Kinhtedothi - The Government issued Decree No. 67/2025/ND-CP dated March 15, 2025 amending and supplementing a number of articles of Decree No. 178/2024/ND-CP on policies and regimes for cadres, civil servants, public employees, workers and armed forces in implementing the organizational arrangement of the political system.

Full text of Decree 67/2025/ND-CP.

Modify the scope of adjustment

Decree 67/2025/ND-CP expands the scope of regulation, amendments and supplements to clarify the agencies, organizations and units within the scope of regulation. Specifically, Decree 67/2025/ND-CP clearly states: This Decree stipulates policies and regimes, including: Policies and regimes for people who retire (retire early and resign); policies for people elected or appointed to leadership and management positions with lower position allowances or who resign from leadership and management positions; policies to encourage cadres, civil servants and public employees to increase their business trips to the grassroots level; policies to promote people with outstanding qualities and abilities; policies to train and improve the qualifications of cadres, civil servants and public employees after reorganization; Responsibility for implementing policies and regimes for cadres, civil servants, public employees and workers in agencies, organizations and public service units of the Party, State, Vietnam Fatherland Front, socio-political organizations and associations assigned by the Party and State from central to district levels, cadres, civil servants at commune level, armed forces (including the People's Army, People's Public Security and cryptography) in implementing the reorganization of the apparatus, administrative units at all levels, streamlining the payroll, restructuring and improving the quality of cadres, civil servants and public employees in the political system, including:

1. Agencies of the Communist Party of Vietnam, the State, the Vietnam Fatherland Front, socio-political organizations at the central, provincial and district levels and armed forces.

2. Administrative organizations of agencies and organizations from the central to district levels directly carry out organizational restructuring or do not directly carry out organizational restructuring but carry out staff streamlining, restructuring and improving the quality of cadres and civil servants.

3. Public service units directly implementing organizational restructuring or not directly implementing organizational restructuring but implementing staff streamlining, restructuring and improving the quality of civil servants, including:

a) Units under the organizational structure of agencies and organizations from central to district level and administrative organizations of agencies and organizations from central to district level;

b) Units under the provincial and municipal Party Committees directly under the Central Government and district, town, county and municipal Party Committees directly under the provinces and centrally run cities; under the People's Committees at the provincial and district levels; under socio-political organizations at the provincial level.

4. Other remaining public service units (not specified in Clause 3 above) must complete the organizational arrangement within 12 months from the date of the arrangement decision by the competent authority.

5. Agencies, organizations and units are arranged according to administrative units at all levels.

6. The associations assigned by the Party and State at the central, provincial and district levels shall carry out the arrangement, consolidation and merger of organizational apparatus.

Add applicable objects

Decree 67/2025/ND-CP amends and supplements Article 2 on the subjects of application to implement the conclusion of the Politburo. Specifically, the subjects of application include:

1. Cadres, civil servants, public employees, and people working under labor contracts in agencies, organizations, and units specified in Article 1 of this Decree and armed forces are directly affected by the implementation of organizational restructuring and administrative unit restructuring at all levels, including:

a) Civil servants and public employees not holding leadership or management positions;

b) Commune-level officials and civil servants;

c) People working under labor contracts for certain types of jobs in administrative agencies and public service units as prescribed by law before January 15, 2019 and people working under labor contracts are subject to policies like civil servants;

d) Officers, professional soldiers, workers, defense officials and contract workers receiving salaries from the state budget in the Vietnam People's Army;

d) Officers, non-commissioned officers receiving salaries, police workers and contract workers receiving salaries from the state budget belonging to the People's Public Security;

e) People working in key organizations;

g) Cadres, civil servants, and public employees in leadership and management positions in agencies, organizations, and units specified in Clauses 1, 2, 3, and 5, Article 1 of this Decree, who wish to resign to create favorable conditions for arranging the number of cadres, civil servants, and public employees in leadership and management positions according to the provisions of law in the implementation of organizational arrangement of the political system.

2. Cadres, civil servants, public employees, and workers receiving salaries from the state budget according to the provisions of law before January 15, 2019, and armed forces with 5 years or less remaining to retirement age in agencies, organizations, and units specified in Article 1 of this Decree are not directly affected by the organizational arrangement but must streamline the payroll, restructure, and improve the quality of cadres, civil servants, and public employees.

