"Heart attack" all year

2023 is a year that brings mixed emotions to stock investors. If at the beginning of the year, stock buyers were elated, by the end of the year, anxiety covered the entire market. In the last days of 2023, emotions were mixed as the VN-Index increased steadily but cash flow dried up.

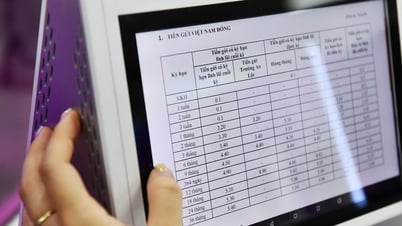

Specifically, the end of 2022 and the beginning of 2023 will be the period when interest rates will be continuously adjusted to decrease deeply. Along with that, there will be a series of measures to support businesses, especially the real estate industry. Many conferences to remove difficulties for real estate are continuously organized by ministries and branches to create confidence in the market.

As a result, the VN-Index recorded a fairly long increase and nearly reached the 1,250 point threshold in early September. Along with the increase in points, the stock market was also optimistic because liquidity improved, the market became more vibrant.

Having had a “heart attack” all year witnessing huge fluctuations in the market, the brave people deserve a “Tet bonus” of 722,000 billion VND. Illustrative photo

However, since mid-September, profit-taking pressure has appeared, causing the VN-Index to reverse and drop sharply to 1,025 points. October was the most "heart-breaking" month for investors when a series of rumors appeared, creating a sell-off. However, in reality, none of the rumors were true, so investor sentiment stabilized again.

Received "Tet bonus" of 722,000 billion VND

Mid-2023 was the most “painful” period of the stock market. Those who bravely stayed in the market enjoyed sweet rewards. Overall, in 2023, the VN-Index still rose quite strongly, bringing huge profits to investors.

Specifically, at the end of the last trading session of 2023, the VN-Index stopped at 1,129.93 points, after increasing by 122.84 points, equivalent to 12.2% to 1,129.93 points compared to December 30, 2022. Thanks to that, the market capitalization of the Ho Chi Minh City Stock Exchange increased by VND 539,176 billion (equivalent to USD 22.1 billion).

If we include the Hanoi Stock Exchange, by the end of the year, the total market capitalization reached nearly VND6 million billion, up 14% compared to the beginning of the year. The capitalization of Vietnam's stock market has increased by nearly VND722,000 billion (about USD30 billion).

It can be seen that investors received a "Tet bonus" of 722,000 billion VND, but it is noteworthy that finance, banking, and real estate - the largest industries in the market - are not the groups with the best profitability.

In 2023, Equipment and Machinery Manufacturing will lead in terms of profitability with an increase of 2.18%. Following are the following industry groups: Plastics and Chemicals Manufacturing (2.02%); Other Finance (1.47%); Supporting Manufacturing (1.13%), Healthcare (1.1%), etc. The real estate industry will only increase by 0.04%.

On the contrary, the Banking industry group decreased by 0.04%, Insurance decreased by 0.61%,...

Low interest rates support stocks in 2024

With the interest rate level in the fourth quarter of 2023 even lower than the Covid-19 period, VCBS Securities Company believes that low interest rates continue to be the main factor supporting market valuation in 2024.

On the other hand, the risks that the Vietnamese economy and stock market will have to face are: the trend of loosening monetary policy is temporarily suspended in the context of both purchasing power (domestic and international) and capital demand of the Vietnamese economy have not significantly improved; Commodity prices rebound along with the strengthening trend of the USD leading to higher inflation; Geopolitical tensions in the region and the world continue to pose the risk of negatively affecting the economic growth of Vietnam's major trade and investment partners.

In such a context, the general market development in the medium term will likely be alternating ups and downs accompanied by differentiation in the industry between leading enterprises with stable business prospects and better endurance than the rest of the industry.

In the long term, Vietnam will be a bright spot in economic growth in the region in the post-Covid-19 pandemic period and continue to maintain great attraction for foreign investment flows, both direct (FDI) and indirect (FII).

In general, the trend of VN-Index since the Covid-19 pandemic has been in line with the trend of interest rate fluctuations. Choosing the reference for the interest rate as the VND deposit interest rate paid after the 12-13 month term and adjusting it according to the average liquidity of the market session in each specific period, VCBS forecasts that the highest level that the VN-Index can reach in 2024 is the 1,300 point area.

“However, we also need to note that the stock market is likely to record sharp corrections alternating with increases in the context of being affected by both positive supporting factors and negative impacts from existing global macroeconomic risks,” VCBS recommended.

Source

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

Comment (0)