At the workshop "Identifying bright spots in business and investment in 2024" organized by CafeF, Mr. La Giang Trung, CEO of Passion Investment said: The stock market is in a good phase despite many macroeconomic difficulties, banking and retail are expected to be the two industry groups that will recover well in 2024.

There will be about 5 - 6 major adjustments.

According to Mr. La Giang Trung, the Vietnamese stock market operates according to macroeconomic policies. Monetary and fiscal policies are strongly stimulating, creating favorable conditions to support the development of stocks. In addition, the growth momentum of major economies in the world is recovering.

In addition, the VN-Index is currently in a fairly low valuation zone; the price-to-earnings ratio (P/E) is below 15 times, while previously this index was mostly above 20 times. Not only that, interest rates are at an all-time low and will continue to fall; global stock markets have all surpassed their peaks.

“With low interest rates and strong business recovery, the Vietnamese stock market is likely to return to the peak of 1,500 this year, which is a premise for surpassing the peak early next year. On January 6, 2022, the VN-Index set a historical peak of 1,528 points. The main trend of the market this year will be upward, but in the process of going from the bottom, it is impossible to avoid corrections. The market will have about 5-6 major corrections in 2024," said the CEO of Passion Investment.

Many people are wondering that in the context of Vietnam attracting the leading foreign direct investment (FDI) capital in the region, FDI capital flow into the stock market has decreased in recent years. What is causing foreign capital not to flow into the Vietnamese stock market?

Responding to this issue, Mr. Le Anh Tuan, Investment Director of Dragon Capital Fund Management Company, said: Since the beginning of the year, foreign investors have net sold more than 10,000 billion VND. If calculated from March 2023, they have net sold more than 38,000 billion VND. “This net selling momentum comes from several reasons such as: Foreign investors have many choices. With an appetite for investing in new technologies, Vietnam has almost none. Large capital sources of foreign investors flow from China to India and Japan; foreign investors are concerned that some of Vietnam's problems are not as expected. In the past 2 months, there has clearly been interest from foreign investors in the Vietnamese market,” said Mr. Le Anh Tuan.

According to Dragon Capital representative, Vietnam is still among the countries that foreign investors are very interested in. If officially upgraded by MSCI (Investment research company providing stock indexes, portfolio risks, performance analysis and management tools for institutional investors and hedge funds), there is a high possibility that foreign capital will return strongly.

Confidence in the new economic cycle

Regarding the real estate market in 2024, Mr. Bui Quang Anh Vu, General Director of Phat Dat Real Estate Development Joint Stock Company said: “During the operation process, many companies have come to Phat Dat. However, the problem is what do we do to invite people in the future? We need their capital and development thinking.”

According to Mr. Bui Quang Anh Vu, before COVID-19, most real estate investors were professional real estate investors who bought to rent. During that period, banks supported loans, and when real estate was profitable, there were many people trading, causing real estate prices to increase "dizzily". However, when COVID-19 broke out, banks tightened lending to real estate, causing the market to decline. Many investors began to lose confidence.

“The solution connects 3 markets: Securities - Currency - Real estate, emphasizing social housing. With the question, what to invest in? I have faith in the new cycle of the economy, the real estate market is still a good investment channel. We must have management, direction, sustainability, bringing benefits to many people”, Mr. Bui Quang Anh Vu commented.

