According to MXV, selling pressure quickly returned and dominated the world raw material market in yesterday's trading day (November 6).

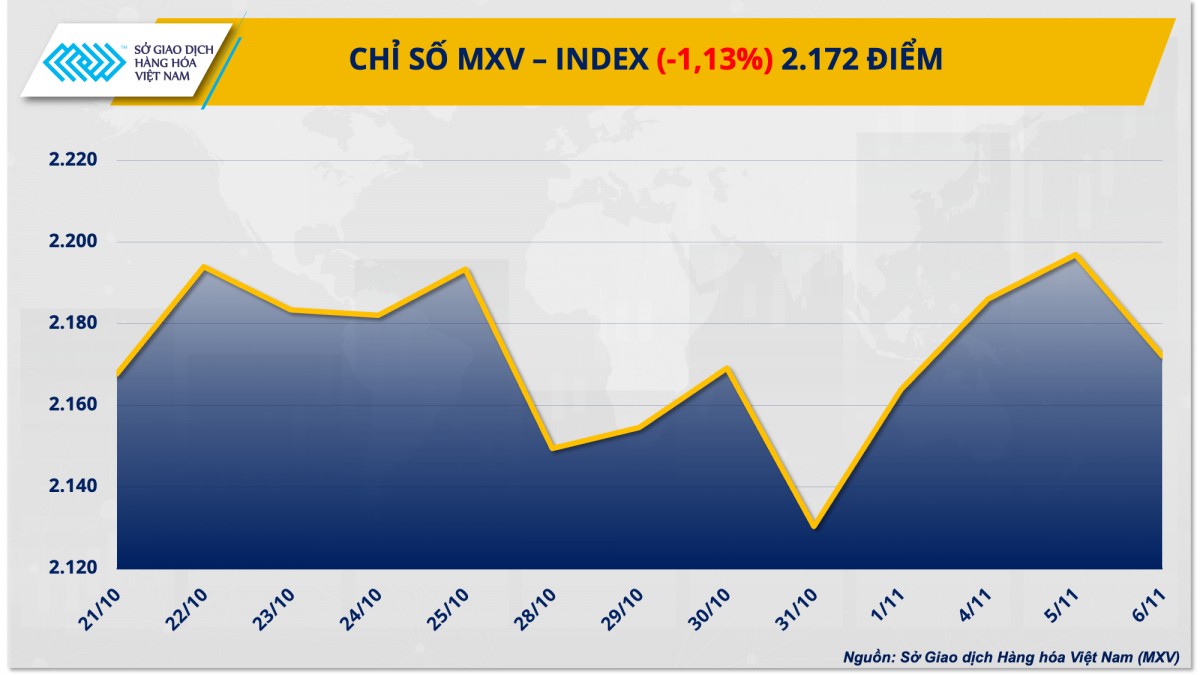

According to the Vietnam Commodity Exchange (MXV), after two positive sessions at the beginning of the week, selling pressure quickly returned and dominated the world raw material market in yesterday's trading day (November 6). At the close, the MXV-Index fell 1.13% to 2,172 points. Notably, the metal group was in red when 8 out of 10 items simultaneously decreased in price, of which COMEX copper and silver plunged more than 5% and 4.4%, respectively. Going against the general trend of the whole market was the agricultural group, notably corn prices continued to increase for the 4th consecutive session thanks to positive demand for ethanol production.

