The central exchange rate increased by 3 VND, the VN-Index increased by 7.43 points or the State Bank of Vietnam pumped a net 5,900 billion VND into the market... are some notable economic news on November 26.

| Review of economic information for the week of November 18-22 Review of economic information for November 25 |

|

| Economic news review |

Domestic news

In the foreign exchange market on November 26, the State Bank listed the central exchange rate at 24,295 VND/USD, a slight increase of 3 VND compared to the first session of the week.

The buying and selling prices of USD were kept unchanged by the State Bank of Vietnam at 23,400 VND/USD and 25,450 VND/USD, respectively.

On the interbank market, the dollar-dong exchange rate closed at 25,415 VND/USD, down only 2 VND compared to the session on November 25.

The dollar-dong exchange rate on the free market decreased by 10 VND in buying while remaining unchanged in selling, trading at 25,730 VND/USD and 25,840 VND/USD.

On November 26, the average interbank VND interest rate decreased by 0.03 - 0.15 percentage points in all terms of 1 month or less compared to the first session of the week; specifically: overnight 5.45%; 1 week 5.45%; 2 weeks 5.48% and 1 month 5.43%.

The average interbank USD offering rate decreased by 0.01 percentage point for overnight and 1-month terms while remaining unchanged for 1-week and 2-week terms, trading at: overnight 4.60%; 1-week 4.67%; 2-week 4.71%, 1-month 4.76%.

Government bond yields in the secondary market increased for 3-year and 5-year terms while decreasing for the remaining terms; closing at: 3-year 1.88%; 5-year 1.97%; 7-year 2.28%; 10-year 2.75%; 15-year 2.95%.

Yesterday's open market operations, on the mortgage channel, the State Bank of Vietnam bid 20,000 billion VND, 7-day term, interest rate at 4.0%. There were 20,000 billion VND won bids. There were 15,000 billion VND maturing on the mortgage channel. The State Bank of Vietnam bid 28-day SBV bills, interest rate auction. There were 300 billion VND won bids, interest rate kept at 4.0%. There were 1,200 billion VND maturing bills.

Thus, the State Bank of Vietnam pumped a net VND5,900 billion into the market through the open market channel yesterday. There were VND77,999.91 billion circulating on the mortgage channel, and VND17,450 billion in treasury bills circulating on the market.

The stock market continued to increase yesterday thanks to large-cap stocks such as banks, securities, and software. At the end of the trading session, VN-Index increased by 7.43 points (+0.60%) to 1,242.13 points; HNX-Index added 1.45 points (+0.65%) to 223.70 points; UPCoM-Index inched up 0.24 points (+0.26%) to 92.06 points. Market liquidity remained low with a trading value of nearly VND14,400 billion. Foreign investors net bought nearly VND200 billion on all three exchanges.

The State Bank of Vietnam is seeking opinions from organizations and individuals on the draft regulation on capital adequacy ratio for commercial banks and foreign bank branches. Regarding the capital adequacy ratio, the draft Circular stipulates the minimum capital adequacy ratio for commercial banks at 10.5%; of which, ensuring minimum Tier 1 capital of 6%, Tier 1 core capital of 4.5%; total Tier 1 capital and Tier 2 capital of 8%, capital preservation buffer of 2.5%. The draft regulation authorizes the Governor of the State Bank of Vietnam to decide in each period if necessary and does not provide specific requirements for the counter-cyclical capital buffer ratio, with the fluctuation range of 0-2.5%.

International News

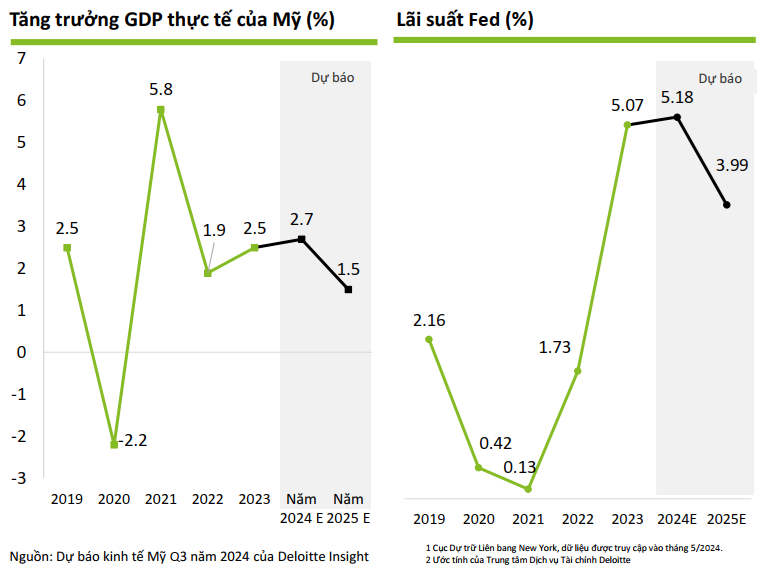

Minutes from the US Federal Reserve’s November meeting released yesterday showed that Fed officials agreed to continue cutting interest rates but at a “gradual” pace. The Fed believes that the country’s inflation is gradually decreasing and the labor market remains positive, allowing for further gradual interest rate cuts.

At the meeting, Fed officials agreed to cut the policy interest rate by 25 basis points to a range of 4.5 - 4.75%. However, officials are still debating the extent of interest rate cuts in the following meetings when there are still many uncertainties about economic conditions.

The market expects the Fed to continue cutting interest rates at its December meeting, although there are still concerns that President-elect Donald Trump's plans, especially his tariff policies, could increase inflation in the country.

The United States recorded several important economic indicators. First, the Federal Housing Administration (FHFA) said that the average home price in the country increased by 0.7% compared to the previous month in September, following a 0.4% increase in the previous month and stronger than the forecast of 0.3%. Thus, the country's home prices increased by about 0.7% in the third quarter and increased by 4.3% compared to the same period in 2023.

Next, new home sales in the US in October recorded 610 thousand units, lower than September's 738 thousand units and also lower than the expected 725 thousand units.

Finally, the Conference Board survey said the US consumer confidence index was at 111.7 points in November, up from 109.6 points in October and nearly matching the forecast at 111.8 points.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-ngay-2611-158169-158169.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)