Record hot growth in Asian market

In a recent report by Savills on the Asia Pacific Retail Market (APAC Pacific Retail - Savills Research), experts pointed out that an important change in the retail sector that has emerged during the pandemic is the rise of e-commerce. Especially online grocery stores, which have become essential during the lockdown.

Specifically, China and South Korea currently boast the highest e-commerce penetration rates in the world by 2022 at 27%, much higher than the global average of 22%.

Meanwhile, early-stage markets such as ASEAN are rapidly digitizing, driven by the region’s young population and rapid technology adoption. The region will see the fastest growth globally, with penetration soaring from 21% to 28% between 2022 and 2026, reflecting a compound annual growth rate of 17% over this period.

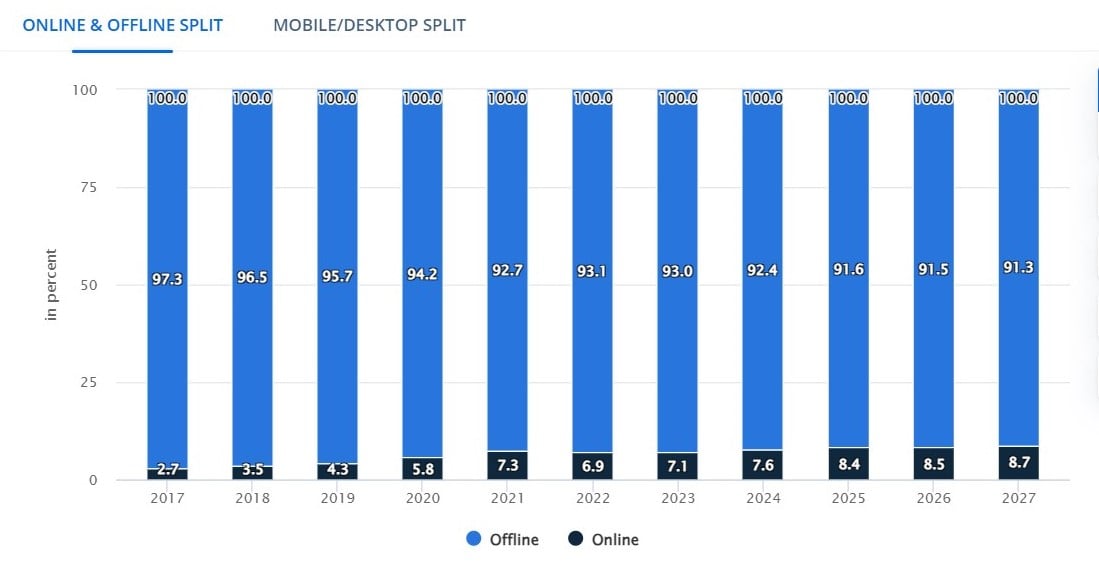

Chart of retail distribution channels in Vietnam from 2017 and expected to 2027.

E-commerce is forecast to account for 29% of retail sales in Asia and 26% in the ASEAN region by 2026. Retailers and property owners should increasingly integrate online experiences into their strategies, especially in emerging markets that are poised to capitalize on the e-commerce opportunity.

Omnichannel capabilities and localization can be key differentiators. Omnichannel retail strategies remain a key driver of both online and offline sales.

Vietnam market is likely to recover by the end of the year.

According to some statistics, the market revenue in Vietnam is expected to reach 12.10 billion USD in 2023. During the period 2023-2027, the revenue is expected to have an annual growth rate of 12.38% with an expected market value of 19.30 billion USD in 2027.

However, according to this unit's report, there is a clear difference in the distribution ratio of retailers between physical retail channels and online retail channels in Vietnam. Specifically, although from 2017 to 2023, the distribution ratio on online retail channels has increased from 2.7% to 7.1%. However, from now to 2027, this ratio is expected to grow slightly to 8.7%.

Ms. Tran Pham Phuong Quyen, Retail Leasing Manager at Savills Vietnam, said that retailers all affirm that online sales only account for a small part of their product distribution results.

“The main activities that brands apply on e-commerce channels are advertising, stimulating demand with price-sensitive customers, attracting customers’ interest in the brand and bringing them to physical stores to experience the products,” Ms. Quyen commented.

Ms. Tran Pham Phuong Quyen, Retail Leasing Manager, Savills Vietnam.

This expert also added that online distribution platforms are now being used as an additional service such as accumulating reward points, creating customer loyalty, running advertising campaigns, increasing brand presence in the e-commerce wave and general online discount days. Many fashion brands said that the percentage of sales coming from online channels only accounts for 3-5%.

Regarding the retail leasing market from now until the end of the year, Ms. Quyen said that Vietnam will welcome a series of new large-scale commercial center projects in both Hanoi and Ho Chi Minh City such as Lotte Mall West Lake Ha Noi, Thiso Retail Phan Huy Ich, and Hung Vuong Plaza reopening. Along with that, some retail blocks in residential areas are in the process of rushing to lease projects, expected to open at the end of this year or the first quarter of 2024 depending on the progress of tenants arranging construction schedules and deploying personnel.

Although the overall economic situation is somewhat gloomy, it does not have much impact on the market performance. Savills Vietnam's Retail Leasing Department also noted that retailers and investors are making efforts in preparing for the peak shopping season at the end of the year.

Along with that, a series of new brands are rushing to prepare the final steps to open their first stores in Vietnam. The main industries can be seen as fashion, sportswear, interior, footwear, bags and accessories. In addition, a number of foreign F&B brands are also in the process of searching for prime locations in both Hanoi and Ho Chi Minh City to open their stores.

Many shopping malls have had to leave their premises vacant for a long time, waiting for a recovery at the end of the year.

In the big picture, Mr. Simon Smith, Head of Research and Consulting, Savills APAC, said that Asia-Pacific is a relatively bright spot globally, despite moderate growth. Despite different macroeconomic conditions, most retail leasing markets in Asia-Pacific have bottomed out and are trending upwards.

“Overall, Asia-Pacific’s new prime shopping mall supply across the 12 markets we monitor is expected to reach 9.5 million square metres between 2023 and 2025. In contrast, key markets such as Taipei (China), Bangkok (Thailand), Ho Chi Minh City and Manila (Philippines) face limited new supply, a shortage of vacant space and rental support programmes. Most prime shopping mall markets in Asia-Pacific will see rent growth of 0-5% in 2023, with Hong Kong (China) and Ho Chi Minh City standing out with a potential increase of 10%,” said Mr. Simon Smith.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)