3. People working within the payroll quota and receiving salaries from the state budget at associations assigned by the Party and the State at the central, provincial and district levels are directly affected by the implementation of organizational arrangement, consolidation and merger.

4. Officials who are not old enough to be re-elected or re-appointed as prescribed in Clauses 1, 2, and 3, Article 2 of Decree No. 177/2024/ND-CP dated December 31, 2024 of the Government stipulating the regime and policies for cases of non-re-election or re-appointment; Cadres who meet the age requirements for re-election and reappointment to the same-level Party Committee, whose working time from the date of the congress organization is from 2.5 years (30 months) to 5 years (60 months) until reaching the retirement age prescribed in Clause 4, Article 2 of Decree No. 177/2024/ND-CP and cadres who are participating in Party Committees in Party Committees must end their activities and consolidate the organizational apparatus with 5 years or less until retirement age, and wish to retire early to create conditions for arranging Party Committee personnel in Party Congresses at all levels leading up to the 14th National Congress of the Party and are approved by competent authorities.

Add "salary retention differential coefficient" to ensure benefits for cadres, civil servants and public employees when they leave their jobs

Regarding determining current monthly salary to calculate policies and regimes, Decree 67/2025/ND-CP adds a "salary retention difference coefficient" to ensure benefits for cadres, civil servants, public employees and employees when they leave work.

Specifically, the current monthly salary is the salary of the month immediately preceding the leave of absence, including: Salary level according to the salary scale, grade, rank, position, title, professional title or salary level according to the agreement stated in the labor contract; salary allowances (including: Leadership position allowance; seniority allowance exceeding the framework; seniority allowance; preferential allowance according to profession; responsibility allowance according to profession; public service allowance; allowance for work of the Party, political and social organizations; special allowance for the armed forces) and salary reservation difference coefficient (if any) according to the provisions of the law on salary".

In addition, Decree 67/2025/ND-CP also amends and supplements the name of Article 6 as follows: "Article 6. Criteria for evaluating cadres, civil servants, public employees and workers to reorganize the apparatus, streamline the payroll and restructure, improve the quality of cadres and civil servants and resolve policies and regimes".

Amending policy for early retirement

Decree 67/2025/ND-CP amends Article 7 and supplements Articles 7a and 7b, specifically regulating policies for people retiring before the age of retirement in the following cases: due to organizational restructuring; due to streamlining the payroll, restructuring and improving the quality of the staff, civil servants and public employees; and early retirement policies for officials who are not old enough to be re-elected or re-appointed or are eligible for re-elected or re-appointed.

Specifically, according to the new regulations, the subjects specified in Clause 1 and Clause 3, Article 2 of this Decree who retire early will enjoy the early retirement policy according to the working time with compulsory social insurance payment and the number of years of early retirement as follows:

a) In case of having 02 to 05 years remaining to the retirement age prescribed in Appendix I issued with Decree No. 135/2020/ND-CP and having enough working time with compulsory social insurance payment to receive pension according to the provisions of the law on social insurance, in addition to enjoying the retirement regime according to the provisions of the law on social insurance, they are also entitled to the following regimes:

No deduction from pension rate due to early retirement;

Receive a subsidy of 05 months of current salary for each year of early retirement compared to the retirement age specified in Appendix I issued with Decree No. 135/2020/ND-CP;

Receive a subsidy of 05 months of current salary for the first 20 years of work with compulsory social insurance. From the 21st year onwards, for each year of work with compulsory social insurance, a subsidy of 0.5 months of current salary will be provided.

In case of 15 years of work or more, paying compulsory social insurance and being eligible for pension according to the provisions of the law on social insurance at the time of early retirement, the employee will be subsidized 04 months of current salary for the first 15 years of work; from the 16th year onwards, for each year of work with compulsory social insurance payment, the employee will be subsidized 0.5 months of current salary.

b) In case of having more than 05 years to 10 years of retirement age as prescribed in Appendix I issued with Decree No. 135/2020/ND-CP and having enough time to pay compulsory social insurance to receive pension according to the provisions of the law on social insurance, in addition to enjoying the retirement regime according to the provisions of the law on social insurance, they are also entitled to the following regimes:

No deduction from pension rate due to early retirement;

Receive a subsidy of 04 months of current salary for each year of early retirement compared to the retirement age prescribed in Appendix I issued with Decree No. 135/2020/ND-CP;

Receive a subsidy of 05 months of current salary for the first 20 years of work with compulsory social insurance. From the 21st year onwards, for each year of work with compulsory social insurance, a subsidy of 0.5 months of current salary will be provided.

