SGGPO

In recent times, MoMo has implemented many effective cooperation models with banks and financial institutions, bringing encouraging results in terms of customer numbers, transaction value and operational efficiency. In particular, this cooperation model is contributing to bringing financial services to many low-income customers.

|

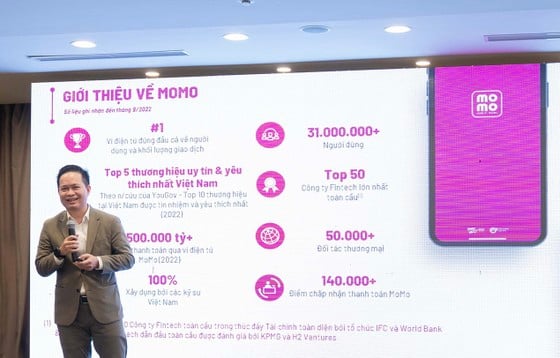

| Mr. Nguyen Ba Diep shared at the forum |

The "sweet fruits" after the handshake between fintech and banks were just shared by Mr. Nguyen Ba Diep, Co-founder of MoMo, and Member of the Standing Committee of the Vietnam Software and Information Technology Services Association (VINASA) at the workshop "Building a digital finance platform - digital banking, data infrastructure and connecting economic sectors" on May 25, 2023 within the framework of the Vietnam - Asia Digital Transformation Summit 2023 held in Hanoi.

Mr. Nguyen Ba Diep said: “Fintechs like MoMo have models to approach customers every day and understand their needs. MoMo can help banks and financial institutions approach customers in a simple, effective way at the lowest cost. The cooperation between banks and payment intermediaries like MoMo will create the most effective cooperation model.”

Three outstanding services are currently being implemented by MoMo and banks and financial institutions with encouraging results:

First, MoMo deployed eKYC technology with banks to help customers identify themselves online, simplifying paperwork when opening a bank account. Currently, more than 230,000 bank accounts have been successfully opened for customers through MoMo.

Second, MoMo acts as an accessible investment platform, connecting customers with many products and services of banks and financial institutions. With services such as Online Savings, Online Gold Shop, Fund Certificates, MoMo helps customers save, buy and sell gold, buy fund certificates anytime, anywhere, online and in real time.

Third, MoMo is a platform for collecting loans and credit cards from 20 large banks and financial companies, supporting 5-7 million customers who need to pay loans and credit cards. The simplicity and convenience of the service not only helps improve customer experience but also helps banks and financial companies save on operating costs.

Mr. Nguyen Ba Diep emphasized the significance of cooperation between fintech and banks in bringing financial services to low and very low income customers - these are the disadvantaged and majority groups, who do not have many opportunities to access banking services: “We hope that in the coming time, the Government and the State Bank will have more policies to support the development of cooperation models between fintech and banks. This is the model that will benefit low-income people, creating significant contributions and impacts on the development of society”.

Source

Comment (0)