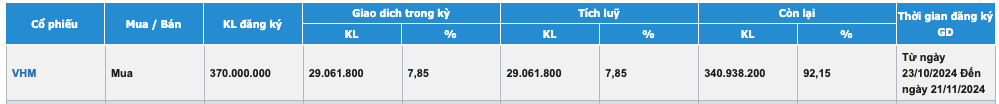

Statistics on HoSE show that in the last two sessions, VHM has bought more than 29 million treasury shares, equivalent to 7.85% of the registered purchase volume.

Continuously decreasing in price for 2 sessions, VHM has bought 29 million treasury shares

Statistics on HoSE show that in the last two sessions, VHM has bought more than 29 million treasury shares, equivalent to 7.85% of the registered purchase volume.

From October 23 to November 21, Vinhomes JSC (VHM) will buy back 370 million treasury shares, equivalent to 8.5% of total outstanding shares.

The reason is that the market price of VHM shares is low compared to their real value, so the buyback is to ensure the interests of the company and shareholders. The capital for the buyback is from undistributed profit after tax according to the 2023 audited financial report.

According to regulations, in each session VHM will order a minimum of 11.1 million shares and a maximum of 37 million shares during the trading period.

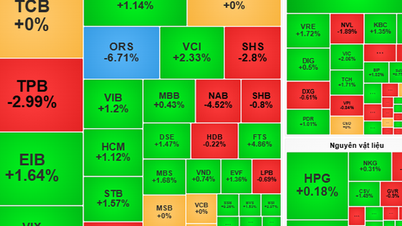

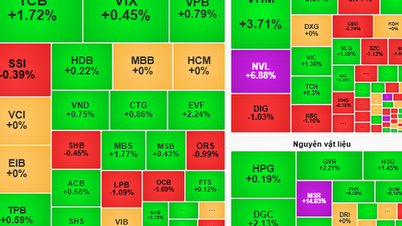

Just 1 day before the historic deal took place, VHM shares skyrocketed in 2 sessions, bringing VHM's market price to its highest level in the past year. However, despite the purpose of raising the stock price, within 2 sessions of the deal, VHM's price dropped sharply. With a sharp decrease in 2 consecutive sessions, VHM became the biggest "culprit" holding down the VN-Index.

On October 23, VHM decreased by 2.59%. On October 24, more than 5 million shares were sold in the ATC session, pushing VHM into a deep decline, down 6.7%, almost hitting the floor. In just 2 sessions, VHM lost nearly 10% of its value.

|

| VHM stock performance. |

Foreign investors also simultaneously sold VHM net in the last two sessions with values of VND87 billion and VND44.5 billion respectively. VHM's market capitalization quickly dropped to VND190,900 billion.

Statistics on HoSE show that in the last two sessions, VHM has bought more than 29 million treasury shares, equivalent to 7.85% of the registered purchase volume. In the coming sessions until November 21, VHM will continue to buy an additional 340 million treasury shares.

|

| Volume of VHM treasury shares purchased in the first 2 sessions of the deal. |

In case VHM buys all the expected quantity, the company's charter capital will decrease from VND43,543 billion to VND39,843 billion.

ACBS's recent analysis said that, with the current market price, VHM may need more than VND16,000 billion to buy back all treasury shares and this transaction may affect the company's debt ratio in the short term.

By the end of the second quarter of 2024, VHM had a total outstanding debt of VND70,500 billion, of which 50% was bank loans, 39% was domestic bonds and the rest was loans from partners. About 86% of the total outstanding debt was in VND and the rest was in USD.

In the first 6 months of the year, VHM's net debt increased by VND10,900 billion to VND49,600 billion, mainly due to the company issuing VND12,500 billion of corporate bonds with a fixed interest rate of 12%/year due in 2026 and 2027. The Net Debt/Equity ratio has been on an upward trend since 2021 and in the first 6 months of 2024, it increased from 21.2% to 24%, but is still lower than the industry median of 26.7%.

Source: https://baodautu.vn/giam-gia-lien-tuc-2-phien-vhm-da-mua-duoc-29-trieu-co-phieu-quy-d228283.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)