|

| MXV-Index |

Precious metal prices plunge to three-week low

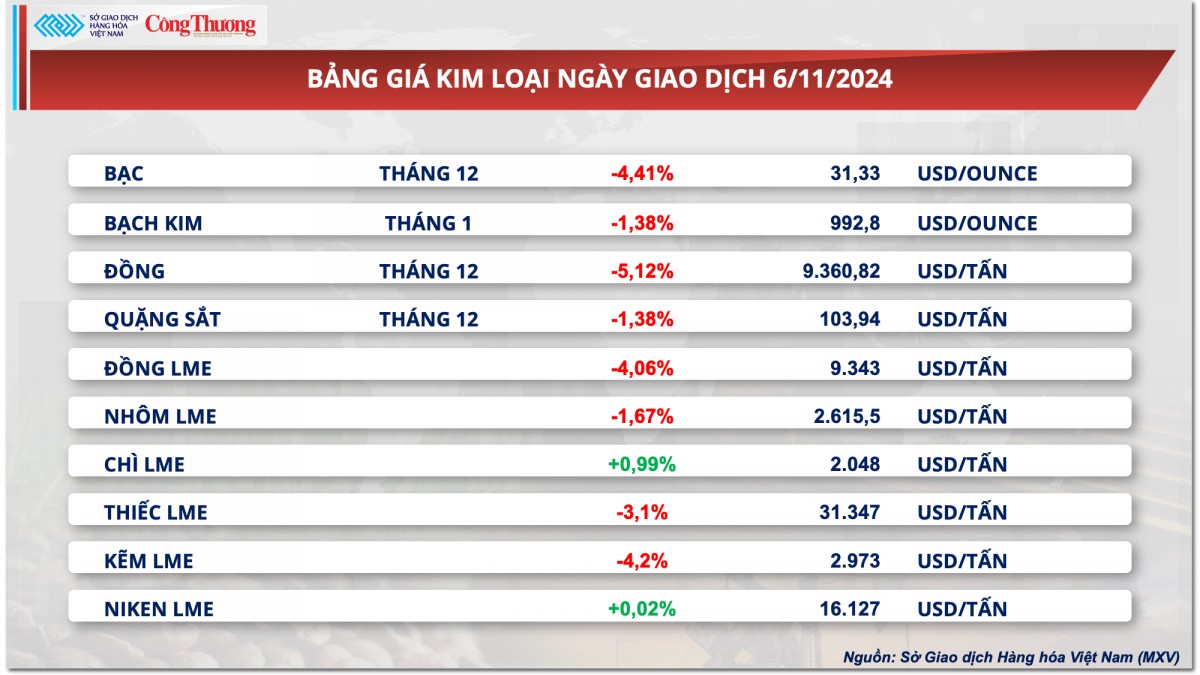

At the end of yesterday's trading session, selling pressure quickly returned to the metal market after the previous session's upswing. For precious metals, silver and platinum prices both plummeted to their lowest levels in three weeks due to pressure from the US dollar. Of which, silver prices fell 4.41% to $31.33/ounce, marking the biggest daily drop in a month. Platinum prices also fell 1.38% to $992.8/ounce.

|

| Metal price list |

Yesterday, the race for the White House between former Republican President Donald Trump and Democratic Vice President Kamala Harris officially ended. Mr. Donald Trump won. According to initial assessments from experts, Mr. Trump's presidency is expected to boost the US economy , but will increase inflation when his immigration, tax and trade policies are implemented. This could boost the USD, while slowing down the process of lowering interest rates by the US Federal Reserve (FED).

Accordingly, the USD also increased sharply in yesterday's session. The Dollar Index, a measure of the strength of the greenback and 6 other major currencies, increased by 1.6% to 105.1 points, the highest level in the past 4 months. The stronger USD increased investment costs, along with concerns about higher interest rates in the US, putting strong pressure on the price of precious metals since yesterday morning.

Similarly, for base metals, most commodities fell due to pressure from the strengthening of the greenback, especially copper, a commodity sensitive to macro fluctuations. Closing, COMEX copper prices fell more than 5% to $9,360/ton, the lowest level in a month and a half. This was also the session that recorded the largest daily decline in copper prices since July 2022.

Adding to the pressure on copper prices, Donald Trump's election as president is expected to bring about a number of changes in clean energy policies in the US, which have boosted the outlook for the metal in recent years. Trump said he would "cancel all unspent funds" under the Inflation Reduction Act (IRA), the signature climate law of the Biden-Harris administration aimed at combating climate change and energy security. The IRA includes hundreds of billions of dollars in subsidies for electric vehicles, solar and wind power, etc. Therefore, if this policy deviates, the supply and demand outlook for copper, a metal widely used in the production of electric vehicles, renewable energy ecosystems, etc., may have to be reassessed. Concerns that copper demand will not increase as strongly as previously forecast pushed the price of this metal down sharply yesterday.

