Continuing the trend of cooling down deposit interest rates in the market, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank - HoSE: VCB) has recently reduced its deposit interest rates again.

Specifically, for 1-month and 2-month terms, Vietcombank maintains the mobilization interest rate at 3%/year. For terms from 3 months to 5 months, customers will only receive an interest rate of 3.3%/year, corresponding to a decrease of 0.2 percentage points compared to the most recent adjustment.

With terms from 6 months to 9 months, savings interest rates are lowered to 4.3%/year, down 0.2 percentage points compared to the old interest rate schedule.

For the 12-month term, Vietcombank has reduced the mobilization interest rate from 5.5%/year to 5.3%/year, equivalent to an adjustment of 0.2 percentage points, which is a historic low, lower than the Covid-19 period. This bank even listed the 12-month term interest rate at 5.5%/year throughout the period from July 2021 to July 2022.

Similarly, for long-term deposits from 13 months to 24 months, Vietcombank also reduced deposit interest rates to 5.3%/year. Thus, Vietcombank has reduced deposit interest rates twice in a row after only a few weeks. The most recent time was on September 14, when Vietcombank also adjusted down 0.3 percentage points for a series of terms.

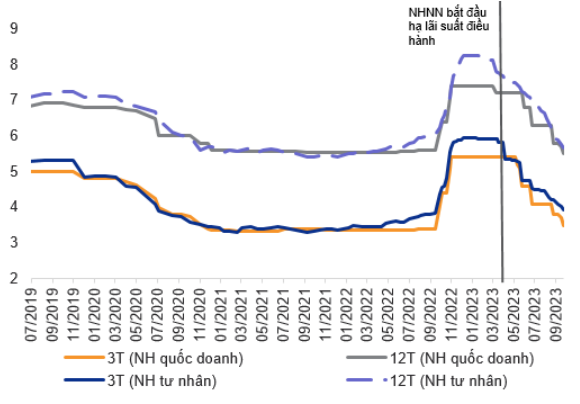

Deposit interest rates continued to decline in September 2023 and have reached near the bottom of the COVID-19 period (2021-first half of 2022) (unit: %) (Source: VNDirect).

In five consecutive open market auctions from September 21 to September 27, the State Bank of Vietnam (SBV) issued a total of VND70,000 billion worth of 28-day treasury bills under the interest rate auction mechanism.

Accordingly, all 70,000 billion VND of treasury bills were successfully bid with winning interest rates fluctuating in the range of 0.49 - 0.69%. The low winning interest rates show that the system has excess liquidity.

According to the October market report, VNDirect Securities believes that this move by the State Bank of Vietnam is not intended to tighten or reverse the current loosening policy, but is only a temporary, short-term solution to absorb excess liquidity (in the context of weak credit growth), contributing to limiting exchange rate speculation and maintaining domestic macroeconomic stability.

The State Bank will calculate a reasonable net withdrawal amount to both limit exchange rate speculation and maintain good liquidity in the banking system to support the economy. At the same time, the net withdrawal amount will be returned to the market later when exchange rate pressure cools down.

However, the analysis team assessed that the recent issuance of treasury bills by the State Bank of Vietnam is unlikely to reverse the current downward trend of deposit and lending interest rates, especially in the context of weak credit growth.

The average 12-month deposit interest rate of commercial banks decreased to 5.6%/year as of September 25, 2023, down 0.3 percentage points compared to the end of August 2023 and 2.2 percentage points compared to the end of 2022. The deposit interest rate level has now reached the bottom of the COVID-19 period (2021-first half of 2022) and VNDirect expects the deposit interest rate level to remain in this range (average 5.5%/year for 12-month term) in the last months of 2023.

The analysis team also expects lending interest rates to continue to maintain a downward trend in the last months of this year thanks to the rapid decrease in capital costs of commercial banks in recent times .

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)