(Dan Tri) - VN-Index recorded an increase and regained the 1,250 point mark, but liquidity "disappeared". While HAGL Agrico's HNG increased by 14.3% on UCPoM, Hoang Anh Gia Lai shares also increased in price.

The market's continued decline for most of this morning's trading session has made many investors worried.

There was a time when VN-Index "dipped" below the threshold of 1,240 points. However, as analysts predicted, this area was a strong support for the index. Here, VN-Index quickly rebounded and reached an increasing state in the afternoon session.

At the end of the session on January 8, VN-Index increased by 4.07 points, equivalent to 0.33%, to 1,251.02 points; HNX-Index increased by 0.89 points, equivalent to 0.4%, and UPCoM-Index increased by 0.53 points, equivalent to 0.57%.

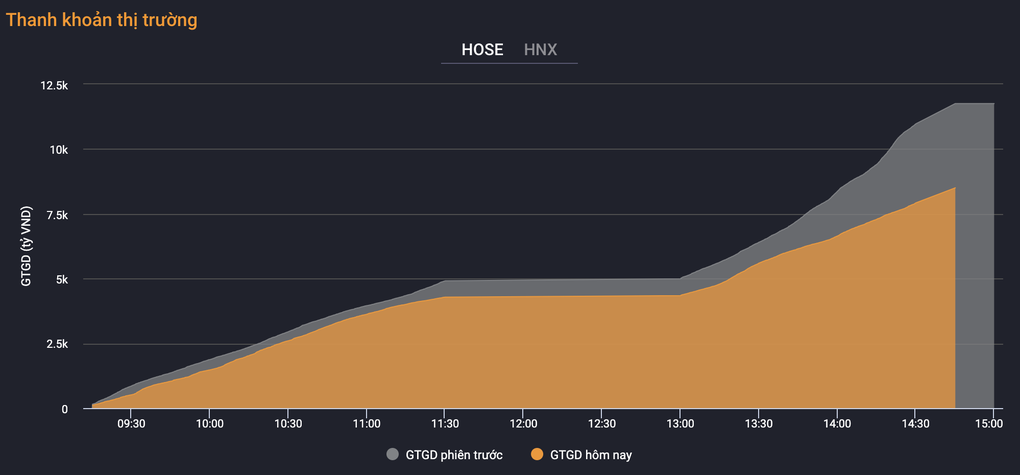

However, market liquidity has not improved. Statistics at the end of the session show that trading volume on HoSE reached 445.75 million units, equivalent to a trading value of VND10,206.12 billion; on HNX it was 37.07 million shares, equivalent to VND589.21 billion; and on UPCoM it was 50.67 million shares, equivalent to VND448.2 billion.

Market liquidity was lower than the previous session even though the market recovered from a strong support zone (Source: VNDS).

The market recovered from the 1,240 point area of VN-Index but very low liquidity showed a decline in selling pressure, investors were not decisive in selling, not synonymous with a strong entry of cash flow.

Market breadth became more positive with 464 stocks increasing in price, 23 stocks hitting the ceiling on all 3 exchanges compared to 329 stocks decreasing, 15 stocks hitting the floor. On HoSE, there were 236 stocks increasing in price, 5 stocks hitting the ceiling with 153 stocks decreasing, 2 stocks hitting the floor.

Besides GMC, which has to continuously "clean the floor" due to its imminent mandatory delisting, HU1 also joined in with a dramatic decrease in amplitude, with no buyers. However, liquidity at HU1 is insignificant, reaching only 400 units.

In the opposite direction, TMT shares steadily increased to the ceiling price of 13,600 VND, with only 47,200 shares matched but the remaining ceiling price buy orders were up to 144,300 units. APG, L10, CIG, GHM also increased to the ceiling price.

HAGL Agrico's HNG shares on UPCoM increased by 14.3% to VND8,000, with matching orders reaching over 21 million units. This code was sold out when there were 5.16 million shares left to buy at the ceiling price.

HNG is having a positive trading streak at the beginning of the new year with an increase of 31.15%. In the past month, HNG has increased in price by nearly 54%. HAGL Agrico shares have performed positively in the context of the company announcing its "debt-free" relationship with Hoang Anh Gia Lai, a company chaired by Mr. Doan Nguyen Duc (Bau Duc).

After HAGL Agrico completes paying VND4,228 billion according to the tripartite commitment agreement with BIDV and Hoang Anh Gia Lai, billionaire Tran Ba Duong's company will receive assets in 4 installments, totaling more than 32,500 hectares of industrial crop land, including more than 8,500 hectares of oil palm and 24,000 hectares of rubber.

On the stock market today, HAG shares also increased by 1.72% to 11,850 VND. While at HAGL Agrico, Mr. Doan Nguyen Duc is Vice Chairman of the Board of Directors but does not own shares, at Hoang Anh Gia Lai, Mr. Duc owns 319.95 million HAG shares, accounting for 30.26%.

Mr. Duc was once the richest person in the Vietnamese stock market 15 years ago. Currently, his assets through owning HAG shares are worth 3,791.4 billion VND, although still a very large number, it has been surpassed by many other businessmen.

According to Hoang Anh Gia Lai's consolidated financial report, as of September 30, 2024, the group had total assets of VND 22,492.1 billion, an increase of about VND 1,600 billion compared to the beginning of 2024.

Mr. Duc once admitted that debt was a big obsession, however, with the amount of 4,228 billion VND that HAGL Agrico paid, Mr. Duc's company paid off the debt of the bond lot coded HAGLBOND16.26 of 2,314 billion VND and paid off Hoang Anh Gia Lai's direct loan at BIDV of 2,094 billion VND.

Source: https://dantri.com.vn/kinh-doanh/thi-truong-thoat-hiem-day-gay-can-tai-san-cua-bau-duc-hien-ra-sao-20250108170217783.htm

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)