Get momentum with gems

Mr. Do Minh Phu was born in 1953 in Yen Bai, is a bachelor of Radio Electronics, Hanoi University of Science and Technology.

From 1992 to 1994, Mr. Phu held the position of General Director of VIGEMTEC Gemstone Joint Venture Company. In 1994, Mr. Phu established and held the position of General Director of TTD Technology and Trade Development Company Limited (TTD).

TTD is the first company to introduce Vietnamese Star Ruby products to the international market with the brand name Vietnam Star Ruby - VSR.

In 2007, to complete the organization, TTD Company officially changed its name to DOJI Gold, Silver, Gemstones & Trading Investment Joint Stock Company. Mr. Phu concurrently held the position of Chairman of the Board of Directors and General Director at DOJI. Since then, his name has always been associated with this brand.

Currently, DOJI operates under a parent-subsidiary model with 14 member companies, 4 joint ventures, 50 branches, nearly 200 centers and more than 400 agents nationwide.

DOJI ecosystem.

Since 2009, DOJI has continuously expanded its ecosystem, from gold, silver, and gemstones to real estate investment, tourism, restaurants, and then entered the banking and finance sector.

In the real estate sector, in 2014, DOJI established DOJILAND Real Estate Investment Company Limited. Some of DOJILAND's outstanding real estate projects include: The Sapphire Residence and Best Western Premium Sapphire Ha Long luxury apartment and condotel complexes, 5-star Diamond Halong Hotel, Nam Vinh Yen New Urban Area, etc.

One of DOJILAND's key projects is the DOJI Tower, known as the "diamond" in the heart of the capital. The building is located at 5 Le Duan, Hanoi, with 16 floors and 3 basements with a total usable area of 18,883m2, and is currently used by DOJI as its headquarters.

In addition to DOJILAND, DOJI also has other members operating in the real estate sector such as Blue Star Real Estate Company Limited, Chau Luc Foreign Trade and Real Estate Investment Development Joint Stock Company, Tam Dao Eco-Tourism Joint Stock Company...

Regarding business performance, by the end of 2023, DOJI recorded a profit after tax of VND 491.3 billion. On average, DOJI earned a profit of more than VND 1.3 billion per day.

However, this profit has decreased by more than half compared to the huge profit of more than VND 1,016 billion of this group in 2022. DOJI's return on equity (ROE) also decreased to 7.5%.

At the end of 2023, DOJI's equity reached VND 6,745 billion, an increase of 6% compared to the end of 2022.

The company's debt-to-equity ratio has increased from 1.95 times last year to 2.35 times, equivalent to nearly VND 15,900 billion in total outstanding debt. Notably, by the end of 2023, the Group will have cleared its bond debt.

Bring TPBank to "acceleration"

Regarding the banking and finance sector, on its website, DOJI also reported on the successful restructuring of Tien Phong Commercial Joint Stock Bank (TPBank) in 2012. At that time, TPBank was one of 9 weak banks forced to restructure.

