(NLDO) – The probability of VN-Index surpassing the 1,300-point mark is increasing as the stock market is being supported by a cooling exchange rate and strong credit growth…

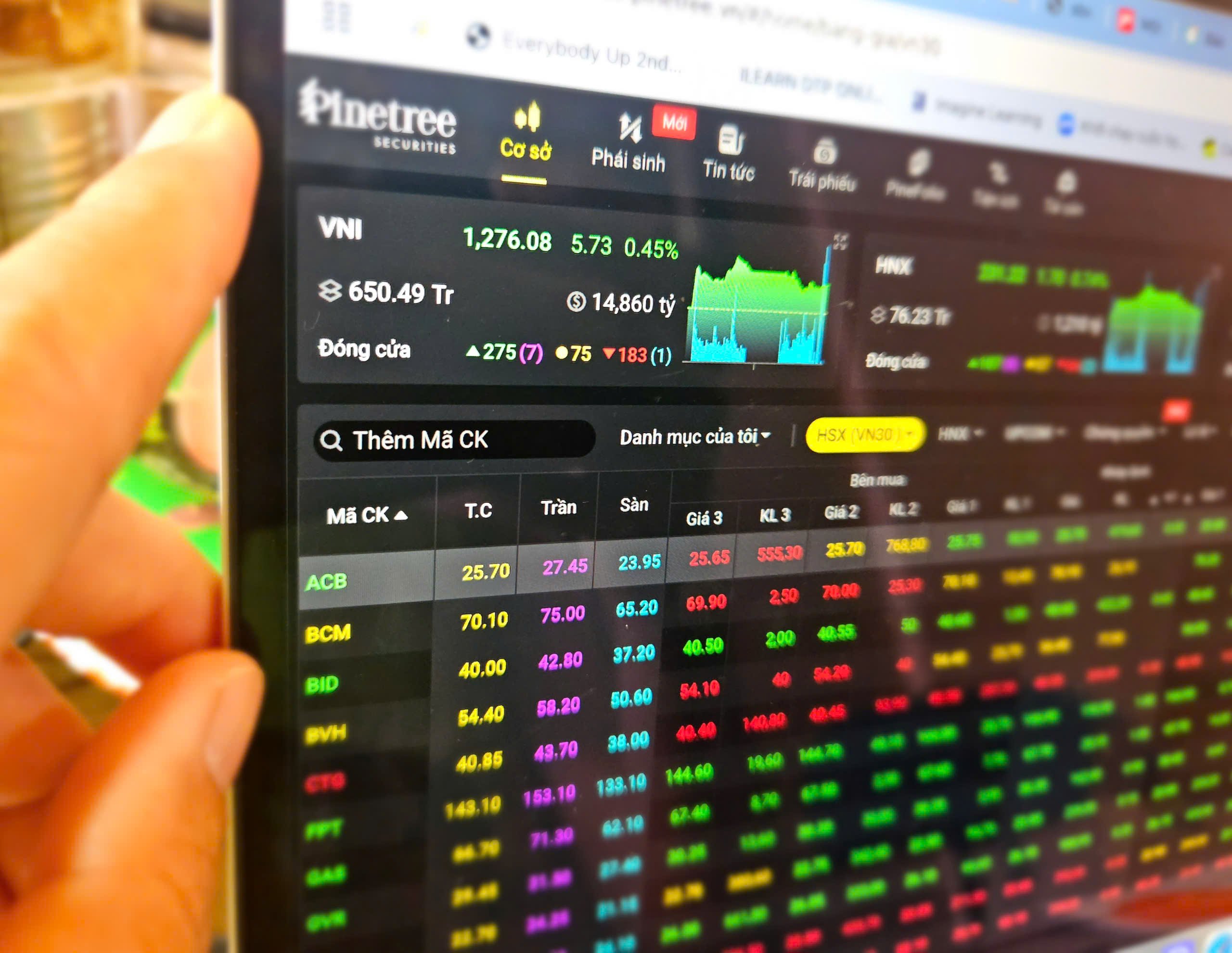

The stock market marked its fourth consecutive week of increase from the 1,220-point price range. At the end of the week, VN-Index increased by 0.07% to 1,276.08 points; HNX-Index increased by 0.74% to 231.22 points.

Market liquidity increased for the fourth consecutive week, showing that cash flow improved quite well, despite foreign investors net selling more than VND 1,800 billion last week.

Many investors said they have started trading more "enthusiastically" in the market, expecting the VN-Index to soon surpass the 1,300-point mark to boost cash flow back more strongly.

"If in late 2024 and early 2025, not only me but many investors in the "lazy trading" group, in the past 2 weeks, I have seen people exchanging and recommending buying and selling stocks more and more actively" - Mr. Nhat Thinh (an investor in Ho Chi Minh City) said.

Pinetree Securities Company believes that the VN-Index will close around 1,276 points - the highest closing level since the end of October 2024. Liquidity levels are gradually improving, as the market has seen more trading sessions of over VND14,000 billion, although cash flow has not spread widely.

Stock market rises for fourth consecutive week, opening up expectations for investors

Other positive points, according to Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department, VNDIRECT Securities Company, are that the State Bank has raised the USD intervention selling price to 25,698 VND/USD, increasing the central exchange rate to 24,572 VND/USD.

