US interest rate policy and conflict in the Middle East caused the USD to continuously hit new peaks compared to other currencies around the world.

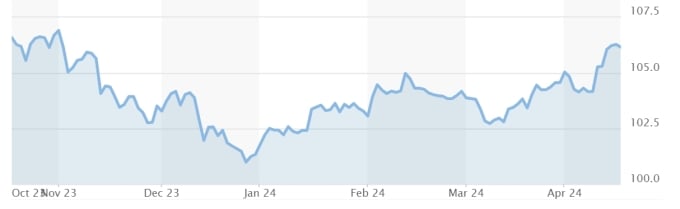

Since the beginning of the year, the US dollar has been on the rise. The Dollar Index - an index measuring the strength of the greenback against a basket of major world currencies - is currently around 106 points, close to the 5-month peak set on April 16.

Last week, the Dollar Index rose 1.7% - the strongest since September 2022. This year, the index has increased 5%.

On April 16, the yen hit a 34-year low against the dollar. Since the beginning of the year, the yen has lost nearly 9% of its value, currently at 154.6 JPY per USD.

The dollar also hit a five-month high against the euro this week. Currently, each euro is worth 1.06 US dollars.

Bloomberg data also shows that nearly all 23 emerging market currencies have lost value against the greenback this year. The Indian rupee has hit a record low. The Malaysian ringgit is also approaching its lowest level since the 1998 Asian financial crisis.

Dollar Index performance over the past year. Chart: Market Watch

Reuters said the main reason for the USD's increase in value is that the market is betting that the US Federal Reserve (Fed) will keep interest rates high for a while longer to curb inflation. The interest rate differential between the US and other economies makes USD-denominated assets attractive, thereby pushing the US dollar price up.

Inflation in the US has accelerated again in recent months. The consumer price index (CPI) released last week showed prices here increased by 3.5% in March, nearly double the Fed's target.

Immediately after the data was released, investors bet the Fed would only cut rates by 50 basis points (0.5%) this year. Meanwhile, earlier this year, they thought the Fed would cut by as much as 150 basis points.

Conversely, investors also believe that other major central banks, such as those in Europe, Canada and Sweden, will ease monetary policy more easily, a change from a few months ago when many thought the Fed would be the first to cut rates.

"We used to be confident that the Fed would act first. But recent data is eroding that confidence. I see a clear upside for the dollar," said Eric Leve, chief investment officer at asset manager Bailard.

The spread between two-year US and German government bond yields last week reached its highest since 2022, after the ECB signaled it could cut interest rates as early as June. This made US bonds more attractive to investors.

Central bank policy has also been increasingly divergent in recent months. The Swiss National Bank cut interest rates by 25 basis points last month, its first cut in nine years. Sweden's central bank has signaled a cut in May if inflation continues to fall. The Bank of Canada has also signaled it is ready to act.

In contrast, Australia, Britain and Norway remain reluctant to ease policy, while the Bank of Japan has ruled out raising interest rates to support its currency.

Eric Merlis, director of global markets at Citizens, believes the dollar will continue to rise, as the Fed's stance is now more hawkish than the ECB's. The euro has lost nearly 4% of its value against the greenback this year.

"The USD still has room to increase in value. The US is the strongest economy at the moment, while Europe is still struggling with growth," he explained.

A stronger dollar would complicate other economies’ fight against inflation, as their currencies lose value. In the US, multinationals would lose international revenue when converted into dollars. Exporters would also lose competitiveness abroad, as their goods become more expensive.

Another factor that could push up the dollar is safe-haven demand. The dollar is a popular destination for investors during times of geopolitical uncertainty.

Conflicts in the Middle East have escalated in recent months. Last weekend, Iran attacked Israel in retaliation for an airstrike on its consulate in Syria earlier this month. On April 16, British Foreign Secretary David Cameron said Israel had decided to retaliate against Iran for last weekend’s attack. These developments will further increase the demand for the US dollar.

The dollar could also be supported by the Fed’s quantitative tightening, according to Brian Liebovich, director of foreign exchange at Northern Trust. Currently, about $95 billion of the Fed’s holdings mature each month and the agency is not buying them back to replace them, which will reduce the money supply in the economy.

Northern Trust had predicted a 5% dollar appreciation by the end of the year, when the US presidential election takes place. However, "market developments this week suggest that this may happen sooner than expected," the financial services firm said.

Ha Thu (according to Reuters, Bloomberg)

Source link

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)