High demand for apartment rentals

In recent years, the demand for renting apartments in Ho Chi Minh City and neighboring provinces such as Binh Duong and Dong Nai has increased.

According to Dat Xanh Services, the number of immigrants to big cities is increasing, while the need to live in a stable environment with full amenities is being sought by many people. Therefore, the apartment segment is also attracting a lot of rental demand.

Mr. Tran Cong Trinh (33 years old, living in Thu Duc city, Ho Chi Minh city) shared: “I used to live in Binh Thanh district, but at the end of 2023 I got married, now I am married and about to welcome a new member, my family has rented an apartment on Pham Van Dong street, Thu Duc city with a cost of more than 10 million/month. Moving from a rented house to an apartment is a common need because the family needs private space and amenities for young children to develop”.

Nowadays, apartments are always of interest to many people looking to rent because they provide many benefits and conveniences...

Currently looking to rent an apartment, Mr. Thai Vo (residing in Hiep Binh ward, Thu Duc city) shared: "Currently, I am also looking for an apartment in Binh Thanh district to rent for my family of 2. There are many apartments for rent in Binh Thanh area, however, I am looking for a house with a price suitable for my income."

According to Mr. Vo, the family also wanted to buy an apartment but their finances did not allow it. Therefore, they decided to rent for a while and save more.

Mr. Nguyen Hong Hai, Chairman of VNO Investment and Development Joint Stock Company (VNO Group), commented that the real estate market has faced many difficulties in recent times, but in general, this is still the leading investment channel and a safe haven for assets. In particular, people's income and needs are increasing, so moving from boarding houses to renting apartments is inevitable.

An apartment is furnished and ready for rent.

Besides, apartments not only meet the housing needs but also provide a better living environment. Residents enjoy many internal and external amenities and will not have many complications compared to having to live in boarding houses.

According to a report by Dat Xanh Services, the demand for real estate purchases, mainly apartments, increased sharply in the first quarter of 2024. Of which, the demand for buying for living accounted for 58%, buying for rental exploitation 18% and long-term investment 16%, only 3%-5% was for short-term investment or other purposes.

Meanwhile, Savills World Research assessed that in the first months of 2024, the increasing trend in rental demand for apartments and serviced apartments was also recorded.

Specifically, for Ho Chi Minh City, supply according to Savills data increased by 8,200 units by the end of 2023. Rents of all grades increased year-on-year thanks to good recovery in demand.

Of which, the rental price of class C has the highest year-on-year increase of 8%, followed by class B at 5% and class A at 3%. The occupancy rate in 2023 in Ho Chi Minh City reached 82%, up 6% year-on-year.

Income generating assets

Mr. Le Van Hung, Director of Nam Phat Real Estate Construction Joint Stock Company, commented: “Currently, apartments are still an attractive investment channel. This type of investment helps investors accumulate long-term assets, while combining leasing with a high and stable average profit rate.”

According to Mr. Hung, apartments are one of the real estate segments that are considered long-term, many investors with idle money will use it to invest in apartments to create accumulated assets.

“Depending on the apartment real estate segment that investors buy, location, area, etc., the rental price will also be different. However, by leaving the real estate empty, renting it out also creates a source of income for investors, stimulating the real estate market,” Mr. Hung commented.

