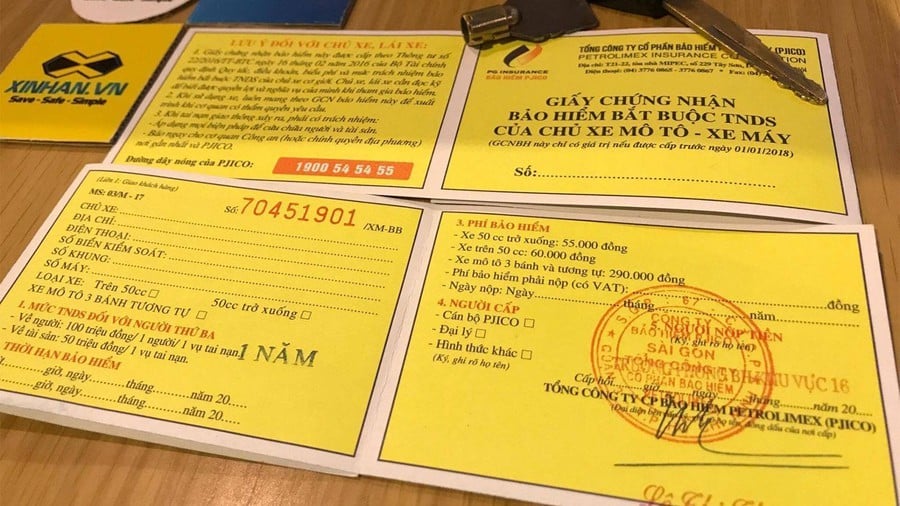

Please let me know how long does it take for the insurance company to make a provisional payment for motorcycle insurance? What are the cases that exclude motorcycle insurance liability? - Reader Ngan Ha

|

1. How long does it take for an insurance company to make a provisional payment for motorcycle insurance?

Specifically, in Clause 3, Article 12 of Decree 67/2023/ND-CP, within 3 working days from the date of receiving the notice of the insurance buyer or the insured person about the accident, the insurance company must make an advance payment of compensation for damage to health and life.

2. Motorcycle insurance compensation advance level

(1) In case the accident is determined to be within the scope of compensation for damages:

- 70% of the estimated insurance compensation as prescribed for one person in an accident in case of death.

- 50% of the estimated insurance compensation as prescribed for one person in an accident in case of bodily injury.

(2) In case the accident is not yet determined to be within the scope of compensation for damages:

- 30% of the prescribed insurance liability limit for one person in an accident in the event of death and an estimated injury rate of 81% or more.

- 10% of the prescribed insurance liability limit for one person in an accident for cases where the estimated injury rate is from 31% to less than 81%.

After making an advance payment, the insurance company has the right to request the Motor Vehicle Insurance Fund to refund the advance payment in case the accident is determined to be excluded from insurance liability or not covered by insurance.

(Clause 3, Article 12, Decree 67/2023/ND-CP)

3. Cases of exclusion from motorcycle insurance liability

Insurance companies are not responsible for insurance compensation in the following cases:

- Intentional acts causing damage by the motor vehicle owner, driver or injured person.

- The driver who caused the accident intentionally fled and did not fulfill the civil liability of the motor vehicle owner. In case the driver who caused the accident intentionally fled but has fulfilled the civil liability of the motor vehicle owner, it is not a case of insurance liability exclusion.

- The driver does not meet the age requirements as prescribed by the Law on Road Traffic; the driver does not have a driving license or uses an invalid driving license as prescribed by law on training, testing, and granting of driving licenses for road motor vehicles; the driving license is erased or uses an expired driving license at the time of the accident or uses an inappropriate driving license for a motor vehicle that requires a driving license. In case the driver has his/her driving license revoked or has his/her driving license revoked, he/she is considered to have no driving license.

- Damage causing indirect consequences includes: reduction in commercial value, damage associated with the use and exploitation of damaged assets.

- Damage to property caused by driving a motor vehicle with a blood or breath alcohol concentration exceeding the normal value according to the instructions of the Ministry of Health ; using drugs and stimulants prohibited by law.

- Damage to property stolen or robbed in the accident.

- Damage to special assets including: gold, silver, precious stones, valuable papers such as money, antiques, rare paintings, corpses, and remains.

- Damage caused by war, terrorism, earthquake.

(Clause 2, Article 7, Decree 67/2023/ND-CP)

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)