Prioritizing growth and promoting credit for the 8% GDP growth target this year will be positive news for banking stocks and the stock market. Despite the CPI index increasing beyond forecast, the USD index in the international market has had a strong correction to below 107 points when the bad news has been reflected. Short-term pressure on the USD/VND exchange rate has decreased.

"The probability of the market surpassing the 1,300-point mark is increasing. Investors can wait for short corrections during the session to increase the proportion of stocks, prioritizing the banking, export (textiles, seafood, wood products), infrastructure construction (especially related to public investment) and construction materials sectors" - Mr. Dinh Quang Hinh expressed his opinion.

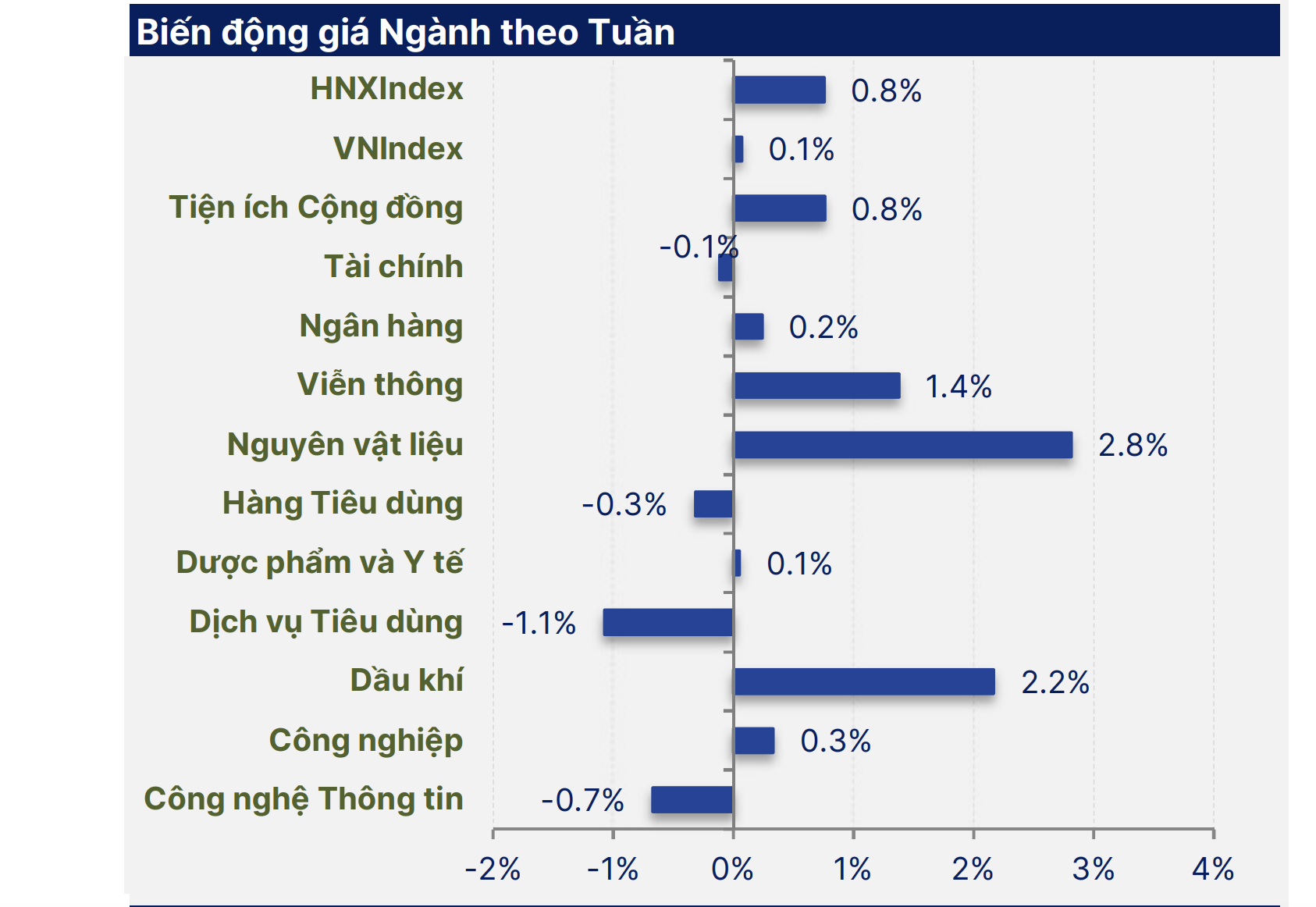

Stock price fluctuations by industry last week. Source: SHS

Experts from Pinetree Securities also said that information related to US inflation is more positive, reinforcing expectations of the US Federal Reserve's (FED) interest rate cut plan. Next week, the market is likely to return to re-examine demand at the 1,270 point area to decide the next trend.

"Among industry groups, public investment flows will likely continue to lead the market and banks will play a role in keeping the market steady at the support level of 1,260 points," Pinetree Securities predicted.

From another perspective, SHS Securities Company believes that investors should wait for the mid-term trend of VN-Index to escape the current prolonged accumulation state, based on the new momentum of macro factors, businesses...

For VN-Index to break out, it will depend largely on banking and real estate stocks - the two stocks with high capitalization rates in the market.

Source: https://nld.com.vn/chung-khoan-tuan-toi-tu-17-den-21-2-vn-index-co-len-duoc-1300-diem-196250216092222074.htm

Comment (0)