Appraisal companies are "afraid" to... appraise.

Raising questions at the 31st Session of the National Assembly Standing Committee on the morning of March 18, delegate La Thanh Tan (Hai Phong delegation) asked the Minister of Finance to inform about the results of price inspection in 2023 and solutions to improve the effectiveness of price inspection in the coming time.

He also wanted to know the minister's views and solutions to the current situation where many valuation enterprises refuse to appraise bidding prices for purchasing equipment for regular operations of State agencies and calculate land prices to determine financial obligations to the State.

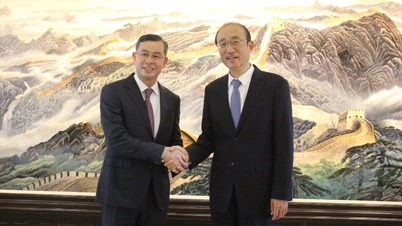

Responding to delegates, Minister Ho Duc Phoc said that the prices of goods, land and products determined by the State are specifically regulated in the Law on Prices and specialized laws. Accordingly, specialized prices are assigned to ministries for management, while the Ministry of Finance provides general guidance.

Regarding the fact that there are companies that refuse to conduct appraisals, Mr. Ho Duc Phoc said that there are many reasons: It could be because these companies have a lot of work, are afraid of legal risks (due to poor capacity, regulations have different interpretations, which can lead to violations...)

He gave an example of determining land prices using the surplus method, which means estimating assumptions leading to many different parameters, which can later lead to errors and the appraisal agency giving the consulting opinion is still responsible.

"The house is a future asset estimated to be sold at 20 million VND/m2, but when sold at 25 million VND/m2, the assessment result was wrong, the appraisal unit is responsible" - Mr. Phoc cited.

Using the right to debate, delegate Ta Van Ha - Vice Chairman of the Committee on Culture and Education emphasized that valuation companies play an important role in the economy . Through recent cases, it has been shown that some companies are responsible for or assist in "depressing" or raising prices.

Among many reasons, Mr. Ta Van Ha said that recently, the number of valuation enterprises has increased too much, then the issue of operational efficiency and professional ethics. There have been cases of collusion, violations and being handled, so now there is a phenomenon of not daring to do it, affecting the general operation.

"I would like to request the Minister to further clarify, with the role of State management, as the agency that issues certificates of eligibility to operate in valuation services, what is the responsibility, what solutions to overcome those limitations, so that valuation companies can operate normally, without affecting the economy" - Mr. Ta Van Ha raised the issue.

Continuing to answer the delegates, Minister of Finance Ho Duc Phoc stated that the view that the ministry has licensed many valuation companies is not entirely correct. Currently, there are only more than 200 valuation companies. To be granted a certificate, appraisers must undergo training and exams, and in the past 3 years, the number of successful applicants has never exceeded 33% of the total number of applicants. The agency strictly manages licensing and operations.

"Like the SCB case, it is clear that the world's leading auditing companies all audited but all violated, so it is clearly due to the auditors and appraisers, not the management" - Mr. Ho Duc Phoc said.

According to the Minister of Finance, some legal documents still have "loopholes" that appraisers take advantage of. Taking the example of land valuation, he said that "according to the surplus method, anyone who goes back to check will find mistakes". Because, the assumption is based on the investment rate because the asset is formed in the future.

"A house when establishing a project, approving technical design, making estimates, but when auditing, inspecting, and checking, it still cuts 5-10%, let alone assuming according to investment rate", according to Mr. Ho Duc Phoc.

The minister also frankly pointed out that there are projects that are not included in the investment rate regulations. For example, the investment rate does not have 3-4 basements, and there are no individual houses from the 4th floor up, but only floors 1 to 3, so we have to assume and the assumption may not be correct.

"Thus, partly due to legal regulations, partly due to price appraisers intentionally making mistakes, if violations occur, disciplinary action must be taken, even criminal action" - the Minister of Finance emphasized.

Not excluding intentional collusion

Delegate Pham Van Hoa (Dong Thap delegation) assessed that among more than 200 independent auditing enterprises, the majority performed their service functions well. However, there were many cases where the audit subjects' errors were overlooked for the auditors' own benefit, leading to loss of state budget and covering up negative violations, such as the SCB case where up to 3 large-scale auditing enterprises committed violations.

"With the function of managing the industry, what solutions does the Minister have to prevent and deter negativity in the private auditing industry?" - Mr. Pham Van Hoa questioned.

In response, the Minister of Finance once again said that some recent cases of independent audits having violations in some criminal cases were due to many factors: staff capacity, sense of responsibility and not excluding collusion in intentional violations.

The Ministry of Finance has very strict instructions from the training stage to the certification examination for auditors. The whole country has 221 auditing companies, 2,363 auditors. Auditing methods have also been issued.

He said that in the coming time, he will continue to tighten the operations of the auditing company to re-examine the records to see if there are any violations and then handle them. Along with that, he will strengthen training, improve professional ethics, culture and service level to perform the task.

Source

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)