SGGPO

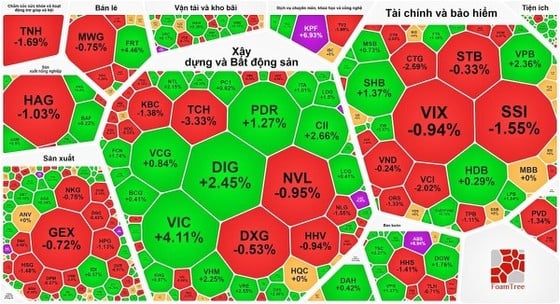

The Vietnamese stock market on September 29th still maintained the 1,150 point mark despite a sharp drop in liquidity and a 3-month low. Of which, the trio of Vingroup stocks increased sharply, contributing to supporting the index quite a bit.

|

| VN-Index maintains 1,150 point mark at the end of September 2023 session |

Investors holding money are still hesitant to buy stocks because of the previous strong fluctuations. In addition to the three Vingroup stocks that increased strongly, VHM increased by 2.25%, VIC increased by 4.11%, VRE increased by 2.55%, VPB increased by 2.36%, BCM increased by 3.42%, contributing to helping the index maintain its green color.

Other stock groups have differentiation within the industry, but the real estate stock group outside the Vingroup trio also has some stocks that have increased well such as: CII increased by 2.66%, DIG increased by 2.45%, PDR increased by 1.27%...

The securities group mainly leaned towards red, in which SSI decreased by 1.55%, VCI decreased by 2.02%, CTS decreased by 2.03%, VIX, VND decreased by nearly 1%, ORS decreased by 1.33%... Only a few stocks remained green, SBS increased by 1.2%, FTS increased by 1.16%.

Banking stocks were more inclined to green with ABB up 1.18%, EIB up 2.87%, SHB up 1.37%, LPB up 1.84%; ACB, MSB, HDB up nearly 1%. On the contrary, STB, VCB, CTG, TPB decreased.

At the end of the trading session, VN-Index increased by 1.72 points (0.15%) to 1,154.15 points with 277 stocks increasing, 212 stocks decreasing and 61 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also increased by 1.85 points (0.79%) to 236.35 points with 108 stocks increasing, 74 stocks decreasing and 68 stocks remaining unchanged. Liquidity continued to decline sharply, with the total trading value in the entire market only about 16,300 billion VND, of which the HOSE floor reached less than 14,000 billion VND.

Foreign investors sold off for the second consecutive session with a total net selling value on the HOSE of nearly VND537 billion. The stocks with the most net sales all decreased in points, including CTG (VND89.46 billion), VCI (VND76.54 billion), HPG (VND51.90 billion), DPM (VND47.12 billion)...

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)