The market started the week with positive green thanks to the great contribution of pillar stocks, however the growth momentum is showing signs of narrowing at the end of the morning session.

Green spread across most stock groups. The telecommunications services group temporarily led the market with an increase of 1.7%, mainly contributed by VGI, FOX, VNZ. On the contrary, real estate was at the bottom with a decrease of 0.19%.

At the end of the morning session on July 29, VN-Index increased by 2.73 points, equivalent to 0.22% to 1,244.84 points. The entire floor had 198 stocks increasing and 181 stocks decreasing.

In the afternoon session, the market continued to maintain green. At the end of the trading session on July 29, VN-Index increased by 4.49 points, equivalent to 0.36% to 1,246.6 points. The entire floor had 244 stocks increasing, 168 stocks decreasing, and 94 stocks remaining unchanged.

Vn-Index performance (Source: TCBS)

HNX-Index increased by 0.86 points to 237.52 points. The entire floor had 97 stocks increasing, 63 stocks decreasing and 62 stocks remaining unchanged. UPCoM-Index increased by 0.28 points to 95.46 points.

The pair HBC and HNG, after receiving HoSE's notice of mandatory delisting due to 3 consecutive years of business losses, were sold off immediately upon opening. At the end of the session, HNG had nearly 11 million units left to sell on the floor, HBC had more than 13 million units left to sell on the floor. In addition, LDG still had a huge amount of remaining floor sales after the negative news, with a remaining floor sale volume of up to 15 million units.

Meanwhile, QCG was rescued after a long series of days on the floor when it ended the session at the ceiling price of 6,770 VND/share with a buy surplus of nearly 728,000 units.

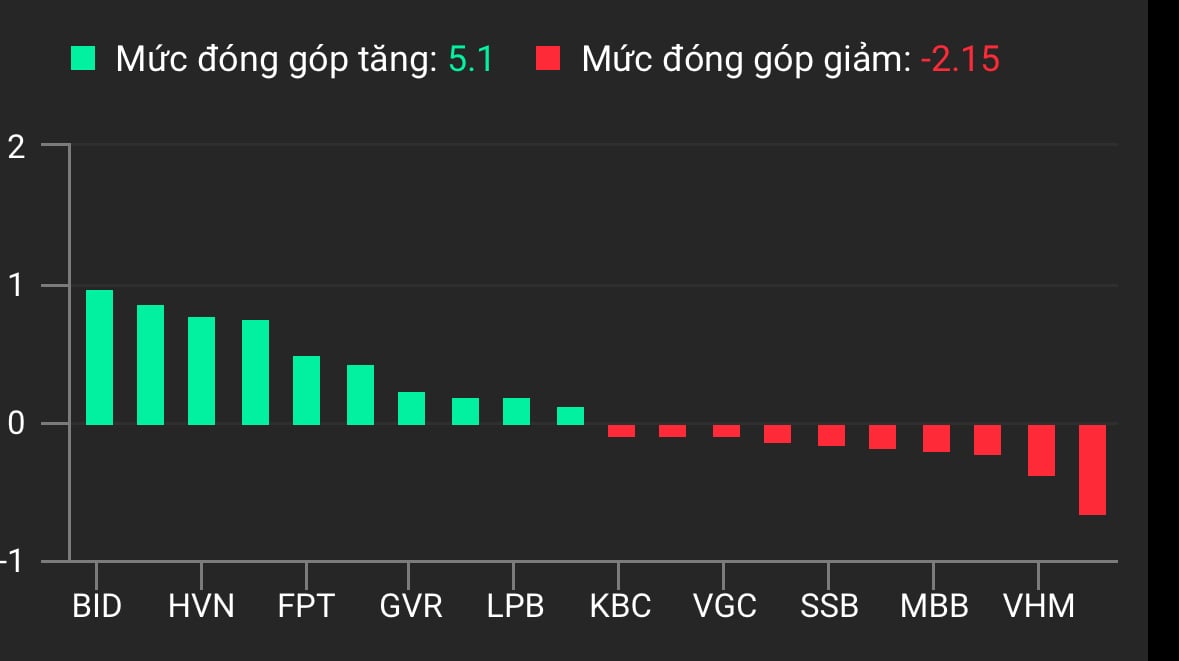

The banking group maintained a slight increase with green dominating, although the increase was mainly around 1%. Of which, BID provided the best support to the market when contributing nearly 1.2 points to the general index, closing the session up 1.84%; LPB also had a positive impact when contributing 0.25 points to the index. On the contrary, MBB and EIB took away a total of more than 0.3 points from the market.

Vietnam Airlines’ HVN shares continued to trade positively, hitting the ceiling price of VND22,350 per share and contributing nearly 0.8 points to the market. Rival VJC fell 1.48% to VND106,200 per share and took 0.2 points off the index.

Codes affecting VN-Index.

The total order matching value in today's session was VND13,125 billion, slightly down from the previous day, of which the order matching value on the HoSE floor reached VND11,380 billion. In the VN30 group, liquidity reached VND4,938 billion.

Foreign investors turned to net buying with a value of 379 billion VND today, of which this group disbursed 1,945 billion VND and sold 1,566 billion VND.

The codes that were sold strongly were PDR 41 billion VND, DCM 39 billion VND, PVS 33 billion VND, MWG 27 billion VND, DBC 25 billion VND,... On the contrary, the codes that were mainly bought were VIX 63 billion VND, FPT 52 billion VND, VNM 37 billion VND, BCM 19 billion VND, VPI 15 billion VND,...

Source: https://www.nguoiduatin.vn/vn-index-tiep-da-hoi-phuc-co-phieu-qcg-va-hvn-tim-tro-lai-204240729155556758.htm

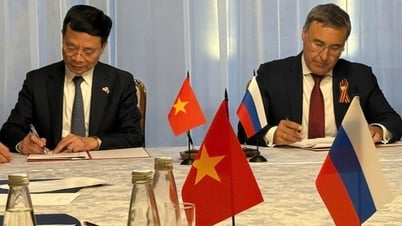

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)