Arabica coffee falls for 7th consecutive day

September Arabica futures marked their seventh consecutive decline, closing 0.23% lower yesterday than the reference. MXV said the market still has a positive view on coffee production and exports in Brazil.

According to experts, Brazil will export a larger amount of coffee in the second half of 2023 when supplies become available after the harvest period, partly offsetting low exports in the first half of the year and contributing to ensuring adequate global supply.

In addition, in a Reuters survey, experts agreed that Brazil's coffee output in the 2023/24 crop year will increase compared to the previous crop year, causing the global supply-demand balance to have a surplus of nearly 1 million bags, a sharp increase compared to the deficit of 3.4 million bags in the previous crop year. Moreover, analysts also said that the coffee supply in the 2024/25 crop year could increase sharply to 69.8 million 60kg bags, close to the record of 69.9 million bags set by the US Department of Agriculture (USDA) for the 2020/21 crop year.

Moving in the same direction, Robusta prices fell for the third consecutive session, down 1.58% compared to the reference price. In the current context, analysts say that Robusta prices are unlikely to continue to remain at the current high level.

El Nino will cause adverse weather in major coffee growing regions in Asia, leading to lower output, but increased exports from Brazil at the moment will push prices down to $2,300 a tonne by the end of the year, analysts said in a Reuters survey.

This morning in the domestic market, the price of green coffee beans in the Central Highlands and the Southern provinces continued to decrease sharply by 1,000 VND/kg, bringing the domestic coffee purchase price down to about 63,900-64,7000 VND/kg. Thus, the domestic coffee price has continuously decreased over the past week, with a total decrease of up to 3,700 VND/kg.

WTI oil loses $80/barrel mark

According to MXV, concerns about macroeconomic conditions in the world's two largest economies, the US and China, have temporarily overshadowed supply risks, causing oil prices to extend their decline into the third consecutive session. At the end of the trading session on August 15, WTI oil prices lost the $80/barrel mark after falling nearly 2%, closing at $79.38/barrel. Brent oil prices fell 1.7% to $83.45/barrel.

Last night, Vietnam time, the Federal Open Market Committee (FOMC) released the Minutes of its July 26 interest rate meeting. Although there were some mixed views on the US Federal Reserve's (FED) interest rate hike plan; however, the Minutes noted that "Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy."

After the Minutes were released, the US dollar appreciated, bond yields increased and risk markets such as stocks fell, reflecting investors' cautious sentiment in the context of interest rates still likely to increase, or remain high for a long time.

The Fed Watch tool showed the odds of a 25 basis point rate hike at the September meeting rose to more than 13% from 10%. This also weighed on oil prices during the session, despite data from the US Energy Information Administration (EIA) reporting a drawdown in inventories.

Specifically, the EIA said that US commercial crude oil inventories fell by nearly 6 million barrels in the week ending August 11, quite close to previous data from the American Petroleum Institute (API). US crude exports increased sharply last week, while imports continued to remain high, reflecting increased domestic and global demand for US oil.

However, US oil production also continued to increase sharply by 100,000 barrels/day last week, reaching 12.7 million barrels/day, the highest level since late March 2020. This contributed to offsetting the shortage in the market and promoting selling pressure in the market.

In addition, diplomatic relations between the US and Iran have achieved a few small breakthroughs, raising expectations that some crude oil from Iran may return to the market after a long period of sanctions.

Source

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

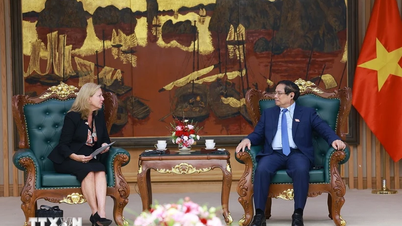

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

Comment (0)