Corn prices extend gains to fourth consecutive session

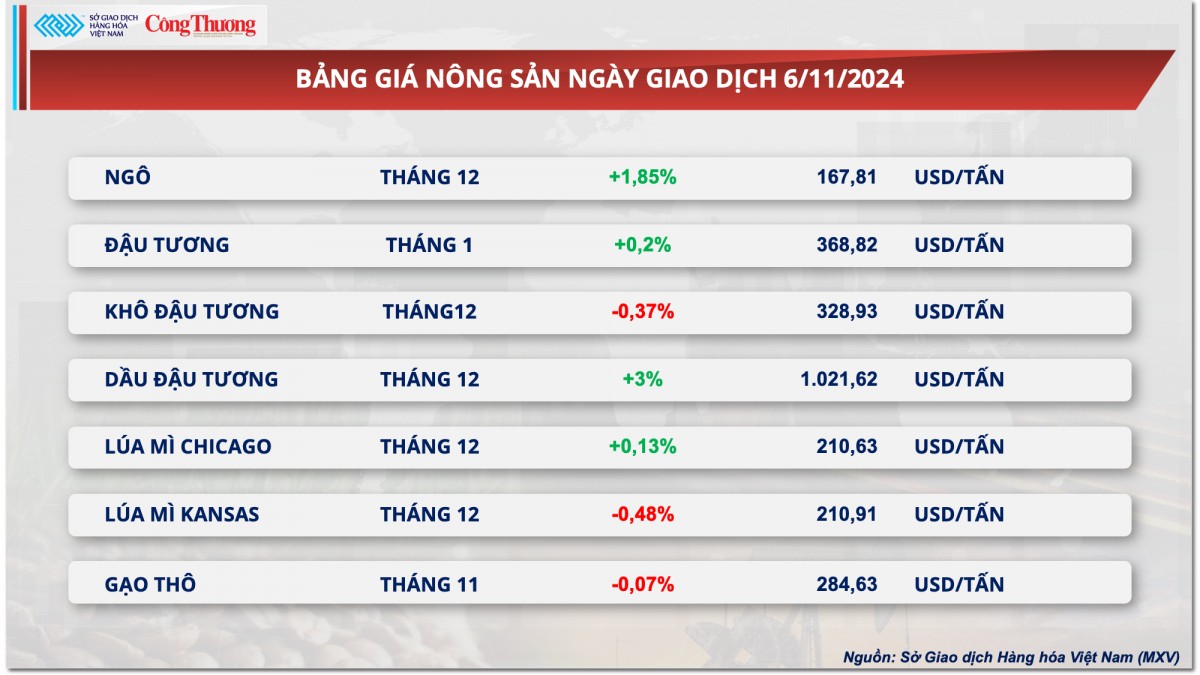

According to MXV, the price of December corn futures increased by nearly 2% at the end of yesterday's trading session, marking the fourth consecutive session of price increase. The market was supported in the context of positive demand for corn recorded in the weekly report of the Energy Information Administration (EIA).

|

| Agricultural product price list |

In its weekly report, the EIA said that US ethanol production increased to a near-record 1.105 million barrels per day (bpd) in the week ending November 1, up 23,000 bpd from the previous week. Ethanol inventories rose 249,000 bpd to 22.02 million bpd due to higher supplies. With weekly ethanol production at a record high, domestic demand for US corn remains generally positive, which has boosted buying pressure in the market.

Meanwhile, soybean prices were little changed with a slight gain yesterday, marking the third consecutive session of gains. The market has recovered from the election-related plunge, as the demand outlook remains relatively positive.

Yesterday’s US presidential election ended with the victory of presidential candidate Donald Trump. This could affect corn and soybean exports to China because Trump tends to escalate trade tensions between Beijing and Washington. If his tough stance on China is repeated as in his previous term, Chinese demand for US soybeans could decline in the coming years, putting pressure on soybean prices after the election results.

In the domestic market, on November 1, the offering price of South American soybean meal to Vietnamese ports decreased slightly. At Vung Tau port, the offering price of soybean meal for delivery in December 2024 fluctuated between 10,500 - 10,600 VND/kg. Meanwhile, for the delivery period in January next year, South American soybean meal was offered at around 10,400 - 10,550 VND/kg. At Cai Lan port, the offering price was recorded 100 - 150 VND higher than at Vung Tau port.