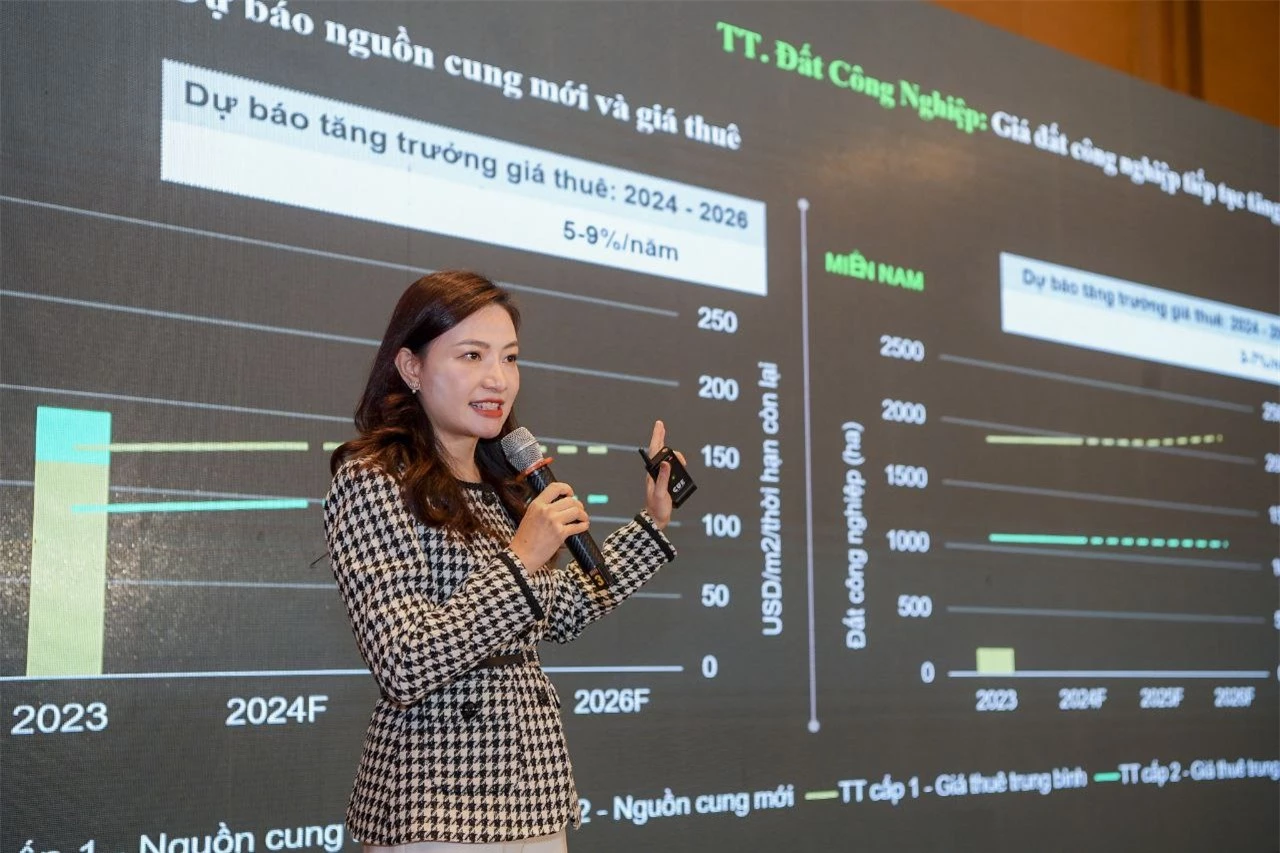

Speaking at the workshop "Identifying bright spots in business and investment in 2024", CEO of CBRE Vietnam Duong Thuy Dung said: "In a series of investment channels, we summarized that stocks on the afternoon of March 25 increased by about 22%; gold increased by about 7%, while investing in an entire apartment, simply looking at rental profits, only increased by 5%".

According to Ms. Duong Thuy Dung, the role of foreign direct investment (FDI) is very important. In reality, the market has many challenges, so domestic development investors focus on the most traditional method, which is mergers and acquisitions (M&A). Currently, when it comes to buying project land, whether it is housing, industry, or commerce, investors really want available products, but it is very difficult in the Vietnamese market due to legal problems, so they choose to buy project land.

“In addition, depending on the product, commercial real estate is a market that investors are interested in, but the success rate is only 5-10%, such as offices with a 95% occupancy rate in Ho Chi Minh City. Industrial real estate still has room, so the success rate is up to 50%. The reason for the failure of each product in the real estate market comes from differences in valuation, legality and ownership structure,” said Ms. Duong Thuy Dung.

Regarding the question "Which segment is the best to invest in in 2024?", Ms. Duong Thuy Dung said: This depends on the total investment amount because there are many products and segments in real estate. For institutional investors, commercial real estate and industrial parks are still their taste. Housing is the product that individual investors are interested in.

According to the CEO of CBRE Vietnam, there are usually 4 segments: affordable, mid-range, high-end, luxury. We have 2 products: mid-range and high-end. Mid-range and near mid-high-end are the segments that most people are interested in and are the bright segments of the market this year and in the coming years.

"Investors have room to find a reasonable price. If comparing the same mid-range product segment with similar quality, Ho Chi Minh City is about 30% higher than the Hanoi market. In the period of 2018 - 2019, many traditional investors from the North invested in the South, but now they are returning to the Northern market and see that there is a lot of room," said Ms. Duong Thuy Dung.

According to Tin Tuc Newspaper

Source

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)