The Consumer Financial Protection Bureau (CFPB) proposal would subject companies like Alphabet (Google), Apple, PayPal and CashApp to bank-like oversight over privacy protections, executive compliance with unfair and deceptive practices.

Reuters quoted a CFPB official as saying that if finalized, the proposal would regulate the operations of 17 companies with a total payment liquidity of $13 billion per year.

Since 2021, the CFPB has been cracking down on tech companies for failing to comply with privacy and competition laws. Last year, the agency launched an investigation into how payment platforms use user data.

In a statement on November 7, CFPB Director Rohit Chopra said that the technology sector has expanded into the financial services sector of the heavily regulated banking industry. “The new rule aims to prevent price gouging by ensuring that non-bank technology companies and payment platforms are under appropriate supervision.”

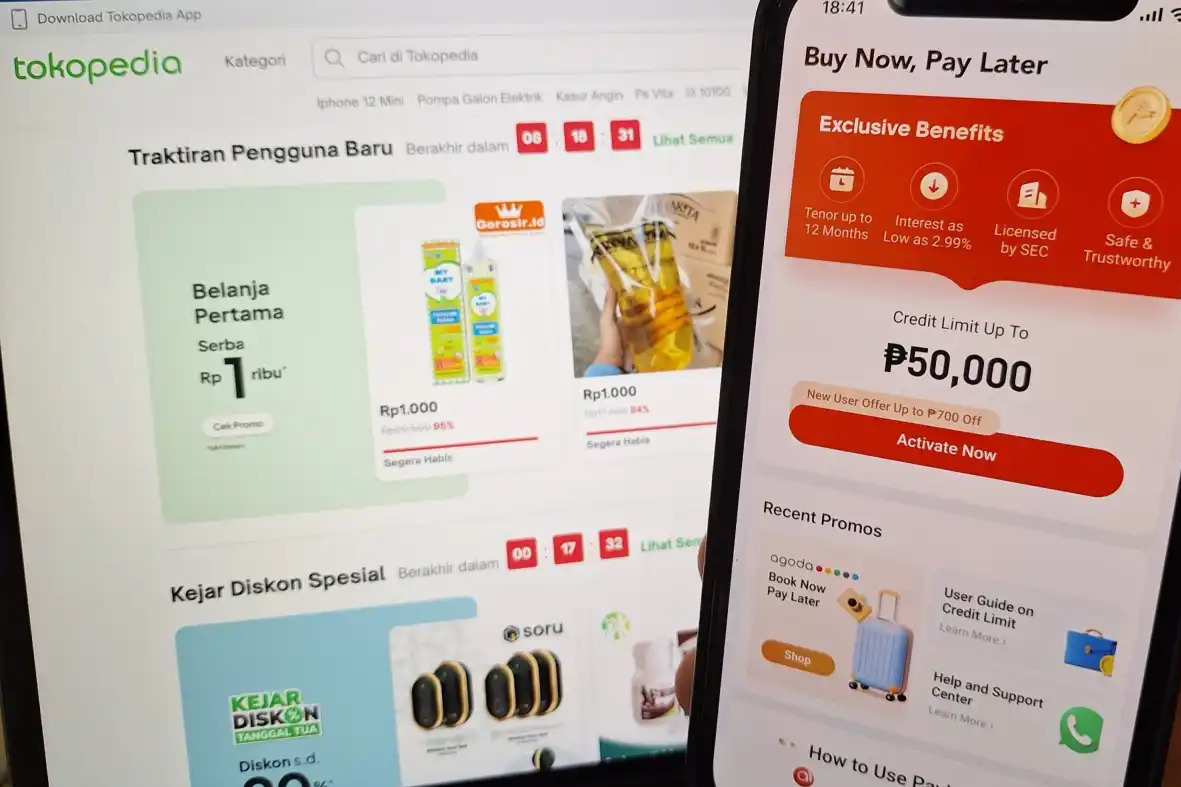

The CFPB also said that Big Tech has collected large amounts of user payment data, but has not ensured transparency, confusing policies that make it difficult for customers, but still makes money from that data. The new proposal is said to apply to companies with more than 5 million transactions per year.

In a statement, the Consumer Bankers Association called the proposal “a step in the right direction.” Meanwhile, the Electronic Transactions Association, which represents banks, fintechs and large tech companies, said in a statement that it wanted to “ensure this proposal achieves its goals of protecting consumers and applying public policy consistently to all players.”

The new proposal will be considered in a process that ends in early 2024.

China catches up with the US in the fintech race

Analysis from CNBC shows that the US is the leading country in the number of the world's most valuable financial technology (fintech) companies, followed by China.

Southeast Asian fintech startup fills lending gap with data

Many young Southeast Asians with limited access to traditional financial services are turning to fintech startups for loans.

Seoul invests 5 trillion won to become fintech capital

Seoul Mayor Oh Se Hoon said he will pour 5 trillion won ($3.7 billion) to turn fintech startups into unicorns and make the South Korean capital a global fintech capital.

Source

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)