PetroVietnam Fertilizer and Chemicals Corporation - JSC (Phu My Fertilizer, HOSE: DPM) has announced its financial report for the third quarter of 2023, recording revenue of VND 2,946 billion, down 21% year-on-year. However, due to the rapid increase in the cost of domestically produced goods, the company reported a pre-tax profit of VND 93 billion, down about VND 1,200 billion in profit compared to the third quarter of 2022.

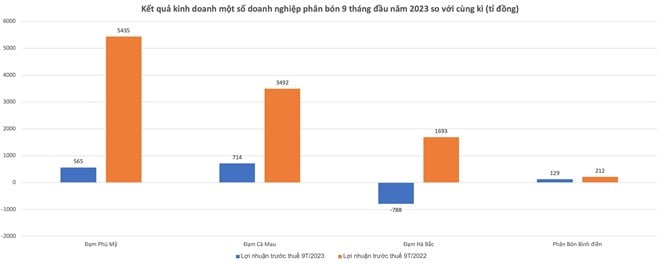

Accumulated in the first 9 months of this year, Phu My Fertilizer earned 565 billion VND in pre-tax profit, down about 4,870 billion VND compared to the same period (5,435 billion VND), thereby only completing 21% of the profit plan set out at the beginning of this year (2,670 billion VND).

Similar to Phu My Fertilizer, another big player in the fertilizer industry also reported a sharp decrease in profits, namely Ca Mau Petroleum Fertilizer Joint Stock Company (Ca Mau Fertilizer, HOSE: DCM). Specifically, at the end of the third quarter of 2023, Ca Mau Fertilizer's revenue reached VND 3,011 billion, down 9% compared to the third quarter of 2022. Pre-tax profit was nearly VND 105 billion, down 87%.

Explaining the fluctuations in business results, Mr. Le Ngoc Minh Tri - Deputy General Director of Phu My Fertilizer - informed that profits in the period decreased sharply due to the decrease in fertilizer prices, which reduced revenue, while the cost of goods increased sharply. In addition, selling expenses increased because the Company promoted sales activities, expanded markets and exported goods.

After 9 months, Phu My Fertilizer achieved more than VND 9,036 billion in revenue, 21% lower than the same period. Pre-tax profit reached VND 714 billion, down 80%. Compared to the target approved by the 2023 Shareholders' Meeting, the company achieved nearly 49% of the annual profit plan.

Ha Bac Fertilizer and Chemicals Joint Stock Company (Ha Bac Fertilizer, UPCoM: DHB) continues to sink deeper into losses. Accordingly, in the last quarter, Ha Bac Fertilizer reported revenue of VND 1,138 billion, down 35% compared to the third quarter of 2022. At the same time, the company reported a pre-tax loss of VND 309 billion, while in the same period last year it made a profit of VND 347 billion.

According to Dam Ha Bac, during the period, the Company's consumption situation encountered many difficulties due to the sharp decrease in domestic Urea and NH3 prices following world prices. In addition, the prices of coal, materials, and other input materials remained high. Domestic coal sources were always in a state of shortage, pushing up product prices.

Not to mention, interest expenses still account for a large proportion because the mechanisms to remove difficulties have not been resolved. The sharp increase in the US dollar exchange rate has led to a sharp increase in financial costs, reducing the company's production and business efficiency.

Accumulated in the first 9 months of 2023, Ha Bac Fertilizer achieved 3,224 billion VND in revenue, down 39% over the same period, achieving 70% of the yearly plan. Pre-tax loss was 788 billion VND (same period profit was 1,692 billion VND).

Notably, as of September 30, 2023, Ha Bac Fertilizer is suffering an accumulated loss of nearly VND 3,763 billion. This causes the company's equity to be negative VND 1,041 billion, in the context of the owner's equity being at VND 2,722 billion.

Meanwhile, Binh Dien Fertilizer Joint Stock Company (HOSE: BFC) recorded pre-tax profit of VND87 billion, up 1,170% compared to the third quarter of 2022. However, after 9 months, the company's after-tax profit decreased by 39%, to VND129 billion.

According to the financial statement of Binh Dien Fertilizer, the company's profit in the third quarter of 2022 increased mainly due to the high demand for fertilizer from farmers, so the sales volume increased compared to the same period, and the gross profit margin also increased. However, the increased sales volume was only concentrated at the parent company, while the high-priced raw material inventory at the subsidiary had not been sold out in the past, so the business results at the subsidiary were not profitable.

In the first 9 months of the year, high bank interest rates also increased the interest expenses of the entire Binh Dien system. At the same time, to maintain market share as well as increase sales output, the Company applied many different sales policies, so the sales expenses in the first 9 months of the year increased. In addition, high-priced raw material inventories at the Subsidiary Company caused the consolidated profit in the first 9 months of 2023 to decrease compared to the same period.

Source

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)