Goldman Sachs believes that the world economy next year will exceed many people's expectations, production will recover and the impact of interest rate hikes will also ease.

In a report released last weekend, Goldman Sachs (USA) forecast the global economy to grow 2.6% next year, higher than the 2.1% estimate of economists in a Bloomberg survey. The US is also expected to outpace other developed countries, with a growth rate of 2.1%.

Goldman also believes that much of the impact from fiscal and monetary tightening will be lost. To curb inflation, the US Federal Reserve has raised interest rates 11 times since March 2022. Last week, Fed Chairman Jerome Powell said he was “not confident” the Fed had tightened enough to control inflation. He signaled that he would still raise rates if necessary.

Goldman said it was unlikely developed countries would cut interest rates in the first half of next year unless economic growth was weaker than expected. They forecast inflation would continue to cool in advanced and emerging economies, to around 2-2.5%.

People walking on the streets of Cologne (Germany). Photo: Reuters

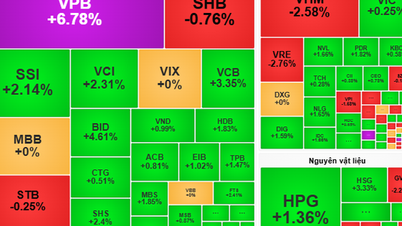

The bank also expects global factory activity to rebound after a series of challenges this year. Global manufacturing is now under pressure as China’s economic recovery is weaker than expected and Europe faces an energy crisis.

The S&P Global Manufacturing Index is now at 49. A reading below 50 indicates contraction. In China, the Caixin/S&P Global Manufacturing Purchasing Managers’ Index (PMI) fell to 49.5 in October, its first reading below 50 since July.

Rising real incomes also helped Goldman to be more optimistic about the global economic outlook next year. "Our economists are positive on disposable income, given the significant slowdown in inflation and a strong labor market," the report said.

They said real income growth in the US could slow from the 4% pace in 2023, but would still support consumption and help US GDP grow by at least 2%. "We continue to assess the risk of a US recession as low, around 15%," the report said, partly because real incomes are still rising. In September, the bank lowered the risk of a US recession to 15% from 20%, citing cooling inflation and a strong job market.

And while many countries are still maintaining tight fiscal and monetary policies, Goldman is confident that the worst is "over." Many economies will avoid recession.

“Both the eurozone and the UK will see significant income growth, around 2% next year, as the gas shock from the Russia-Ukraine conflict gradually eases,” the economists concluded.

Ha Thu (according to CNBC)

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)