The yen strengthened against the US dollar as weaker-than-expected US jobs data and investors speculated that Japanese authorities were about to intervene.

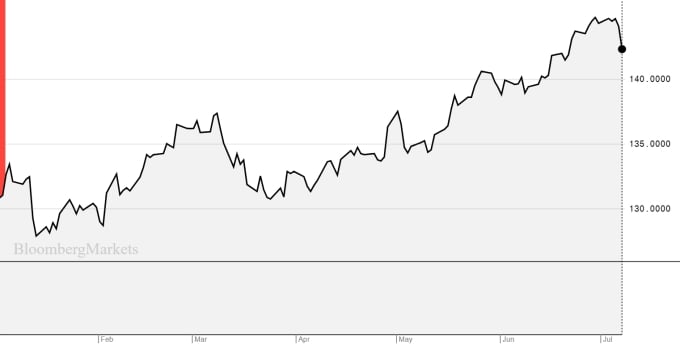

In trading on July 7th, the yen rose 1.4% against the US dollar, reaching 142 JPY per USD. This was the strongest increase since March.

The USD depreciated as data from the US Department of Labor showed that the country created the fewest jobs in 2.5 years in June. The number of new jobs also declined in April and May.

"Risk-averse sentiment dominated the market this week. Investors are also concerned that Japanese authorities are about to intervene in the currency market," Joe Manimbo, senior market analyst, told Reuters.

The USD/JPY exchange rate movements since the beginning of the year show that the Japanese yen has been continuously weakening recently.

The yen weakened from mid-June, after the Bank of Japan (BOJ) announced on June 16th that it would keep short-term interest rates unchanged at -0.1% and the 10-year bond yield ceiling at 0%. This move contrasted with those of the European Central Bank (ECB) and the US Federal Reserve (Fed), prompting investors to sell the currency and move to other assets offering higher returns.

The yen is one of the worst-performing currencies this year. Last month, one US dollar was worth 145 yen – a level not seen since November last year.

Yesterday, Eisuke Sakakibara – former Japanese Vice Minister of Finance from 1997 to 1999 – predicted that the yen could hit a three-year low against the US dollar, at 160 JPY per USD. At this level, he suggested that Japanese authorities might intervene to support the domestic currency.

This week, Japan's Ministry of Labor also announced that May wages rose at their fastest pace since early 1995. This further reinforces the view that the Bank of Japan (BOJ) will have to change its current ultra-loose monetary policy.

"They've made it very clear that if there's evidence of stronger, more sustainable wage growth, they'll be more confident that they can meet their inflation target and move away from loose monetary policy," said Lee Hardman, strategist at MUFG.

Ha Thu (according to Bloomberg, Reuters)

Source link

![[Image] Fifth meeting of the Steering Committee for National Projects in the Railway Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F06%2F1767712857541_ndo_br_dsc-0581-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh attends the Conference on the Implementation of Tasks for the Finance Sector in 2026](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F06%2F1767699638245_ndo_br_dsc-0196-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Canadian Minister of International Development Randeep Sarai](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F06%2F1767708661052_image123-3433-jpg.webp&w=3840&q=75)

![[Photo] Standing Committee member of the Party Central Committee Tran Cam Tu inspects preparations for the 14th Party Congress.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F06%2F1767695749033_image1122-1262-jpg.webp&w=3840&q=75)

Comment (0)