In case of 15 years of work or more, paying compulsory social insurance and being eligible for pension according to the provisions of the law on social insurance at the time of early retirement, the employee will be subsidized 04 months of current salary for the first 15 years of work; from the 16th year onwards, for each year of work with compulsory social insurance payment, the employee will be subsidized 0.5 months of current salary.

c) In case of having 02 to 05 years remaining to the retirement age prescribed in Appendix II issued with Decree No. 135/2020/ND-CP and having enough working time with compulsory social insurance to receive pension according to the provisions of the law on social insurance, including 15 years or more working in a heavy, toxic, dangerous or especially heavy, toxic, dangerous job on the list issued by the Government agency performing the function of state management of labor or having 15 years or more working in an area with particularly difficult socio-economic conditions issued by the Government agency performing the function of state management of labor, including working time in a place with a regional allowance coefficient of 0.7 or higher before January 1, 2021, in addition to enjoying the pension regime according to the provisions of the law on social insurance, they are also entitled to the following regimes:

No deduction from pension rate due to early retirement;

Receive a subsidy of 05 months of current salary for each year of early retirement compared to the retirement age prescribed in Appendix II issued with Decree No. 135/2020/ND-CP;

Receive a subsidy of 05 months of current salary for the first 20 years of work with compulsory social insurance. From the 21st year onwards, for each year of work with compulsory social insurance, a subsidy of 0.5 months of current salary will be provided.

In case of 15 years of work or more, paying compulsory social insurance and being eligible for pension according to the provisions of the law on social insurance at the time of early retirement, the employee will be subsidized 04 months of current salary for the first 15 years of work; from the 16th year onwards, for each year of work with compulsory social insurance payment, the employee will be subsidized 0.5 months of current salary.

Supplement Article 7a. Policy for people retiring before retirement age due to streamlining payroll, restructuring and improving the quality of staff, civil servants and public employees

Subjects specified in Clause 2, Article 2 of this Decree who retire early shall enjoy the benefits specified in Clause 2, Article 7 of this Decree. In addition, they shall enjoy a one-time retirement allowance for the period of early retirement:

1. For those who retire within 12 months from March 15, 2025, they will receive a subsidy equal to 01 month of current salary multiplied by the number of months of early retirement compared to the retirement date specified in Appendix I and Appendix II issued with Decree No. 135/2020/ND-CP;

2. For those who take leave from the 13th month onwards from March 15, 2025, they will receive 0.5 times the allowance level in Clause 1 of this Article.

Supplement Article 7b. Early retirement policy for cadres who are not old enough to be re-elected or re-appointed or who meet the age requirements for re-election or re-appointed

The subjects specified in Clause 4, Article 2 of this Decree who retire early are entitled to the benefits specified in Clause 2, Article 7 of this Decree. In addition, they are entitled to a one-time retirement allowance for the early retirement period equal to 01 month of current salary multiplied by the number of months of early retirement compared to the retirement date specified in Appendix I and Appendix II issued with Decree No. 135/2020/ND-CP.

Amendment and supplementation of funding sources for implementing the regime

Decree 67/2025/ND-CP amends and supplements Point a, Clause 2, Article 16 on funding sources to implement the regime for civil servants and employees in public service units .

Specifically, for public service units that self-guarantee regular and investment expenses; public service units that self-guarantee regular expenses: Funds for resolving policies and regimes come from the unit's revenue from public service activities and other legal sources of revenue.

In case public service units do not have enough funding to resolve policies and regimes, they can use funds allocated according to regulations of public service units to resolve policies and regimes.

In case public service units self-insure regular expenses ordered by the State through service prices but the service prices do not include all the constituent elements to resolve policies and regimes, the source of funding to resolve policies and regimes shall be supplemented by the State budget.

