| Coffee export prices are forecast to increase until April 2024 Coffee exporting enterprises proactively meet EU market regulations |

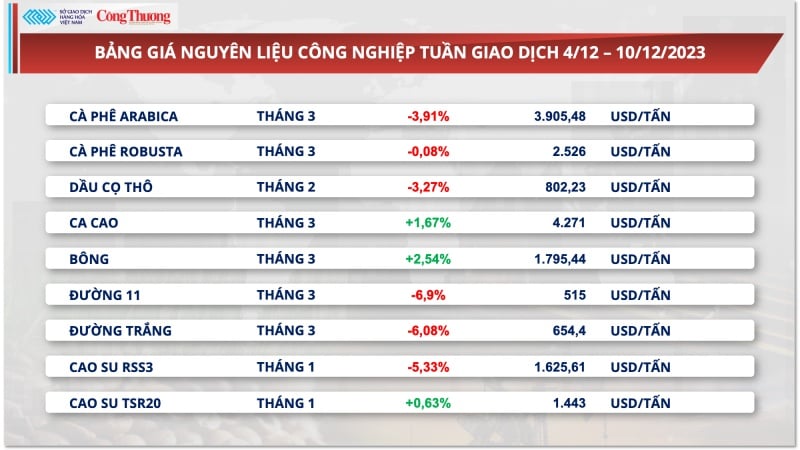

According to the Vietnam Commodity Exchange (MXV), at the end of the trading week of December 4-10, the two coffee commodities also decreased by 3.91% for Arabica and 0.08% for Robusta, respectively. Inventory data recovered after a week of deep decline along with positive prospects for new crop coffee supply in Brazil are two important reasons for the price reversal.

|

| Coffee export prices turned down last week |

Certified Arabica stocks on the Intercontinental Exchange-US (ICE-US) rose by 10,633 60kg bags last week, bringing the total certified coffee holdings to 234,699 bags, off the more than 24-year low recorded last week.

The International Coffee Organization (ICO) forecasts a surplus of around 1 million bags in the 2023/24 coffee crop year, compared to a deficit of nearly 5 million bags in the last crop year. Increased production in Brazil and several other major producing countries is the reason for the current surplus forecast. In November, the country exported more than 234,700 tons of coffee, up 8% from the same month in 2022.

In the domestic market, recorded this morning (December 11), the price of green coffee beans in the Central Highlands and the Southern provinces fluctuated between 60,400 - 60,600 VND/kg, unchanged from the previous day.

Mr. Nguyen Duc Dung - Deputy General Director of MXV commented that in the first months of 2024, Vietnam's Robusta coffee supply may dominate the global market share. With the amount of coffee available thanks to harvesting activities, coffee prices are expected to decrease in the short term. However, the adjustment will be relatively gentle and prices may stay above 2,300 USD/ton.

|

| Vietnam's coffee exports are still growing |

In fact, Vietnam's coffee exports are still on a positive trend. Regarding coffee exports, according to the General Department of Customs, the country's coffee exports by the end of November reached about 3.5 billion USD. In the context of a global shortage of supply, pushing prices up, Vietnam is entering the main harvest season, the coffee industry is expected to have a bustling business season at the end of the year. Up to now, this enterprise has exported about 150,000 tons of coffee of all kinds, mainly raw coffee.

Export turnover also grew quite well compared to the same period, thanks to the sharp increase in coffee prices, from 1,000 USD/ton a few years ago, to now it has increased 3 times. This is the result of improving product quality thanks to changing the mindset from farmers' production to businesses' processing.

In the first 11 months of 2023, the country's coffee exports reached about 3.5 billion USD. Trade activities will continue to be vibrant in the last months of the year, when Vietnam enters the peak harvest season of the new crop. Notably, the export price of coffee in October continued to set a new record of over 3,600 USD per ton, up nearly 9% compared to September and up 40.7% over the same period. This will be the driving force for businesses to continue to take advantage of opportunities to increase exports.

Regarding the market, in October 2023, Vietnam's coffee exports to the US reached approximately 1,760 tons, worth about 6.31 million USD, up 11.2% in volume and 22.2% in value compared to the previous month, but down sharply by 78.8% in volume and 69.3% in value compared to the same period in 2022.

In the first 10 months of 2023, Vietnam exported nearly 93,840 tons of coffee to the US, earning 225 million USD, down 3.5% in volume and 4.3% in value compared to the same period last year.

Notably, in October 2023, the average export price of Vietnamese coffee to the US reached a record high of 3,586 USD/ton, up 9.9% compared to September 2023 and up 45.1% compared to October 2022.

However, the coffee industry also faces many challenges, such as climate change causing reduced output, unstable profits for farmers, the coffee area in our country is shrinking; the rate of processed coffee is increasing but slowly.

Not to mention, from the beginning of 2025, Vietnamese coffee businesses must also proactively meet the latest requirements of the European market, resolutely not importing coffee grown on deforested areas or causing forest degradation. Along with strong fluctuations in trade, sustainable production trends, and quality issues, the domestic coffee industry must strive to adapt to maintain its position as the second largest exporter in the world.

Source link

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Attractive extracurricular lessons through interactive exhibition at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/1f307025e1c64a6d8c75cdf07d0758ce)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)