Business owes tax, director's departure is delayed

Last week, the Saigon Port Customs Branch, Region 4 (HCMC Customs Department) sent 5 notices to the Exit Management Department (Ministry of Public Security) requesting temporary suspension of exit for a number of legal representatives of enterprises with tax debts. Of which, the highest tax debt is 680 million VND for Quy Thinh Trading Company Limited (District 12, HCMC). The administrative decision on tax management, not yet completed tax payment obligations of this enterprise was issued in October 2013, nearly 11 years ago.

Second is the tax debt of 290 million VND of ATB Food Industry Company Limited (District 5, Ho Chi Minh City), the person whose exit was delayed is Mr. NHH - Chairman of the Board of Directors and Director. In addition, there is Mr. DHS - Chairman of the Board of Directors, legal representative of Saigon DD Wood Company Limited (the company owes 62 million VND); Ms. TTQ - Director of ND Construction, Trade and Service Company Limited (District 2, Ho Chi Minh City, still owes more than 10.2 million VND)...

Many businesses with tax debts have had their legal representatives issued exit suspension notices by customs authorities.

In particular, in the 5 temporary exit suspension notices of the above customs unit, there is the case of Ms. LHB - Chairman of the Board of Directors and Director of GT Chemical Trading Company Limited (Binh Duong). Ms. LHB was requested to temporarily suspend her exit from May 18 because the company she is legally representing owes 997,222 VND in taxes. The decision to enforce the decision "not yet fulfilling tax obligations" was made 10 years ago, in May 2014. Similarly, in February, the director of a company in Ho Chi Minh City was also temporarily suspended from leaving the country because the company owed 1.1 million VND in taxes, not including late payment penalties.

In addition, there are some cases where many people only found out at the airport that they were temporarily suspended from leaving the country due to tax debts. For example, in October 2023, Ms. LTV, legal representative of Baby Care Trading Company Limited (District 1, Ho Chi Minh City), submitted a petition to the Saigon Port Customs Branch, Region 1 because she received a notice of temporary suspension of exit while she had never been a director and did not know anything about Baby Care Company. She affirmed that her information was stolen to establish a company with bad intentions, evade taxes and requested the business registration licensing agency to coordinate work, provide Baby Care Company's records to the police to verify the forgery, revoke the business registration certificate of this company, and cancel the notice of temporary suspension of exit for her.

It can be seen that more and more business leaders are banned from leaving the country because of tax debts, even for very small amounts, less than 1 million VND. Many opinions say that postponing the departure of business leaders just because of 1 million VND in tax debts is "a bit too much".

Regarding this, lawyer Nguyen Quoc Toan, Director of IAM Law Firm (HCMC), said that tax debt, even 1 dong, is a violation and individuals and businesses involved in overdue tax debt are all subject to the same legal provisions. Tax does not distinguish between rich and poor. That is, there is no such thing as a small or large debt, only overdue debt is a violation.

Citing the story of an old American man who paid his house tax of $500 but forgot about the interest accrued during the time the payment check was sent, which was $8.41, and then three years later had his house worth $60,000 seized, lawyer Nguyen Quoc Toan said: If you owe more than $8, your property can be seized. The principle of American law is that if you do not pay enough tax in the previous year, the property owner will be considered to have tax debt. Here, the tax debt of the enterprise is only nearly 1 million VND, a small number at first, but if you calculate the overdue debt and interest debt over the past 11 years, the debt certainly does not stop at 1 million VND.

Sharing the same view, Associate Professor, Dr. Dinh Trong Thinh (Academy of Finance), financial economics expert, commented: Tax is a legal regulation with the highest legal nature, contributing to the state budget that every individual and enterprise with revenue and profit must pay. In principle, enterprises and their legal representatives must calculate, declare, and comply with tax payment.

"Simply put, decisions to temporarily suspend exports or enforce customs duties related to tax debts aim to ensure the rule of law for businesses and entrepreneurs. Once a business is established and is the legal representative of the business, the rule of law must be put first. Tax debt and tax enforcement notices are sent to businesses many times by the management agency. During that time, how could the legal representative of the unit not know? Or do they think the amount is small and not worth worrying about? I think there should be no discrimination and leniency in cases of tax arrears like this," Associate Professor, Dr. Dinh Trong Thinh expressed his opinion.

Late tax refund for businesses, who is responsible?

If the tax industry increasingly tightens tax payment and tax debt, on the other hand, many businesses believe that for late tax refunds, the tax authority also needs to take responsibility.

Recently, Vietnam Rubber Investment Company Limited said that the company has been delayed in tax refunds for about 2 years now, with an amount of up to nearly 70 billion VND. The amount of delayed tax refunds is even larger than the company's capital. The company is forced to temporarily suspend operations because it has no working capital. According to the company representative, although facing difficulties, the company cannot dissolve because if it dissolves, it will be much more difficult to complete the procedures to receive tax refunds later. The "temporary withholding" of tens of billions of VND in value added tax has caused the company to lack financial resources, unable to fulfill export orders and continuously lose customers.

Previously, in 2023, many wood industry enterprises also reported that it was "as difficult as reaching the sky" to get a VAT refund. For example, Fococev VN Joint Stock Company was delayed in refunding VND355 billion and had submitted 29 tax refund dossiers from June 2020 to February 2023. Some enterprises said that they were "collateral damage" from enterprises that had closed down and fled their business registration addresses, while the tax refund dossiers required verification of invoices and documents of these enterprises.

According to lawyer Nguyen Quoc Toan, the VAT refund is actually the tax that the enterprise has paid when purchasing domestic goods to process for export. This means that the enterprise has advanced money to the state budget to "keep", so after the enterprise meets the regulations, the tax authority must be responsible for refunding. However, not all enterprises have met the requirements for a complete set of input purchase invoices to receive a tax refund. Therefore, most of the applications are delayed due to failure to meet the requirements, or are stuck in the process of verifying invoices and documents. Especially at a time when the number of enterprises closing down or going bankrupt is up to thousands of enterprises every month.

"Verifying invoices is an internal matter of the tax sector. However, the tax sector must ensure that the law requires that tax refund applications for businesses be processed within 40 days. The tax sector's responsibility is not only to collect taxes correctly, fully, and promptly, but also to be responsible for fighting tax evasion, fighting tax fraud, especially fighting the appropriation of the state budget through value-added tax refunds. If the investigation and verification are not thorough, allowing the state budget to be appropriated, tax officials will be held responsible. In reality, there are no regulations on how tax agencies that delay tax refunds will be handled," said lawyer Toan.

According to Mr. Dau Anh Tuan, Deputy General Secretary of the Vietnam Federation of Commerce and Industry (VCCI), the delay in VAT refunds has greatly affected the capital flow for production and business, causing huge losses for businesses. In particular, the time required to verify documents is often prolonged and many businesses report that "they do not know when it will be completed".

Source: https://thanhnien.vn/co-nen-hoan-xuat-canh-lanh-dao-dn-vi-no-chua-toi-1-trieu-dong-tien-thue-185240520232133915.htm

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

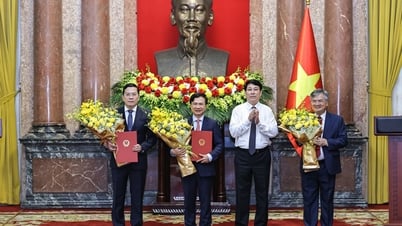

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

Comment (0)