The global economy has positive developments, stock indexes have recovered; deposit and lending interest rates continue to decrease; remittances have grown strongly; key transport infrastructure has continuously started up... are the driving forces for the real estate market to return to the "race" from the end of this year onwards.

The global economy has positive developments, stock indexes have recovered; deposit and lending interest rates continue to decrease; remittances have grown strongly; key transport infrastructure has continuously started up... are the driving forces for the real estate market to return to the "race" from the end of this year onwards.

|

New dynamics emerge at the end of the year

Bright colors in terms of economy, infrastructure, remittances, etc. are gradually emerging, creating an opportunity for a "reversal" for the Southern real estate market after a long period of fluctuations.

The fact that the new laws on real estate and land price list of Ho Chi Minh City have officially come into effect has further boosted the confidence of buyers who are “sensitive” to the market. Continuous investment and improvement in transport infrastructure is the most obvious driving force of the real estate market in the South in general and Ho Chi Minh City in particular.

In a recent sharing, Mr. Troy Griffiths, Deputy General Director of Savills Vietnam emphasized that the revised Law, updated planning and key infrastructure projects are expected to be a great driving force for the housing market in Ho Chi Minh City in the coming time. Specifically, in the last 6 months of 2024, a number of infrastructure projects in Ho Chi Minh City will be inaugurated, such as Nam Ly Bridge in Thu Duc City or the first phase of Nguyen Van Linh Tunnel in District 7; along with key projects such as Ring Road 3, Metro Line 1 and An Phu intersection under implementation, which are expected to promote traffic connectivity for Ho Chi Minh City.

|

Several key traffic projects will be inaugurated in 2024, promoting traffic connectivity for Ho Chi Minh City. Photo: Ha Vy |

Mr. Vo Huynh Tuan Kiet, Director of Housing CBRE Vietnam, shared the same view when emphasizing that infrastructure is a factor that greatly affects the real estate market. Mr. Kiet cited that the metro system has created the general appearance of the entire Eastern area of Ho Chi Minh City. Projects along the metro have had very high price increases, from 50 - 70%, with some projects increasing by nearly 150%. "The increased investment in the infrastructure network will help the real estate market get back on track. The market picture in the coming time will develop in a much more sustainable direction," affirmed the CBRE expert.

The strong growth of remittances is a driving force for the socio-economic development and real estate investment picture. Statistics show that in the first 6 months of 2024, remittances to Ho Chi Minh City reached 5.178 billion USD, equal to 54.7% compared to the whole year of 2023 and an increase of 19.5% over the same period. The continued strong growth of remittances in recent times shows the confidence of overseas Vietnamese in the stable macroeconomic situation and favorable investment and business environment.

Deposit and loan interest rates remain attractive, which is considered a driving force for the real estate market to recover. This year, the State Bank of Vietnam has reduced the operating interest rate four times, reducing deposit interest rates by 3-4%, and lending interest rates have also decreased by at least 2% since the beginning of this year. Many banks have launched preferential loan packages for consumption and home purchases. In addition, inflation has been well controlled, which is the basis for banks to continuously lower interest rates in recent months.

|

Homebuyer confidence rebounds after much positive news. Photo: Ha Vy |

Not to mention, the positive growth signals of the economy in the recent past such as the country's GDP in the first 9 months of 2024 increased by 6.82% compared to the same period in 2023, FDI attraction reached 24.78 billion USD, increased by 22.7% compared to the same period in 2023; CPI in the first 9 months of 2024 increased by 3.88% compared to the same period in 202; Vietnam's economy is not in the negative growth zone, the global macro economy is more stable... are opportunities for real estate to continue to maintain the recovery momentum.

In addition, opportunities also come from the expected increase in housing demand at the end of the year as has often happened in previous years, pushing the Ho Chi Minh City housing market into a new growth cycle.

