Nvidia joined the trillion-dollar club after its shares rose 4.2% to trade around $409 per share before the open on May 30.

The Santa Clara, California-based company joins the ranks of tech giants Microsoft, Alphabet, Amazon and Apple in surpassing a $1 trillion market cap. NVDA is now the ninth stock to reach that milestone.

This figure is double the market capitalization of Taiwan Semiconductor Manufacturing Co (TSMC), the world's second largest chipmaker ($535 billion).

NVDA jumped more than 26% on May 25 after the company reported better-than-expected quarterly results on May 24. The stock is up about 165% year-to-date.

Notably, Nvidia forecasted revenue of $11 billion with a margin of error of just 2% for Q2 2024. This is 50% higher than the consensus estimate of $7.15 billion.

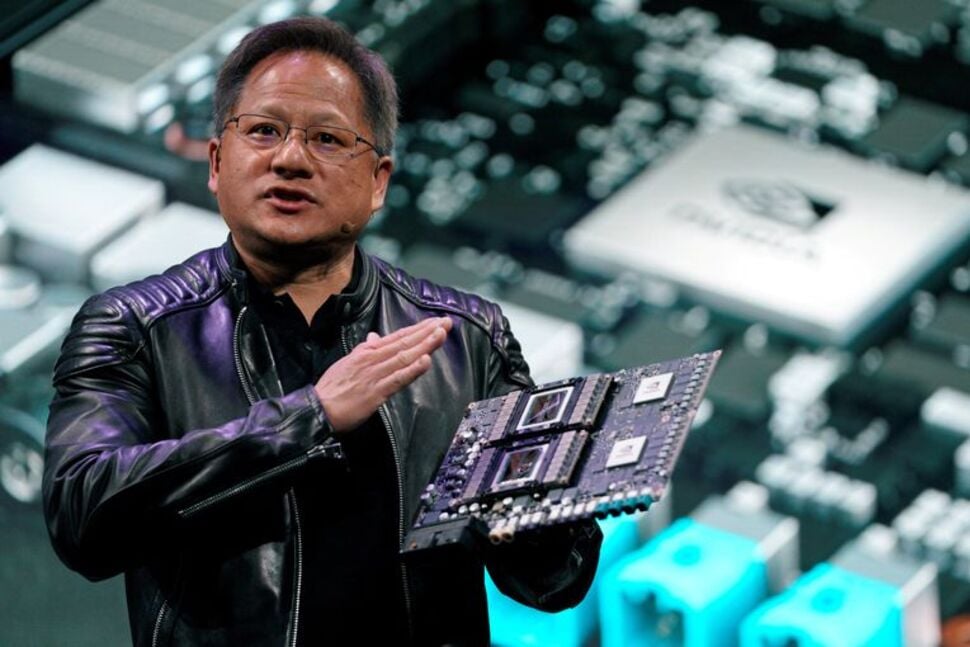

Jensen Huang, co-founder and CEO of Nvidia. Nvidia's market value increased by $207 billion in two days after the company provided a better-than-expected revenue outlook on May 24. Photo: USA Today

One of the factors contributing to Nvidia's stock market rally in the first half of the year was the ongoing artificial intelligence (AI) craze.

The explosion of OpenAI's ChatGPT chatbot late last year has sent tech companies racing to launch their own generative AI solutions, leading to increased demand for the advanced chips used to power these products.

Amid the AI craze, Stifel analyst Ruben Roy raised his price target on Nvidia shares to $300 from $225 last week. According to Roy, Nvidia remains the company best positioned to benefit from the AI investment cycle in the medium term .

Nguyen Tuyet (According to Reuters, CNBC, Finbold)

Source

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)