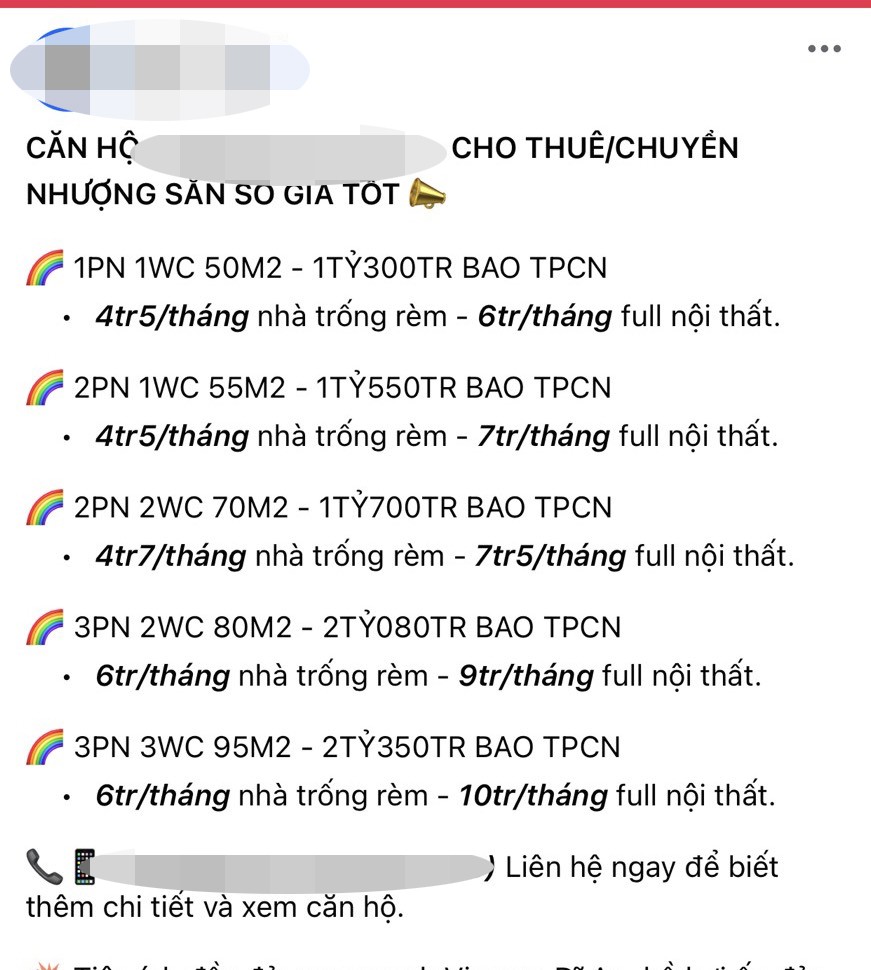

Currently, the demand for renting apartments from investors is very high and there are many price segments to choose from. This makes the apartment rental market still vibrant.

Mr. Phan Binh (from Binh Phuoc province) said that 4 years ago, taking advantage of idle money, he bought a newly opened project in the area near Pham Van Dong street, Thu Duc city. Currently, the above apartment has been handed over and the rental price is 9 million VND/month. According to Mr. Binh, this is not only the family's property but also creates a source of income that greatly supports the family's financial expenses.

With many buyers and investors wondering whether to put down money to "close" an apartment. Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, said that consumers should clearly define their purpose. If they buy to live in, they can make a transaction when their finances allow to immediately meet the practical needs of settling down.

“Waiting for apartment prices to drop sharply is very difficult, because supply cannot improve quickly. When the revised Law on Real Estate Business comes into effect, the number of investors meeting the requirements to implement projects will decrease. Meanwhile, the need to own a house is always present, especially in large cities,” Mr. Nguyen Quoc Anh shared.

According to experts, long-term apartment investment still generates profits from rental.

According to Mr. Quoc Anh, if investing in the long term and investing for the purpose of renting to generate cash flow, apartments are still a type that can be considered. The reason is because the growth in apartment investment profits (price increase rate plus rental yield) in the period 2015 - 2023 reached 97%, ranking No. 1 compared to other types of investment such as stocks, gold, savings, foreign currency.

Experts from Batdongsan.com.vn believe that it is difficult to detect the bottom or peak of apartment prices. Buyers and investors should clearly identify their needs, monitor the market situation and make decisions when their needs are met.

Besides price, it is necessary to carefully research many other important factors such as investor reputation, location and amenities to serve your life well or ensure liquidity and effective rental.

Batdongsan.com.vn’s price history reflects the sharp price increases of many apartment projects in the beginning of this year. In Ho Chi Minh City, some projects have increased their selling prices by over 45%, such as Thao Dien Apartment or Khang Gia Apartment (Go Vap District).

Among them, apartment seekers are most interested in Vinhomes Grand Park, Vinhomes Central Park, Celadon City, Q7 Saigon Riverside, Mizuki Park, Masteri Thao Dien, Vinhomes Golden River Ba Son, Sunrise City, Eco Green Saigon, CityLand Park Hills. This list is mostly large projects, located in densely populated areas.

Source: https://www.nguoiduatin.vn/nguon-thu-tu-can-ho-cho-thue-kich-cau-nha-dau-tu-a665973.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

Comment (0)