Buyers seize the opportunity, revealing the area that "overwhelms" supply and demand in Ho Chi Minh City

Market pressures such as interest rates, supply-demand balance, project legality, homebuyer confidence, etc. are gradually being “removed”, although not completely. Accordingly, recently, both real buyers and investors have actively participated in the market, seizing opportunities in the new cycle.

This is evidenced by the fact that more than 2,000 apartment transactions were successful in the third quarter of 2024, nearly double that of the previous quarter. Low-rise products recorded 150 successful transactions, achieving an absorption rate of nearly 90% of the product portfolio opened for sale in the quarter (data reported in the third quarter of 2024 by CBRE Vietnam).

According to this unit, the housing supply in the Ho Chi Minh City market is still mainly concentrated in Thu Duc City and District 7. In particular, Thu Duc City dominates demand with a variety of choices for buyers compared to other areas.

|

Land fund for townhouse development in Ho Chi Minh City will shift to the East and South of the city. Source: Cushman & Wakefield. |

CBRE Vietnam also pointed out that the townhouse - villa segment in Ho Chi Minh City continues to be scarce. Projects launched on the market at this time are developed by reputable investors, have transparent legal status, and clear construction progress. This has boosted buyers' demand for "putting down money".

It is noted that the Thu Duc City area (HCMC) with its continuously invested traffic infrastructure has promoted the opportunity for projects to take the lead; increasing the profitability for buyers.

Here, some low-rise projects such as Masterise Home's The Global City with a scale of more than 117.4 hectares are receiving positive attention from the market. Thanks to its prime location in An Phu Ward (formerly District 2, now Thu Duc City, Ho Chi Minh City) and a series of infrastructure projects that have been and are about to start construction, the project is a "bright spot" in the year-end housing supply of the real estate market in the East of Ho Chi Minh City.

Previously, the project handed over the SOHO commercial townhouse area, attracting residents to live and many F&B, education, service, beauty, shopping brands... to participate in business activities here. Early this November, The Global City will officially launch the first high-rise segment of the urban area.

|

Buyers seize real estate opportunities at the end of the year. Photo: illustration |

In the apartment segment, new supply in the East includes projects such as Eaton Park, The Opus One, FIATO Uptown; King Crown Infinity... Although this number is slightly higher than other areas of Ho Chi Minh City, it is still very limited compared to the potential and actual demand of the area.

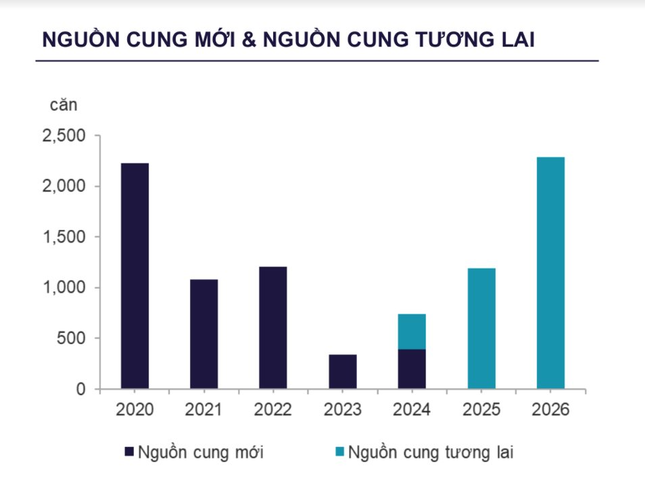

According to Savills Vietnam's forecast, future new supply in both the apartment and low-rise housing segments in Ho Chi Minh City will continue to be limited. The Eastern region (Thu Duc City) will still "dethrone" when it accounts for nearly 50% of the total supply in the future market. Accordingly, projects with proper legal procedures, good sales policies and reputable investors will continue to lead the market, creating momentum for a new development cycle.

Source: https://tienphong.vn/xuat-hien-loat-dong-luc-moi-ve-cuoi-nam-bat-dong-san-tphcm-don-dau-co-hoi-post1686893.tpo

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)