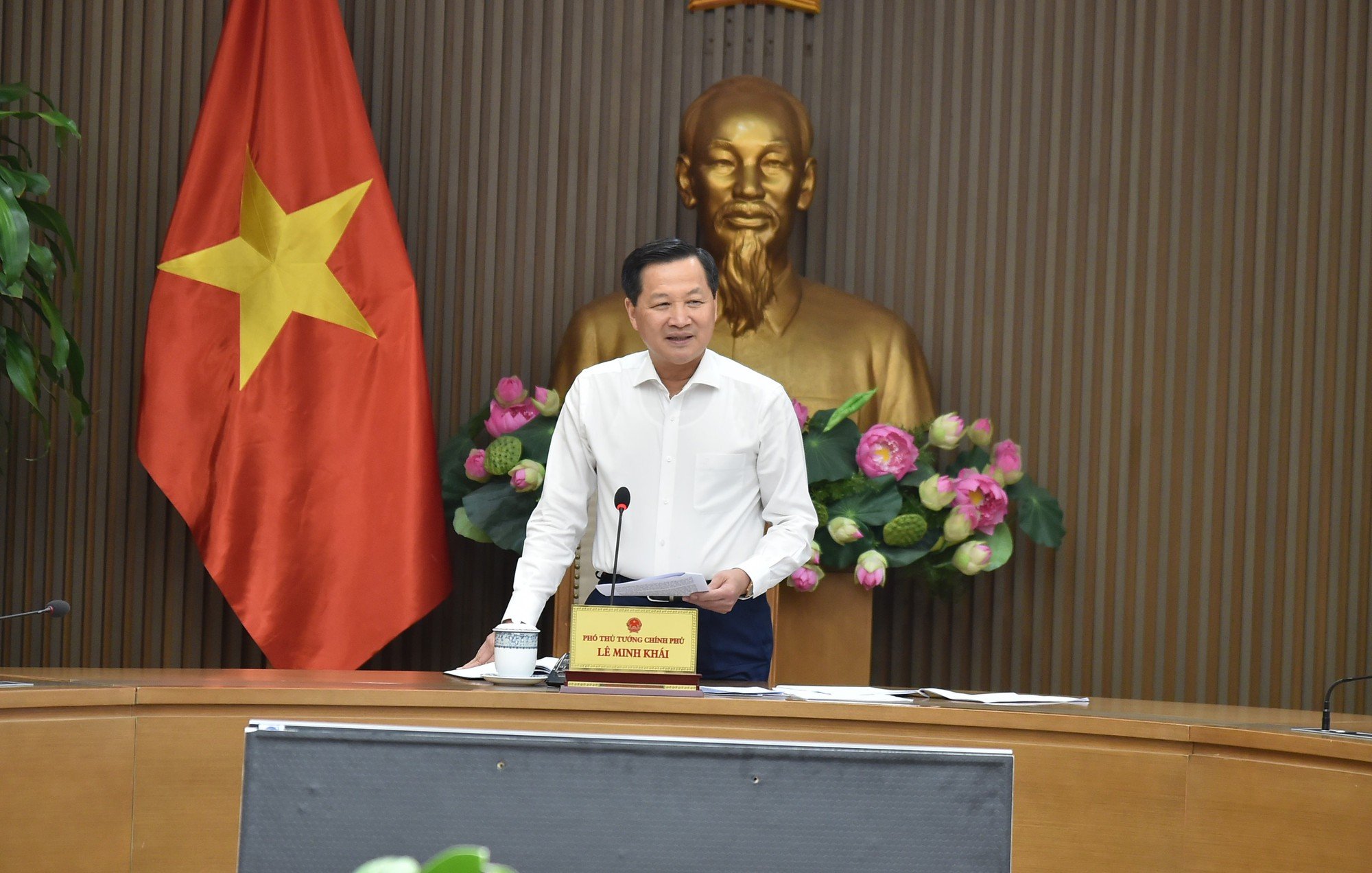

On May 24, Deputy Prime Minister Le Minh Khai chaired a meeting with ministries and several state-owned commercial banks on solutions to improve access to capital and reduce interest rates.

Deputy Prime Minister Le Minh Khai emphasized: Banks and businesses "must go the same way".

The State Bank's report on solutions to improve access to credit and reduce interest rates said: as of May 16, 2023, capital mobilization of credit institutions reached over VND 12.4 million billion, up 2.1% compared to the end of 2022 and up 6.28% compared to the same period in 2022. Outstanding debt of the whole economy reached over VND 12.25 million billion, up 2.72% compared to the end of 2022 and up 9.32% compared to the same period in 2022.

Regarding interest rates, implementing the policy of the National Assembly, the direction of the Government and the Prime Minister on reducing lending interest rates to remove difficulties for the economy, businesses and people, in March, April and May 2023, the State Bank continuously adjusted the operating interest rate down 3 times by 0.5-1.5%.

Speaking at the meeting, Deputy Prime Minister Le Minh Khai emphasized: Banks and businesses "must go the same way". However, banks are particularly important institutions, so they must ensure the safety of the system; the management of the monetary market must also comply with market rules...

The Deputy Prime Minister requested the State Bank to absorb opinions, continue to review regulations and procedures, and immediately remove any subjective issues to best serve the borrowing needs of businesses and people, especially small and medium enterprises.

Working scene.

Deputy Prime Minister Le Minh Khai requested the State Bank to further analyze factors related to credit provision for businesses, especially small and medium enterprises; carefully assess the capital absorption capacity of business groups; review policy mechanisms to amend, supplement, complete or propose to competent authorities for consideration and decision;...

Regarding interest rate management, appreciating the positive actions of banks in response to the Prime Minister's direction in implementing solutions to reduce lending interest rates, Deputy Prime Minister Le Minh Khai requested the State Bank and the banking system to continue implementing solutions to reduce operating costs and lower deposit interest rates to establish a reasonable interest rate level to support businesses in accessing capital, overcoming difficulties, and developing production and business.

A reasonable deposit interest rate must be established for a suitable lending interest rate. Enterprises must develop and banks must develop. The Deputy Prime Minister requested the State Bank, based on the Government's and Prime Minister's resolutions, to continue implementing solutions to manage credit growth, interest rates, exchange rates, and connect banks and enterprises, etc. to review, improve, and create a synchronous legal environment for credit institutions to operate openly and transparently; create favorable conditions for enterprises to access credit, ensuring the task of stabilizing currency value, macroeconomics, exchange rates, and the safety of the commercial banking system.

The Deputy Prime Minister requested that a reasonable deposit interest rate level must be established so that lending interest rates are appropriate.

Deputy Prime Minister Le Minh Khai requested the State Bank and ministries to "respond to policies more quickly", provide timely information so that public opinion can understand and reach consensus in the process of directing the implementation of monetary policies; strengthen inspection and supervision work, and resolutely and strictly handle cases of harassment, annoyance, corruption, negativity, and group interests in accordance with the law.

Ministries and sectors, according to their assigned functions and tasks, especially the Ministry of Planning and Investment, continue to research and propose policies to perfect institutions and create a common environment for businesses to develop and manage effectively.

Receiving the direction of Deputy Prime Minister Le Minh Khai, Deputy Governor Dao Minh Tu said that in the coming time, the State Bank will continue to direct the commercial banking system to reduce operating costs in order to continue to lower interest rates, share profits with businesses; review and reduce fees; create synchronization for banks; restructure debts, "more urgently"... The State Bank will also revise a number of points of Circular 39/2016/TT-NHNN regulating lending activities of credit institutions and foreign bank branches to customers in the direction of "being more open but not lowering standards".

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)