NDO - On December 17th, trading remained sluggish, with mixed performance across sectors, causing the overall index to fluctuate slightly around the reference point before finally sinking into the red by the end of the morning session. Large-cap stocks such asFPT , VCB, and MWG had the most negative impact on the VN-Index. At the close of trading, the VN-Index fell 2.07 points to 1,261.72 points.

On the HoSE exchange, the trading value in this session decreased compared to the previous session, reaching over 8,719.81 billion VND.

Foreign investors continued to net sell 669 billion VND on the HoSE exchange. On the buying side, SIP shares were the most heavily bought (35 billion VND), followed by VHM (33 billion VND), HDB (32 billion VND), etc. Conversely, FPT was the most heavily sold (312 billion VND), followed by MWG (80 billion VND), NLG (63 billion VND), etc.

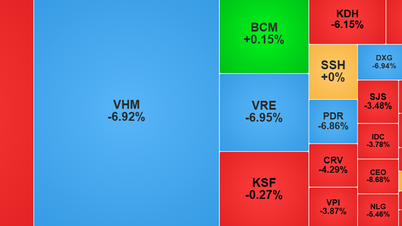

Today's session saw rather sluggish trading in blue-chip stocks, mostly fluctuating within a narrow range. At the close of trading, only 5 stocks in the VN30 index (ACB , HDB, MBB, PLX, VHM) saw slight gains of 0.2-0.85%; 6 stocks (CTG, HPG, SAB, SSB, STB, TPB) remained unchanged; and the remaining 19 stocks declined.

Specifically, FPT fell 1.27% to 148,000 VND/share, and MWG decreased 1.15%.

The remaining stocks: BCM, BID, BVH, GAS, GVR, MSN, POW,SHB , SSI, TCB, VCB, VIB, VIC, VJC, VNM, VPB, VRE saw slight declines of less than 1%.

In terms of sectors, steel stocks closed lower, with VCA falling to its floor price of 14,250 VND/share, TLH down 2.59%, NKG down 2.14%, and HSG slightly down. Conversely, SMC rose 2.05%, while HMC and HPG remained unchanged.

Securities stocks closed the session in slight red. Besides SSI mentioned above, FTS fell 1.61% to 42,850 VND/share, while APG, CTS, HCM, ORS, TVB, TVS, VCI, and VIX also saw slight declines. Conversely, TCI rose 1.07%, AGR, DSE, and VDS also saw slight increases, while BSI and VND remained unchanged.

Similarly, the banking sector stocks closed lower. Besides the VN30 group stocks ACB, BID, CTG, HDB, MBB, SHB, SSB, STB, TCB, TPB, VCB, VPB, and VIB mentioned above, the remaining stocks EIB, LPB, and MSB saw slight increases, OCB experienced a slight decrease, and NAB remained unchanged.

In addition, sectors such as transportation, materials for production, insurance, utilities, distribution and retail, and software also closed in the red.

Conversely, real estate stocks closed slightly higher, with FIR hitting the ceiling price, DXS rising 1.45%, HTN up 3.97%, SCR up 1.24%, and so on.

Other sectors such as raw materials, consumer goods and decorations, and telecommunications closed in the green.

* The Vietnamese stock market index was mostly in the red throughout today's session. The VNXALL-Index closed down 4.44 points (-0.21%) at 2,096.54 points. Trading volume reached 461.73 million units, equivalent to a trading value of VND 11,824.85 billion. Across the market, 167 stocks increased in price, 99 remained unchanged, and 190 decreased.

* On the Hanoi Stock Exchange (HNX), the HNX-Index closed at 226.89 points, down 0.15 points (-0.07%). Total trading volume reached over 28.21 million shares, with a corresponding transaction value of over 548.57 billion VND. Across the entire exchange, there were 76 gainers, 64 unchanged stocks, and 73 losers.

The HNX30 index closed down 0.66 points (-0.14%) at 479.93 points. Trading volume reached approximately 15.81 million units, with a corresponding value of over 396.18 billion VND. Among the HNX30 stocks, 12 increased, 3 remained unchanged, and 14 decreased in price.

On the UPCoM market, the UPCoM Index rose, closing at 92.77 points, up 0.13 points (+0.14%). Total market liquidity reached over 22.70 million shares traded, with a corresponding trading value of over 391.31 billion VND. Among UPCoM stocks, 130 ended the trading day higher, 110 remained unchanged, and 125 declined.

* On the Ho Chi Minh City Stock Exchange, the VN-Index closed down 2.07 points (-0.16%) at 1,261.72 points. Trading volume reached over 484.99 million units, equivalent to a transaction value of VND 11,786.02 billion. Across the entire exchange, there were 147 gainers, 78 unchanged stocks, and 232 losers.

The VN30 index fell 4.19 points (-0.31%) to 1,327.63 points. Trading volume reached over 145.48 million units, equivalent to a transaction value of VND 5,015.24 billion. At the end of the trading day, 5 VN30 stocks increased, 6 remained unchanged, and 19 decreased.

The top 5 stocks with the highest trading volume were VIX (over 13.21 million units), HPG (over 10.80 million units), HDB (over 8.72 million units), DXG (over 8.41 million units), and VPB (over 8.18 million units).

The top 5 gainers were STG (7.00%), ABS (6.94%), PAC (6.94%), SGT (6.93%), and FIR (6.93%).

The 5 stocks with the biggest price drops were VCA (-6.86%), HNA (-5.69%), VRC (-4.82%), VID (-4.32%), and RYG (-3.44%).

* Today's derivatives market saw 182,433 contracts traded, with a value exceeding VND 24,287.50 billion.

Source: https://nhandan.vn/khoi-ngoai-day-manh-ban-rong-vn-index-giam-nhe-post850971.html

![[Photo] Two flights successfully landed and took off at Long Thanh Airport.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F15%2F1765808718882_ndo_br_img-8897-resize-5807-jpg.webp&w=3840&q=75)

Comment (0)