Concept

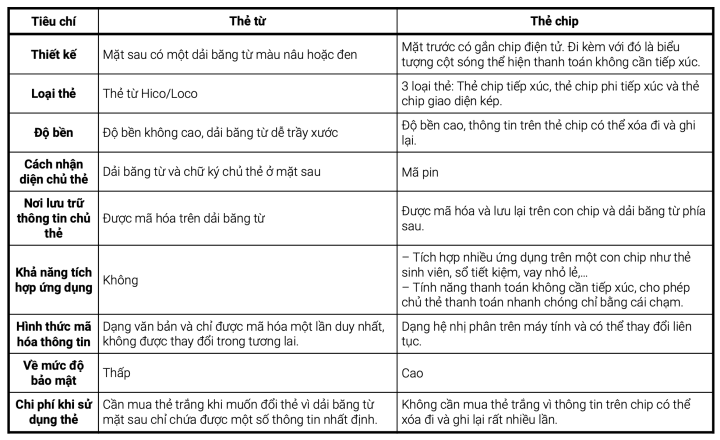

Magnetic stripe ATM cards have been a familiar type of bank card for many years. These cards have a black magnetic strip on top. This strip contains the cardholder's information.

A chip-embedded ATM card is a type of card that has an electronic chip embedded in the front. This chip contains the cardholder's (encrypted) information.

ATM cards with embedded chips.

Card security level

With magnetic stripe cards, the cardholder's information within the black bar is stored as text; it is easily decrypted and stolen. The security level is low, making it easy for criminals to secretly attach devices that record the PIN entry process from the user.

With chip cards, the cardholder's information is encoded as a sequence of binary symbols used by computers. The chip's encryption enhances the information; the chip's encoding is continuous.

Durability

Magnetic stripe cards have low durability, and the magnetic strip is easily scratched. In contrast, chip-embedded ATM cards are highly durable, and the information on the chip can be recorded multiple times.

How to identify the cardholder

Older magnetic stripe ATM cards had a simple way of identifying the cardholder: through the magnetic strip. The cardholder's photo was printed on the card, and their signature was on the back.

Conversely, ATM cards with chips have a more complex cardholder identification system. The chip identifies the cardholder using a PIN code.

Application integration capabilities

A key feature of chip-embedded ATM cards is their ability to integrate into various applications. For example, they can be used for small loans, savings accounts, student cards, etc. Older magnetic stripe cards do not have this feature.

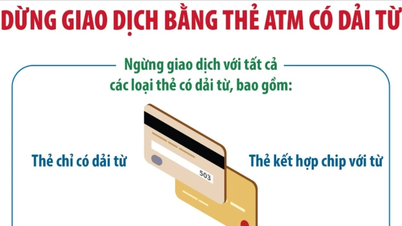

The difference between magnetic stripe ATM cards and chip cards.

Cost savings

Magnetic stripe cards can only store certain information and cannot be erased or re-written. Therefore, there is an additional cost to purchase blank cards. Conversely, information on chip cards can be erased and rewritten multiple times. Therefore, there is a cost savings on purchasing blank cards.

Quantity

Magnetic stripe cards come in only one type, while chip-embedded ATM cards come in three types: contact chip cards, contactless chip cards, and chip cards.

In addition to the advantages mentioned above, chip-embedded ATMs also have a robust security operating principle. When a chip card is used for payment, the chip generates a unique and non-repeating transaction code.

If your card information is stolen or the card is counterfeited, the fake card will never work. Because the stolen transaction code cannot be reused, the card will be rejected.

Tue Lam (Compiled)

Source

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

Comment (0)