Investment Comments

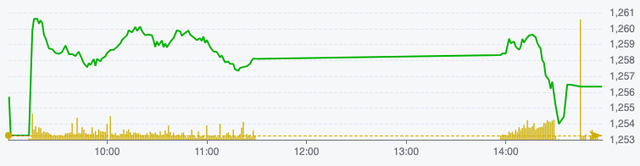

Tien Phong Securities (TPS): The sharp decrease in liquidity in the session of September 12 shows that both buyers and sellers need a clear and strong market move to confirm the next trend.

The trading session on September 13 is of great importance to the trend. If liquidity rebounds, the trend of the session on September 13 will have a great impact on the market's future trend.

Investors who accept the risk and have disbursed previously can reduce their proportion. Investors with low risk appetite should still wait for a clear signal from the market before disbursing.

VN-Index performance on September 12 (Source: FireAnt).

VPBank Securities (VPBankS): The fluctuations may continue when testing supply in the upcoming sessions with low liquidity.

Market cash flow is still in leading stock groups such as banks, securities, real estate, etc. Although market liquidity has decreased, the positive breadth shows that investors are looking for opportunities in the context of recovery sessions that are often technical.

Investors can continue to observe market developments at the resistance zone of 1,260 - 1,265 points when the VN-Index has lost the MA50 and MA100-day lines at this level.

Saigon - Hanoi Securities (SHS): In the short term, the VN-Index trend is still negative when trading below the 20-session average price range, equivalent to 1,265 - 1,270 points.

VN-Index may continue to be under pressure to correct to the psychological support zone of 1,250 points and recover to retest the current nearest resistance zone of around 1,265 points.

Investment Recommendations

- PLX (Vietnam National Petroleum Group – Petrolimex): Neutral. 1-year target price is 48,000 VND/share, up 3.4% from current.

PLX's domestic petroleum consumption remained at 2.65 million m3/ton (up 0.6% YoY). However, retail sales increased at a rate of 4% YoY and 2.8% QoQ, reaching 1.85 million tons.

PLX opened 60 new stations in the first 7 months of the year, expanding the number of gas stations by 2% since the beginning of the year. In addition, the profit margin in the second quarter of 2024 is also supported by Decree 80, which will take effect from November 2023. This Decree shortens the cycle of adjusting gasoline prices from 10 days to 7 days and adjusts other components of the retail price formula more frequently and more closely follows the actual costs of the business.

With higher-than-expected Q2/2024 profit, SSI estimates 2024 pre-tax profit to increase by 12% to VND4,950 billion (up 25% YoY), mainly due to increased profit margins. SSI forecasts domestic gasoline consumption at 10.76 million tons (up 4.1% YoY) and retail sales at 7.3 million tons (up 4.5% YoY).

For 2025, SSI forecasts that pre-tax profit will increase by 6% to VND5,250 billion (up 12.7% YoY) thanks to a 4.1% increase in gasoline consumption.

- OCB (Oriental Commercial Joint Stock Bank): Pending sale.

According to TCBS Research, Moody's has upgraded OCB Bank's outlook from "negative" to "stable", reflecting improvements in the bank's financial factors, including the ability to maintain capital stability and asset quality after OCB achieved positive results in risk management and profit growth.

Moody's said that OCB has made solid progress, helping to improve its ability to cope with future risks. Investors can continue to hold shares and wait for profit-taking opportunities.

Source: https://www.nguoiduatin.vn/lang-kinh-chung-khoan-13-9-co-the-chiu-ap-luc-dieu-chinh-ve-vung-1250-diem-204240912160359735.htm

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

Comment (0)