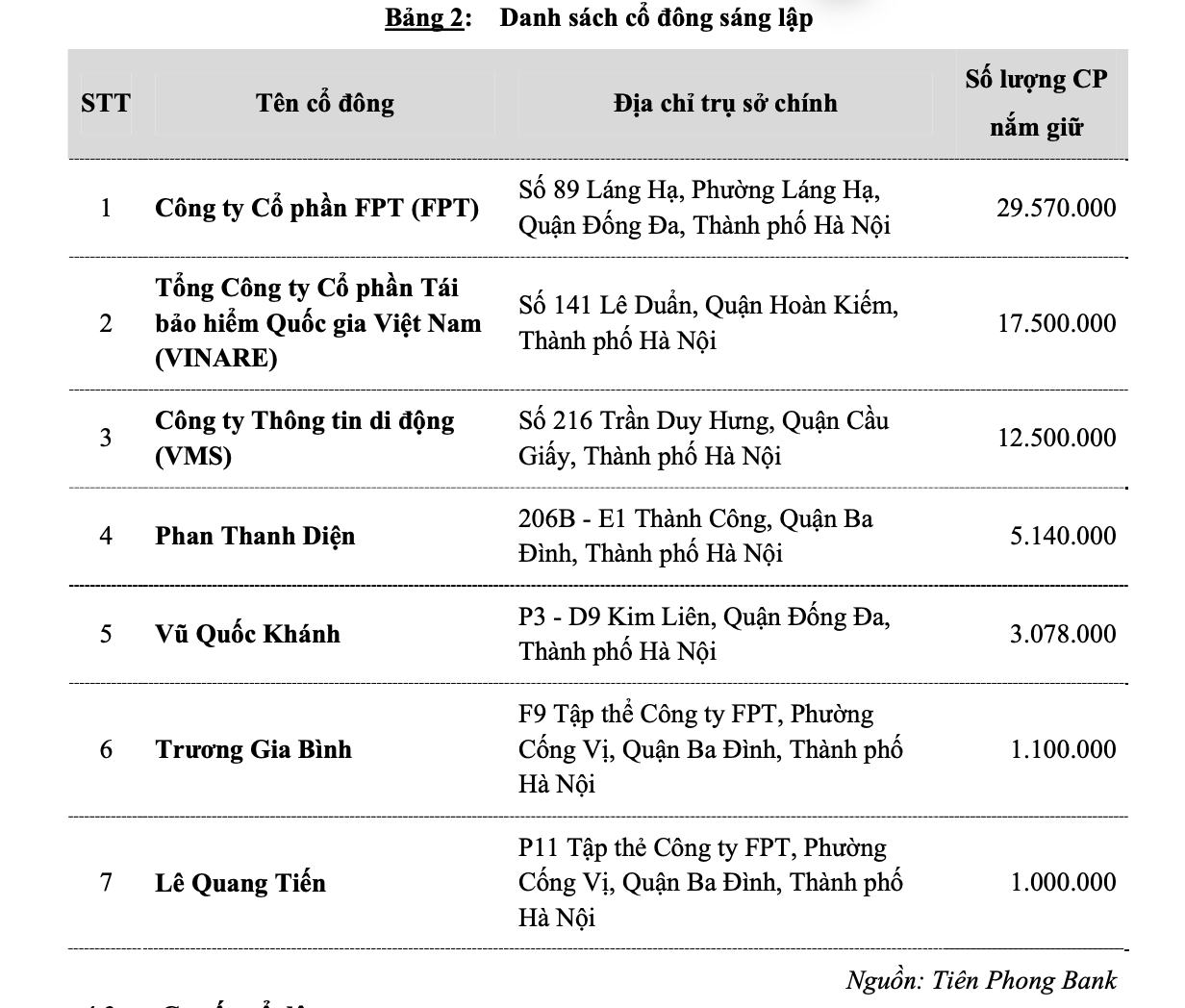

TPBank was established in 2008 with famous founding shareholders such as FPT Corporation, Mobile Information Company (now MobiFone) and Vietnam National Reinsurance Corporation (Vinare).

However, after 3 years of operation, by the end of 2011, TPBank had accumulated losses of nearly 1,367 billion VND, bad debt increased so much that the bank had to restructure according to the request of the State Bank.

TPBank founding shareholders.

At that time, DOJI invested in TPBank, holding 20% of the capital, becoming the largest shareholder at that time at the bank. Up to now, according to TPBank's management report for the first 6 months of 2024, DOJI currently has nearly 130.6 million TPB shares, equivalent to 5.93% of the bank's capital, and Mr. Phu currently owns more than 10% of the contributed capital at DOJI.

Immediately after the presence of DOJI, the "hot seat" of TPBank changed hands, Mr. Do Minh Phu took the position of Chairman of the Board of Directors. At the same time, major changes also quickly took place at the bank.

TPBank has successfully increased its charter capital from VND3,000 billion to VND5,550 billion. At the end of 2012, the bank reported a profit after tax of VND116 billion, while the previous year it lost nearly VND1,400 billion.

By the end of 2013, TPBank's total assets had doubled from the previous year, from VND15,120 billion to VND32,088 billion. The bank's customer loans also doubled to nearly VND12,000 billion.

In particular, TPBank reported a 3.2-fold increase in pre-tax profit compared to 2012, reaching VND381 billion. Since then, the bank's profits have continued to grow.

In 2018, the bank's after-tax profit exceeded VND1,000 billion and by 2022 it will reach over VND7,800 billion. In the 10 years from 2012 to 2022, the bank's profit has expanded nearly 70 times.

In 2017, to comply with new regulations in the Law on Credit Institutions, faced with the choice between DOJI and TPBank, Mr. Phu resigned from all positions at DOJI to hold the position of Chairman of the purple bank.

However, his mark at DOJI is still strong when his son, Mr. Do Minh Duc, is holding the position of Permanent Vice Chairman and his daughter, Ms. Do Vu Phuong Anh, is also holding the role of General Director at this Group. On the DOJI website, Mr. Phu is currently Chairman of the Group's Founding Council.

In 2023, with the ambition to become a financial group with coverage in the fields of banking, finance, and securities, TPBank will acquire Viet Cat Fund Management Company for a maximum amount of VND 125 billion.

Viet Cat Fund Management JSC was established in 2008 with a charter capital of VND 25 billion. VFC provides fund management services and investment portfolio services according to specific requirements for customers with separate investment needs.

Entering 2024, TPBank sets a pre-tax profit target of VND 7,500 billion.

At the annual general meeting of shareholders, Mr. Do Minh Phu said that the profit growth target of over 34% in 2024 is a quick move to make up for the previous slowdown to handle the bank's bad debts. This is a challenge, however, looking at the business results, the bank is confident in completing the set target.

At the end of the first 6 months of the year, TPBank reported business results with net interest income increasing by 14% to VND6,664 billion.

The bank reported pre-tax net profit of nearly VND 3,733 billion and after-tax profit of nearly VND 2,986 billion, up 20% compared to the first 6 months of 2023.

As of March 31, 2024, TPBank's total assets reached VND 361,555 billion, a slight increase of 1.37% compared to the beginning of the year. Of which, customer loans increased by nearly 4% over the same period last year to nearly VND 210,530 billion.

Regarding loan quality, at the end of March 2024, TPBank's total bad debt was VND 4,399 billion, an increase of 4.7% compared to VND 4,200 billion in the same period last year. As a result, TPBank's bad debt/loan balance ratio increased from 2.05% at the end of 2023 to 2.06%.

Source: https://www.nguoiduatin.vn/ba-thap-ky-di-len-tu-da-quy-cua-chu-tich-tpbank-do-minh-phu-20424081617135921.htm

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)