In recently published reports, international financial organizations such as the World Bank (WB) and Fitch Ratings have made quite optimistic forecasts about the prospects of Vietnam's economy in the next two years. Notably, both WB and Fitch Ratings forecast that after a year of stagnation, Vietnam's economic growth will recover strongly to 5.5% (WB) and 6.3% (Fitch Ratings) in 2024.

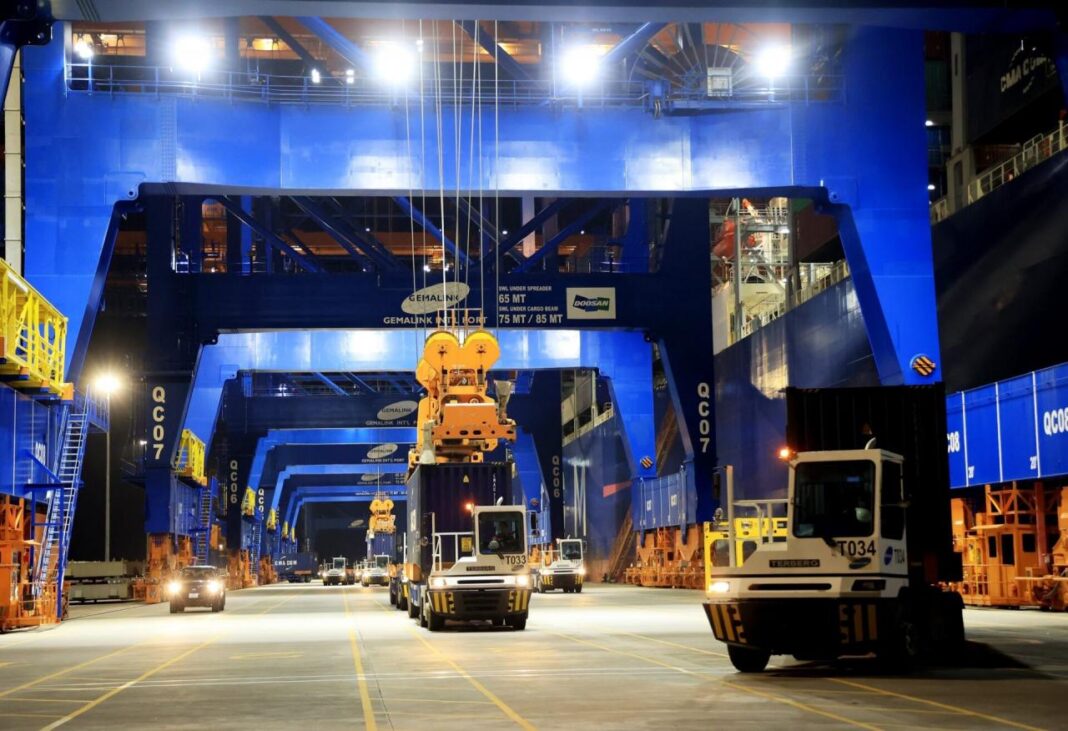

Vietnam's economy is recovering strongly. Illustration photo: VNA

Growth will recover strongly

In a report released on November 9, credit rating agency Fitch Ratings assessed that in the first 9 months of 2023, Vietnam's economic growth slowed to 4.3% amid weak external demand and persistent difficulties in the real estate sector. However, according to Fitch Ratings, Vietnam's fiscal and monetary policies have provided much support to the country's economy.

On that basis, Fitch Ratings forecasts that Vietnam's economic growth will reach 6.3% in 2024 and 7.0% in 2025. Fitch Ratings also believes that the medium-term fundamentals of Vietnam's economy remain positive and sustainable growth momentum will open up positive business prospects for banks.

Previously, in the Vietnam Macroeconomic and Poverty Reduction Outlook Report released in early October, the World Bank stated that Vietnam’s real GDP growth is expected to slow to 4.7% in 2023 due to weak private consumption, sluggish real estate market, and sharp decline in external demand. Despite the slowdown in growth, the poverty rate is expected to decline from 3.2% in 2022 to 3.0% in 2023.

Moreover, despite external headwinds, Vietnam’s external economic position improved in the first quarter of 2023, with the current account surplus at 1.5% of GDP. The merchandise trade balance improved as imports declined more than exports, partly due to lower intermediate goods imports. In addition, the services trade deficit narrowed as international tourists returned.

According to the World Bank, the financial account remains in surplus due to strong foreign direct investment (FDI) and portfolio investment flows. The overall balance of payments surplus has enabled the State Bank to accumulate foreign exchange reserves of USD 88.7 billion by the end of the first half of 2023 (equivalent to 3.3 months of imports).

The budget balance by mid-2023 is estimated to record a lower surplus (1.5% of GDP), compared to 5.2% of GDP in the first half of 2022, due to a 7% decrease in budget revenue and a 12.8% increase in budget expenditure in the first half of 2023 (y/y). Increased public investment (up 43% y/y in the first 6 months of 2023) has partly supported the economy, but the estimated implementation rate remains low, reaching only 30.5% of the investment expenditure estimate, due to inherent implementation challenges.

The World Bank forecasts that after a year of slowdown, Vietnam's economic growth is expected to recover to 5.5% in 2024 and 6.0% in 2025. Domestic demand is expected to remain the main growth driver, albeit at a slower pace than last year. Average inflation for the year is estimated at 3.5%, due to expected increases in civil servant wages, before easing to 3.0% in 2024 and 2025, assuming stable energy and commodity prices.

Continued support for aggregate demand is needed.

Despite the positive forecasts for Vietnam’s economic growth prospects over the next two years, the WB said that the outlook is subject to a number of growing risks. Lower-than-expected growth in developed economies and China could reduce external demand for Vietnam’s exports. Further tightening of monetary policy in large and developed economies could rekindle exchange rate pressures on domestic currencies, leading to capital outflows. Domestically, rising financial risks and vulnerabilities require close monitoring and continued innovation.

Monetary policy is actively supporting growth. Illustration photo: VNA

In that context, the World Bank recommends that in the short term, Vietnam's fiscal policy should continue to support aggregate demand. A fully implemented investment budget, combined with steps to remove bottlenecks in public investment procedures, is a way to raise public investment to 7.1% of GDP in 2023, compared to 5.5% in 2023, thereby supporting aggregate demand. Further loosening of monetary policy is considered appropriate, but further interest rate cuts will increase interest rate differentials with global markets, potentially putting pressure on the exchange rate.

To mitigate rising financial risks, according to the WB, measures to increase banks' capital ratios and strengthen the banking supervision framework are ways to ensure the stability and resilience of the financial sector.

In the long term, Vietnam has the ambition to become a high-income country by 2045. To achieve that goal, the WB believes that Vietnam needs to increase productivity by improving the fundamentals of the financial sector, addressing institutional bottlenecks in public investment to address infrastructure shortages, and creating a favorable environment for the domestic private sector to operate more effectively, in addition to addressing risks of climate change and environmental sustainability./.

Viet Thang

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)