the third US bank to go bankrupt in nearly two months. In Europe, Credit Suisse, the second largest Swiss bank, is also at risk of bankruptcy. Timely financial support packages from governments and central banks have prevented a widespread banking crisis that could have led to an economic recession.

- Restricting rice exports, climate change threatens food security

On July 20, India - the world's largest rice exporter - suddenly banned the export of ordinary rice. The sudden cut in India's rice supply, combined with the impact of climate change and geopolitical conflicts, pushed the price of Thai rice, the Asian standard, to a 15-year high, creating a hoarding mentality in many countries. These factors have affected consuming countries, especially poor countries in Asia and south of the Sahara. The Global Food Security Summit in the UK proposed solutions towards sustainable food systems and climate change adaptation.

- COP28 reaches historic agreement on fossil fuel curbs

The 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) on December 13 made a major breakthrough when it included the issue of cutting fossil fuels in the joint statement for the first time. After nearly three decades of holding climate summits, these countries have reached a consensus on gradually shifting away from fossil energy sources, aiming to achieve the goal of net zero emissions by 2050. [caption id="attachment_604803" align="aligncenter" width="1280"]

Euglena's biofuel production plant in Yokohama (Japan). Photo: Thanh Tung/VNS[/caption]

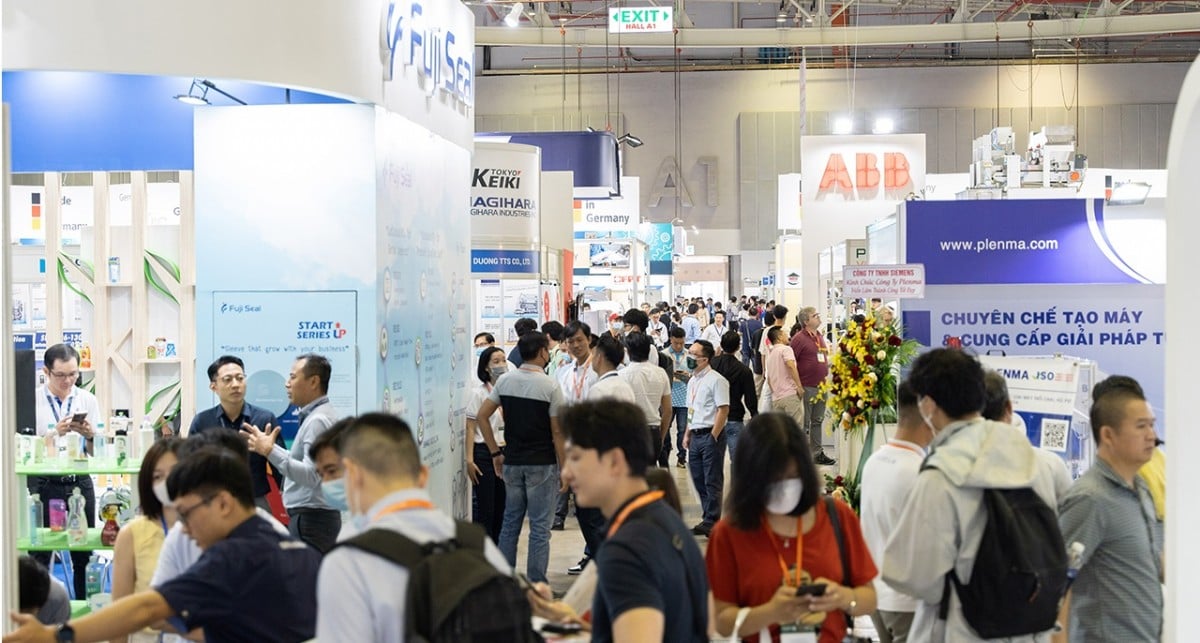

- Generative AI applications become the phenomenon of the year

Generative AI has become one of the most explosive technology trends of the year, after ChatGPT caused a global "fever" by reaching 100 million users by the end of January 2023 after 2 months of launch. Generative AI has had a year of remarkable development in terms of usability through chatbots, voice cloning, and video applications. This groundbreaking technology is revolutionizing the way economic sectors operate, dramatically changing the job market and reshaping the future of industries.

- World gold price breaks all-time high

The world gold price on December 4 rose to a record high of 2,152.3 USD/ounce, and has shown no signs of stopping. The reason for the gold price "breaking the peak" is due to escalating geopolitical conflicts, high inflation, gold becoming a "safe haven" asset. Central banks have bought an unprecedented amount of gold. Capital flows into gold have affected global markets, causing stocks to fall and extending the decline of the USD.

- EU imposes carbon tax on imported goods

From 1 October, the European Union (EU) will launch a pilot phase of the Carbon Border Adjustment Mechanism (CBAM), the first step towards imposing tariffs on imports from countries that do not meet environmental standards by 2024. This is an effective tool to encourage businesses outside Europe to reduce carbon emissions. They will lose their competitive advantage if they do not adjust their emissions during production to comply with EU environmental regulations.

- Central banks put the brakes on interest rate hikes

On June 14, the US Federal Reserve (Fed) stopped raising interest rates after 10 consecutive increases since March 2022. Then, on October 26, the European Central Bank (ECB) paused its 10-time interest rate hike streak. More positive signals from the labor market and inflation were the first grounds for the Fed, ECB and other leading central banks to stop raising interest rates. This move has helped countries prevent the trend of their domestic currencies falling sharply against the USD and control foreign currency debt.

- EU, US enact unprecedented laws to protect cyberspace for users

On August 25, the European Union (EU) enacted two laws to control technology, the Digital Services Act and the Digital Markets Act. On October 30, the US President signed the first comprehensive executive order on artificial intelligence to prevent national security and economic risks. This is the first time in history that the EU and the US have applied laws to tighten censorship of online content and the operations of technology companies. These groundbreaking legal documents force these companies to implement new methods to ensure cyberspace safety.

- Risk of international transport crisis from vital shipping route through the Red Sea

Attacks by Yemen’s Houthi forces on cargo ships passing through the Red Sea since December 3 have disrupted oil and cargo shipments between Asia and Europe. Shipping companies have diverted more than $30 billion worth of cargo away from the Red Sea, a vital shipping route that carries about 12% of global trade and is the gateway to the Suez Canal. The incident has sparked a shipping crisis and threatens to disrupt supply chains, pushing up oil prices, transportation costs and inflation./.

Vu Hoa

Vietnamese trainees at the Sumitomo shipyard (Japan). Photo: Thanh Tung/VNS[/caption] Vietnam.vn would like to introduce 10 outstanding events of the world economy in 2023 as voted by the Editorial Board of Economic News - Vietnam News Agency.

Vietnamese trainees at the Sumitomo shipyard (Japan). Photo: Thanh Tung/VNS[/caption] Vietnam.vn would like to introduce 10 outstanding events of the world economy in 2023 as voted by the Editorial Board of Economic News - Vietnam News Agency. Euglena's biofuel production plant in Yokohama (Japan). Photo: Thanh Tung/VNS[/caption]

Euglena's biofuel production plant in Yokohama (Japan). Photo: Thanh Tung/VNS[/caption]

Comment (0)