The indices fluctuated above the reference range in the first session of the week (July 29), however, the increase range was very narrow with low liquidity.

Temporarily closed, VN-Index only increased by 2.73 points, equivalent to 0.22%, to 1,244.84 points; HNX-Index increased by 0.42 points, equivalent to 0.18%, and UPCoM-Index inched up by 0.3 points, equivalent to 0.32%.

HoSE liquidity only reached 231.75 million shares, equivalent to VND5,484.35 billion; on HNX it was 22.36 million shares, equivalent to VND428.15 billion and on UPCoM it was 18.13 million shares, equivalent to VND273.69 billion. This shows that investors are relatively cautious in their buying and selling decisions.

Market breadth was tilted towards gainers, with 199 gainers versus 181 losers on HoSE; 74 gainers versus 57 losers on HNX and 147 gainers versus 71 losers on UPCoM.

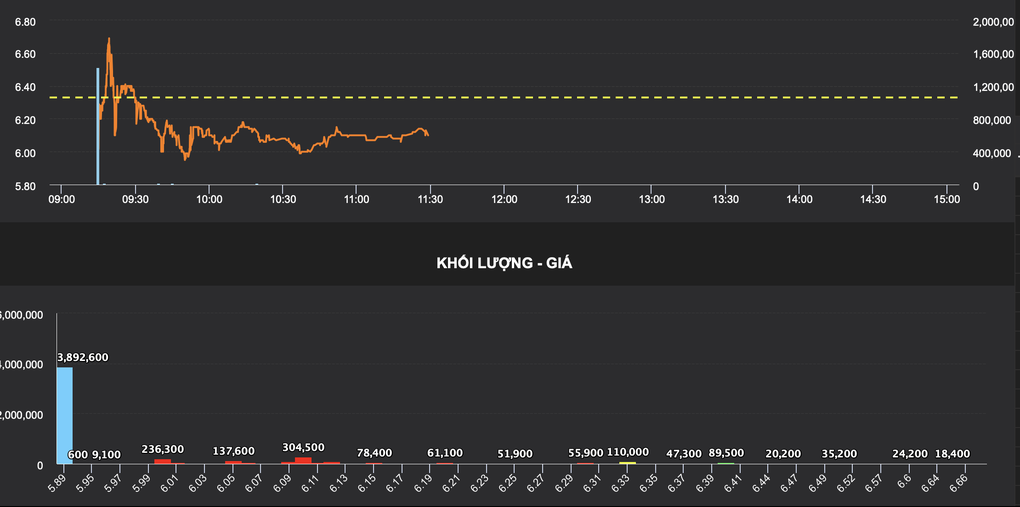

QCG escaped the floor price drop in the morning session of July 29 (Screenshot).

This morning, Quoc Cuong Gia Lai's QCG stock made a spectacular exit from the floor. This code was successfully "rescued" with all floor price sell orders quickly absorbed at the beginning of the session.

After hitting the floor price of VND5,890/unit, this code even reached an increase of VND6,690 at one point and is currently down 3.6% to VND6,100. Order matching at QCG reached 6.2 million units, of which 3.9 million shares were matched at the floor price.

On the contrary, the sell-off is still taking place at LDG. The market price of this stock is only 2,100 VND, the matched orders reached 2.7 million units but the remaining floor selling price is up to 14.3 million shares.

Similarly, investors also fled from HBC of Hoa Binh Construction Group and HNG of Hoang Anh Gia Lai International Agriculture Joint Stock Company (HALG Agrico) after the "bad news" that HoSE would delist these two stocks.

HBC almost lost liquidity when the matched volume for the entire morning session only reached nearly 250,000 units, the remaining remaining sell orders at the floor price were up to 12.76 million shares, the market price was 6,750 VND. HNG matched 2.26 million shares but the remaining sell orders at the floor price were 10.45 million shares, the market price was only 4,340 VND.

According to HoSE, Hoa Binh Construction Group, chaired by Mr. Le Viet Hai, had undistributed profit after tax as of December 31, 2023 of negative VND 3,240 billion, exceeding the company's actual contributed charter capital of VND 2,741 billion.

According to Decree No. 155/2020 of the Government, Hoa Binh Construction Group was forced to delist due to violations in the following cases: Business production results were loss for 3 consecutive years or the total accumulated loss exceeded the actual contributed charter capital or negative equity in the audited financial statements of the most recent year before the review time.

HAGL Agrico, chaired by billionaire Tran Ba Duong, has also suffered losses for three consecutive years. According to the audited consolidated financial report, the company lost more than VND1,119 billion in 2021, more than VND3,576 billion in 2022, and more than VND1,098 billion in 2023. HNG shares are also under securities control.

Some real estate stocks adjusted but the decrease was not large such as D2D, HQC, TDH, HDG, PDR; KBC... The group that increased in price included TDC, DIG, TCH, DXS, CRE, but the increase was also very modest.

Most banking stocks increased and positively supported the main index. BID increased by 1.2%; TPB increased by 1.1%; NAB increased by 1%, LPB, CTG, HDB, VPB, VCB, TCB also reached an uptrend. Securities stocks recovered broadly with VIX, ORS, CTS, VND, HCM, VCI, SSI, DSE, BSI, AGR.

Fertilizer stocks attracted attention with BFC hitting the ceiling, no sellers and over 1 million units of ceiling-price buy orders, VAF hitting the ceiling, SFG up 3.5%; DCM up 1.4%; DPM also increased.

Source: https://dantri.com.vn/kinh-doanh/thao-chay-khoi-hbc-va-hng-sau-hung-tin-qcg-duoc-giai-cuu-20240729125318174.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)