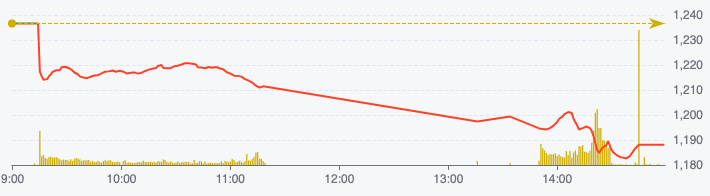

Negativity dominated the stock market right from the opening of the first session of the week, selling pressure weighed heavily on pillar stocks, causing the VN-Index to continuously plummet. The entire market had 844 stocks falling, of which 127 hit the floor.

At the end of the trading session on August 5, VN-Index decreased 48.53 points, equivalent to 3.92% to 1,188.07 points.

The "culprit" in today's session came from the banking group when the codes VCB, BID, TCB, CTG, VPB were in the top 10 negatively affecting the market and took away a total of 10 points. Along with that, the light blue color dominated the chemical, steel, and technology groups.

VN-Index performance on August 5 (Source: FireAnt).

This decline was in line with the stock market around the world. At the end of the session on August 5, Japan's Nikkei closed down 4,389.5 points, equivalent to 13.47%. South Korea's Kospi fell 234.62 points, equivalent to 8.77% and the market had to temporarily suspend trading.

Chinese stocks were in the red, with the Shanghai Composite down 1.41%, the Shenzhen Component down 1.47%, and the Hang Seng Index down 2.17%. Even markets considered more stable like Singapore and Australia were not spared from the sell-off, with declines of over 3%.

Why?

According to Mr. Pham Tuyen - Investment Consulting Director of KIS Vietnam Securities Company, the decline of the Vietnamese stock market occurred in a rather complicated global political context. In addition, the global stock market fell quite sharply from the peak, which also affected investor sentiment.

Many stocks violated the margin lending ratio, which was also the reason for the widespread sell-off.

According to Mr. Tuyen, in just a few sessions, VN-Index will approach the 1,170 - 1,175 point mark. More broadly, VN-Index will reach the 1,150 point range when the market is still as weak as it is now.

Sharing the same view, Mr. Nguyen The Minh - Director of Analysis of Yuanta Vietnam Securities Company said that it is likely that VN-Index will decrease to the bottom of April 2024 (equivalent to 1,175 points), then the cash flow will rebalance.

Technically, the VN-Index is falling into the oversold zone. After deep corrections, the market P/E (valuation level) has returned to 13.5 times (the bottom level in April). Meanwhile, the projected P/E for 2024 has also decreased to 11.5 times, indicating that stock returns are at 9-10%.

Don't buy the bottom yet.

Giving advice to individual investors, experts from KIS Securities said that they should not buy the bottom yet. Political tensions in the Middle East will especially affect the psychology of investors globally, including Vietnam.

Therefore, according to Mr. Tuyen, if investors intend to buy at the bottom, they should not, they should wait for the time when the market "stops the bleeding".

In the next 1 or 2 sessions, there will likely be panic, causing the market to fall into an alarming state when a series of stocks begin to reach the margin call threshold (mortgage liquidation).

According to Mr. Tuyen, investors holding stocks should take advantage of recovery sessions to ensure the safety of their portfolios and limit the use of margin at the present time.

Experts from Yuanta Securities Vietnam also agree that it is not advisable to buy the bottom at the present time. Currently, investors who do not have margin pressure should not sell at the present time, because the stock price is quite low.

For the whole month of August, according to Mr. Minh, the opportunity for VN-Index to increase is very high because there is still the story of September with the US Federal Reserve (Fed) cutting interest rates and the upgrading process has added prefunding, whether or not there is an upgrade, this is still positive information to support the market's return.

In the cautious scenario, investors should wait for the market to confirm the uptrend again before buying stocks. However, investors with a high cash ratio and a risk appetite can still consider partially disbursing and buying during market sell-offs.

Source: https://www.nguoiduatin.vn/vn-index-thung-moc-1200-diem-dieu-gi-dang-xay-ra-voi-thi-truong-chung-khoan-204240805161635919.htm

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

Comment (0)