In addition, Decree 67/2025/ND-CP also adds Clause 5 and Clause 6 to Article 16 as follows:

For those working within the payroll quota and receiving salaries from the state budget at associations assigned by the Party and the State at the central, provincial and district levels, directly affected by the implementation of organizational arrangement, consolidation and merger: Funding for resolving policies and regimes is provided by the state budget.

For administrative organizations that end the implementation of special financial mechanisms such as public service units from January 1, 2025, the source of funding for policy and regime settlement will be provided by the state budget.

Eliminate regulations on additional local support policies

Decree 67/2025/ND-CP removes Clause 6, Article 19, which stipulates that the People's Committees of provinces and cities, based on the ability to balance the local budget, submit to the People's Councils of the same level to issue additional support policies for subjects under their management.

At the same time, Decree 67/2025/ND-CP also stipulates: Cases that have been resolved by competent authorities for additional support policies from local budget sources according to regulations in Clause 6, Article 19 of Decree No. 178/2024/ND-CP before March 15, 2025 will still enjoy this additional support policy.

Transitional provisions

Decree 67/2025/ND-CP clearly states: Cases in which policies and regimes are being resolved due to the reorganization of the apparatus and administrative units at district and commune levels as prescribed in Decree No. 29/2023/ND-CP but the competent authority has not yet issued a decision to resolve policies and regimes shall apply the policies and regimes prescribed in this Decree.

Cases that are implementing policies and regimes due to the arrangement of administrative units at district and commune levels, and have been resolved by competent authorities according to Decree No. 29/2023/ND-CP but the time of leaving work is after January 1, 2025, the policies and regimes prescribed in this Decree shall be applied.

In the cases specified in Clause 4, Article 2 of this Decree, the competent authority has resolved policies and regimes according to Decree No. 177/2024/ND-CP. If the policies and regimes are lower than those specified in this Decree, the policies and regimes specified in this Decree shall apply.

In cases where the competent authority has resolved policies and regimes according to the provisions of Decree No. 178/2024/ND-CP, if the policies and regimes are lower than the policies and regimes prescribed in this Decree, they will be granted additional policies and regimes according to the policies and regimes prescribed in this Decree.

In cases of restructuring the apparatus or changing the organization or changing the organizational chart, the competent authority has decided to retire before the age limit before January 1, 2025 according to the Government's regulations guiding the implementation of the Law on Officers of the Vietnam People's Army, the Law on Professional Soldiers, Defense Workers and Civil Servants and the Law on Cryptography, but by January 1, 2025 the competent authority has not issued a decision to resolve the policy and regime, the policy and regime prescribed in this Decree shall be applied.

Decree 67/2025/ND-CP takes effect from the date of signing (March 15, 2025).

Source: https://kinhtedothi.vn/quy-dinh-moi-ve-che-do-doi-voi-can-bo-cong-chuc-vien-chuc-trong-thuc-hien-sap-xep-to-chuc-bo-may.html

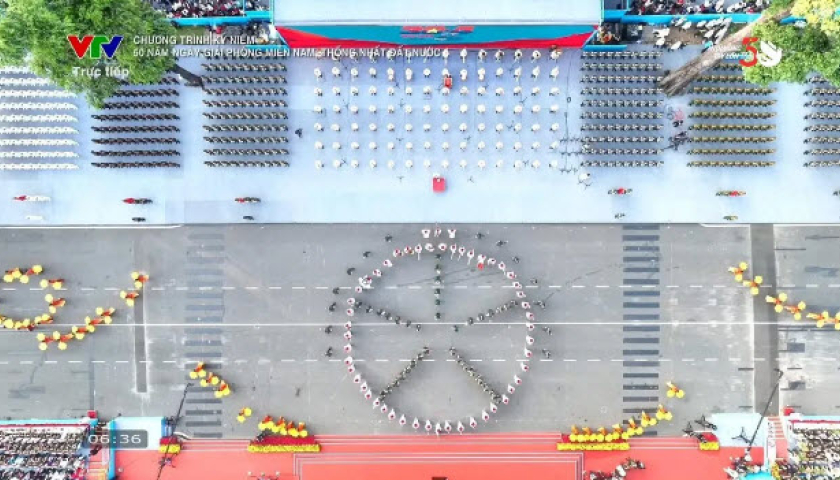

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

Comment (0)