On October 17, the stock market recorded a volatile trading session when the VN-Index opened with a slight green thanks to some individual stocks, especially QCG, which at times hit the ceiling. However, after 10 a.m., the index fell sharply, falling back to nearly 1,270 points.

At around 2:00 p.m., the market recovered thanks to strong demand, especially from banking, securities and real estate stocks after investors received information that the State Bank announced the transfer of two compulsory purchasing banks: CBBank transferred to Vietcombank and OceanBank transferred to Military Bank (MB).

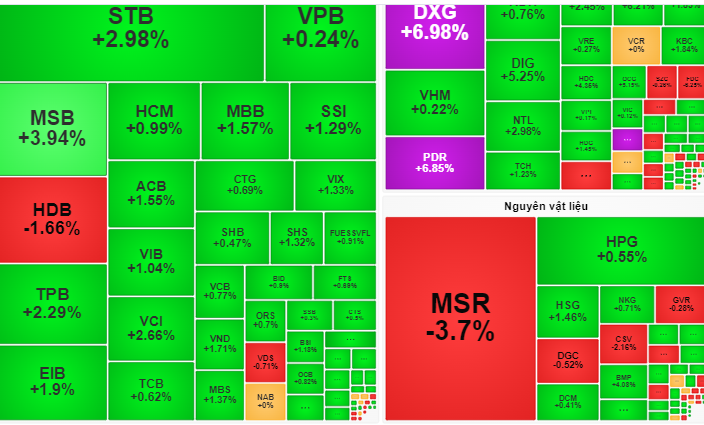

This created optimistic expectations about the stability and development of the banking industry, promoting a strong increase in demand. As a result, out of 27 bank stocks listed on the HoSE, 24 stocks increased in price again.

In addition, after Ho Chi Minh City announced a new draft of land price list with a significant decrease compared to the previous draft, many stocks in the real estate group also increased impressively: DXG (Dat Xanh) increased by the ceiling of 7%, PDR (Phat Dat) increased by 6.8%, NVL ( Novaland ) increased by 2.55%, DIG increased by 5.2%, NTL increased by 2.9%, VHM increased slightly by 0.2%...

This increase spread to other stocks, especially the VN30 group, helping the market recover positively.

At the end of the session, VN-Index increased by more than 7 points, closing at 1,286.5 points, ending the previous three-session decline.

Session 10-17, out of 27 bank stocks listed on HoSE, 24 stocks increased in price.

Securities stocks also recorded a slight increase, especially HCM, SSI, VCI, and VND increased by 1-2%. Meanwhile, real estate stocks had strong differentiation.

Large-cap stocks such as DXG and PDR all hit their ceiling prices, while small and mid-cap stocks remained in the red, contributing to the sharp increase in prices of other real estate stocks such as NVL, DIG and VHM.

Market liquidity remained positive with a trading value of VND15,700 billion. Although foreign investors net sold more than VND400 billion, the optimism of domestic investors still prevailed. The biggest contribution to the increase of VN-Index came from the banking and real estate groups, helping the market regain growth momentum.

According to some securities companies, the session on October 17 had a bright spot in the consensus recovery of large-cap stocks and the positive spread of cash flow. However, the market needs more time to accumulate and consolidate the uptrend.

VCBS Securities Company recommends that investors should consider increasing the proportion of stocks that have adjusted well, especially those in the banking and securities sectors.

Source: https://nld.com.vn/chung-khoan-ngay-mai-18-10-nhom-co-phieu-nao-se-tao-bat-ngo-196241017165427542.htm

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)