Slowing inflation has helped investors feel optimistic, but British people are still under great pressure as prices of goods and interest rates remain high.

Inflation in the UK, where people are under greater pressure to spend than in most other rich countries, cooled last month, with consumer prices rising 7.9% in June compared to a year earlier, according to the Office for National Statistics (ONS). Inflation in the UK was 8.7% in May.

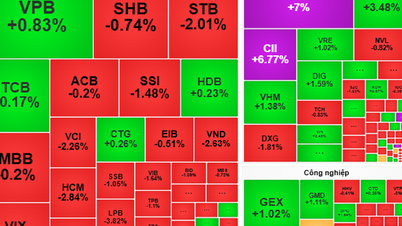

The surprise data sent British stocks soaring on hopes that the Bank of England (BoE) would not need to raise interest rates as sharply as previously expected. The FTSE 250 index rose nearly 3% on July 19. Investors cut their forecast for the BoE's benchmark interest rate to 5.85% next year, down from 6.5% just two weeks ago, according to Tradeweb data.

Better-than-expected inflation data has prompted markets to reassess the extent to which the BoE will need to raise interest rates to ease inflationary pressures, said Ellie Henderson, an economist at Investec. “UK interest rate expectations have been scaled back significantly,” she said.

The stock market is sensitive to small changes in UK inflation data. But behind the changes, UK consumer prices continue to rise at a faster rate than most other rich countries, leading to the biggest fall in real incomes for people in seven decades.

“For families across the country, prices are still rising too fast and there is a long way to go,” said Jeremy Hunt, UK Chancellor of the Exchequer.

Unlike in the US, where mortgage rates are fixed for between 15 and 30 years, mortgages in the UK are typically fixed for just two to five years. Jon Glenister, an electrician living in West London, recently saw his mortgage rate jump to more than 5%, from 1.6%.

"I can barely cope with the rising prices and mortgage payments. I don't go out as much, I don't eat out as much. I eat less meat because it's so expensive," Glenister said. According to a survey of 2,156 people conducted by the ONS between June 28 and July 9, nearly a third of Britons are using savings to pay bills, and nearly half are struggling to pay their rent and mortgages.

The cost of living crisis is one of the reasons why Chancellor Rishi Sunak is at risk of political defeat. A YouGov poll from July 10-11 found that 43% would vote for the opposition Labour Party and just 25% for Chancellor Rishi Sunak. The polls also suggested the government was at risk of defeat in the upcoming special elections.

Food prices are the main reason why UK inflation is higher than many other rich countries. Food inflation eased in June but remained at 17.3%. In the US, food prices were 4.7% higher in June than a year earlier.

People buy vegetables and fruits in central London, Britain, August 19, 2022. Photo: Reuters

Faced with rising costs of essentials, workers in the UK have secured larger pay rises than have been typical in recent decades. Average weekly pay, excluding bonuses, was 7.3% higher in the three months to May than in the same period a year earlier, the fastest rise on record outside the pandemic, according to the ONS.

But even so, workers' spending power still fell 0.8% from a year earlier as real earnings fell when inflation was taken into account. Britain has seen strikes in the health care, transport andeducation sectors over the past year as workers fought to protect their purchasing power. Last week, the government offered millions of civil servants a pay rise of at least 6% in an effort to end those disputes.

Reduced spending, combined with labour shortages, has hit some businesses. Andy Kehoe runs a pub in London and has raised beer prices to keep up with higher energy costs. The price shock has put some of his regulars out of the restaurant, and he is now struggling to retain staff. “I’m losing money. High prices are keeping people at home, but I have to pay my people and keep going,” he said.

Policymakers at the BoE have long worried about the potential for a price-wage spiral, in which initial price increases trigger wage hikes that force firms to raise prices further. More recently, they have expressed concern about the role of profits in keeping inflation high. Many argue that firms’ efforts to maintain or increase profit margins keep prices high.

Speaking to bankers last week alongside BoE Governor Andrew Bailey, Treasury Secretary Jeremy Hunt said regulators would act to ensure profits did not rise too quickly. “I will continue to work with regulators to ensure the needs of families are prioritised during this difficult time,” he added.

However, the main weapon in the fight against inflation remains the BoE's interest rates. Policymakers have signaled some caution, with two of the BoE's nine governors voting against further rate increases at recent meetings, arguing that it would take time for the rate hikes to have an effect.

Phien An ( according to WSJ )

Source link

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)