A year full of difficulties and challenges

On the morning of November 1, reporting and explaining a number of socio-economic issues, State Bank Governor Nguyen Thi Hong emphasized that monetary policy management in 2023 will continue to be a year full of difficulties and challenges.

This happens when the world economy continues to develop in a complex and unpredictable manner, with more challenges than expected, one difficulty after another. Domestically, the internal difficulties of the economy cannot be resolved in a short time.

In addition, monetary policy must perform many tasks such as: controlling inflation, supporting economic growth, reducing interest rates, stabilizing the money and foreign exchange markets. As well as ensuring the safe operation of the banking system in all situations.

“Faced with the above difficulties, the State Bank has implemented synchronous solutions and monetary policy tools at the right time and in the right doses to contribute to the overall success of the economy. That is, controlling inflation, supporting economic growth and ensuring major balances of the economy,” the Governor said.

Governor of the State Bank Nguyen Thi Hong (Photo: Quochoi.vn).

Accordingly, when the State Bank designs monetary management policies, it will have to respond to urgent developments in the immediate future, but it must also carry out fundamental tasks and solutions in the medium and long term. Only then can it aim to ensure sustainable macroeconomic balance.

World Bank warns

Regarding credit management and credit access, Governor Nguyen Thi Hong emphasized that this is an issue that delegates are most concerned about. Because the internal nature of the economy, investment demand depends heavily on bank credit capital. Currently, Vietnam's credit debt to GDP is among the highest in the world and the World Bank has warned.

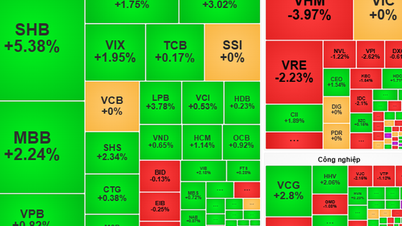

According to statistics, in 2015, the ratio of outstanding credit to GDP of Vietnam was 89.7%, in 2016 it was 97.6%, in 2017 it was 103.5%, in 2018 it was 102.9%, in 2019 it was 110.2%, in 2020 it was 114.3%, in 2021 it was 113.2%, in 2022 it was more than 125%.

The Governor said that in 2023, the State Bank has operated very flexibly on credit when implementing solutions to promote both the credit supply side as well as solutions to promote the credit demand side.

Regarding supply-side policy, at the beginning of the year, the State Bank set a target for credit growth for the whole year of 14%. By mid-year, it had allocated and announced to all credit institutions in the entire system with a target of about 14%.

At the same time, the State Bank has also flexibly operated to support the system's liquidity to facilitate credit institutions and promote increased credit supply for the economy.

According to Governor Nguyen Thi Hong, Vietnam's credit balance to GDP is among the highest in the world.

Regarding demand-side policies, despite the high global interest rates, the State Bank has boldly adjusted the operating interest rate four times to reduce the interest rate level of new loans by about 2% compared to the end of last year. If the outstanding balance of old and new loans is included, it will decrease by about 1%. Compared to the end of last year and before the Covid-19 pandemic, the interest rate has returned to the same level or even decreased by about 0.3%.

The State Bank has also issued a Circular on restructuring debt repayment terms and maintaining debt groups. It has proactively proposed credit packages such as: VND 120,000 billion for housing loans for low-income people and workers; VND 15,000 billion for aquaculture credit packages... All of these solutions have contributed to boosting credit demand.

The State Bank has also coordinated with localities to organize many conferences connecting banks and businesses to remove difficulties and problems related to credit in localities.

However, according to the Governor, credit is still growing slowly and as of October 27, 2023, credit increased by 7.1% compared to the end of last year.

The Governor said that the Government and the State Bank have also organized many thematic conferences to analyze the causes of low credit growth.

Currently, under the strong direction of the Government, the Prime Minister, ministries, branches and the State Bank are also implementing synchronous solutions in parallel with solutions from the bank. That is, promoting trade to increase export orders and enhancing exploitation of domestic demand so that businesses with output and feasible projects will have access to credit.

The Prime Minister has established a working group to remove difficulties for real estate and the working group as well as the Ho Chi Minh City Real Estate Association have also identified that about 70% of the causes leading to those difficulties are legal.

"When legal factors are resolved, credit will certainly increase along with this process," said Ms. Hong.

Regarding the characteristics of small and medium enterprises in Vietnam, which account for 95% of the total number of enterprises in the country, Ms. Hong said that these enterprises face difficulties in both competition and financial potential. Therefore, the State Bank has repeatedly recommended strengthening solutions such as loan guarantees for small and medium enterprises.

At the same time, the State Bank has also directed credit institutions to review and minimize administrative procedures and loan applications during the credit review process .

Source

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)