Prices of some other goods

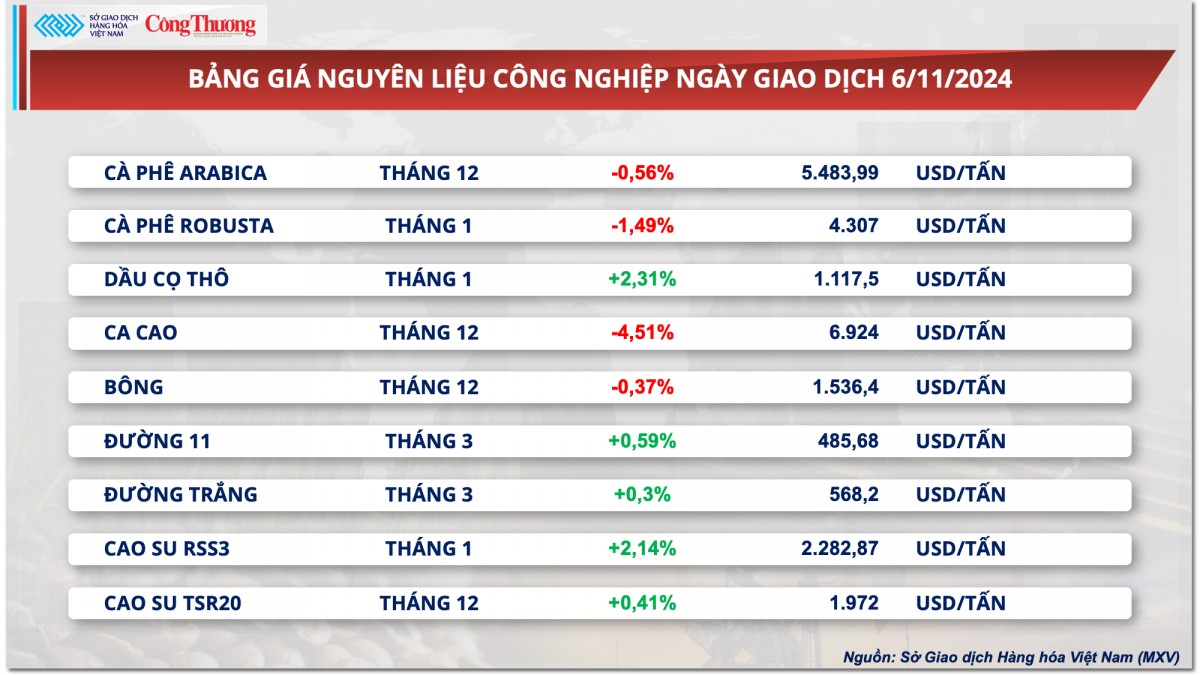

|

| Industrial raw material price list |

|

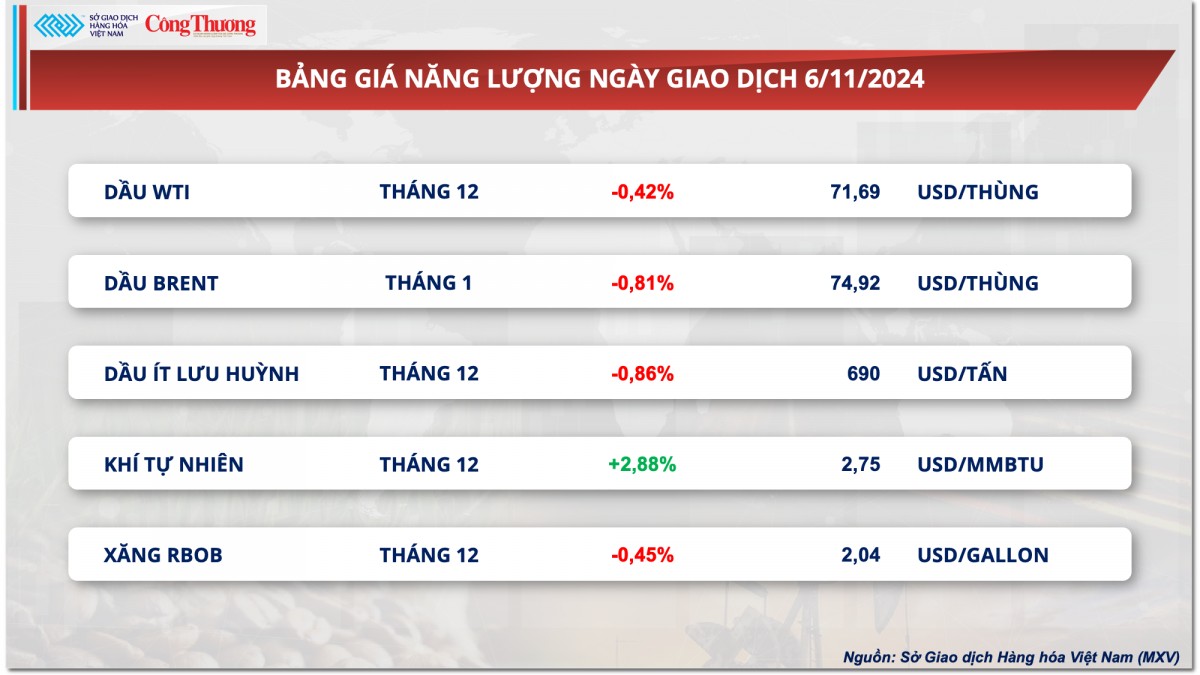

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-7112024-gia-kim-loai-dong-loat-giam-gia-ngo-di-nguoc-chieu-thi-truong-357358.html

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Infographic] Numbers about the 2025 High School Graduation Exam in Dong Thap Province](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/c6e481df97c94ff28d740cc2f26ebbdc)

Comment (0)