Do not expect employees to request to receive social insurance at one time.

On the morning of June 29, with 454/465 delegates participating in the vote in favor (accounting for 93.42%) the National Assembly passed the Law on Social Insurance (amended). The Law consists of 11 chapters, 141 articles (an increase of 1 chapter and 5 articles compared to the draft Law submitted by the Government; an increase of 2 chapters and 16 articles compared to the current Law) and 9 new groups of points.

Before the National Assembly deputies pressed the button to approve, Chairwoman of the Social Affairs Committee Nguyen Thuy Anh reported on the reception, explanation and revision of the draft Law on Social Insurance (amended).

Regarding the conditions for receiving one-time social insurance (point d, clause 1, Article 70 and point d, clause 1, Article 102). Ms. Thuy Anh said that at the discussion session in the hall, 18 delegates chose option 1, 7 delegates chose option 2, 5 delegates proposed other options; some other opinions said that it is necessary to regulate to ensure the rights of workers but not encourage them to receive one-time social insurance so that they continue to participate in social insurance to ensure social security when they retire.

Chairwoman of the Social Committee Nguyen Thuy Anh.

On June 18, 2024, the National Assembly Standing Committee directed to collect votes to seek opinions from National Assembly deputies on this content. The results showed that 355/487 deputies gave their opinions.

Of these, 310/355 National Assembly deputies (accounting for 87.32% of the deputies giving opinions) chose Option 1; 38/355 National Assembly deputies (accounting for 10.70% of the deputies giving opinions) chose Option 2; 07/355 National Assembly deputies (accounting for 1.97% of the deputies giving opinions) did not choose one of the two options but proposed another option.

Based on the results of the consultation, the National Assembly Standing Committee requests the National Assembly to accept and revise the draft Law according to Option 1, which is the option chosen by the majority of National Assembly deputies and this is also the Option the Government prioritizes when submitting to the National Assembly at the 6th session.

Accordingly, employees who have paid social insurance before the effective date of this Law, have stopped participating in social insurance, after 12 months are not subject to compulsory social insurance but also do not participate in voluntary social insurance, have paid social insurance for less than 20 years, and have a request, are entitled to receive a one-time social insurance payment.

The Standing Committee of the National Assembly found that the option chosen by the majority of delegates was also the option with more advantages.

Ensuring the continuity of current regulations, not affecting much the nearly 18 million people participating in social insurance, will limit disruption in society.

This plan institutionalizes the spirit of Resolution No. 28 "reducing the situation of receiving one-time social insurance benefits by increasing benefits if the social insurance participation period is reserved to receive retirement benefits" and limits the situation of a social insurance participant receiving multiple one-time social insurance benefits in the past.

The draft regulations also aim to approach international standards and practices on social insurance and contribute to adapting to the current rapid population aging rate in our country.

In the long term, new participants will only receive social insurance benefits once in some special cases, which will contribute to increasing the number of people staying in the system to enjoy social insurance benefits from their own accumulation process when participating in social insurance and reducing the burden on society and the State budget. In the future, priority will be given to balancing resources to implement policies and regimes of a social protection nature.

Although there are regulations on receiving one-time social insurance benefits, the National Assembly Standing Committee does not expect employees to request to receive one-time social insurance benefits. Employees need to continue participating in social insurance to ensure long-term social security.

Therefore, the National Assembly Standing Committee strongly notes that the Government in the coming time needs to have fundamental, long-term solutions to support employees participating in social insurance who are facing immediate difficulties in life, such as having appropriate credit policies;

Continue to review, supplement and perfect legal policies on labor and employment (Employment Law, Labor Safety and Hygiene Law, etc.) to maintain stable employment, income, consultation, connection, career guidance, training and career change so that workers can have sustainable jobs;

Promote communication solutions so that employees understand the benefits of receiving monthly pensions and the disadvantages of choosing to receive one-time social insurance benefits, along with strengthening inspection, examination and implementation of sanctions against violations of social insurance by state management agencies and policy implementing organizations...

Handling late payment and evasion of social insurance payment

On late payment, evasion of payment of compulsory social insurance, unemployment insurance, measures to handle violations of late payment, evasion of payment of compulsory social insurance, unemployment insurance.

There are opinions suggesting that the provisions of the draft Law should be reviewed to ensure consistency in the Vietnamese legal system. There are opinions suggesting that the responsibilities of state management agencies on social insurance should be defined in handling enterprises that have violated the law.

National Assembly deputies voted to pass the Law on Social Insurance (amended).

In response to the opinions of National Assembly deputies, the National Assembly Standing Committee directed a review to ensure the avoidance of overlap in the legal system, accordingly, removing the provision on applying the measure of temporary suspension of exit in Articles 40 and 41 of the draft Law.

In addition, the National Assembly Standing Committee has stipulated the responsibility of the inspection agency in handling late payment and evasion of social insurance payment as stated in Clause 3, Article 35 of the draft Law .

Source: https://www.nguoiduatin.vn/duoc-rut-bhxh-mot-lan-voi-nguoi-dong-chua-du-20-nam-a670742.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Update] - Thanh Hoa: 55 thousand delegates attended the conference to disseminate and implement the Resolution of the 11th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/4/16/f1c6083279f5439c9412180dda016c15)

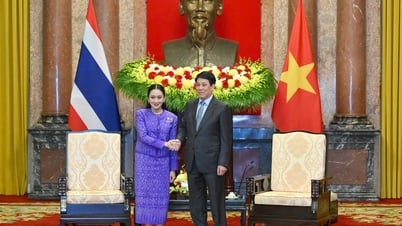

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)