SGGPO

Strong selling pressure with high liquidity caused VN-Index to fall nearly 30 points in the first trading session of the week. Foreign investors net sold a record amount of nearly VND1,062 billion on the HOSE floor.

|

| Market fell sharply in the first trading session of the week |

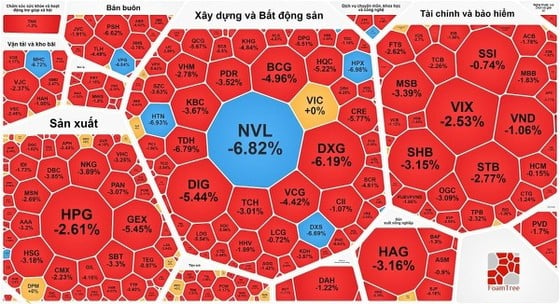

The Vietnamese stock market opened the trading session on September 11 with an immediate increase of nearly 10 points. However, after that, selling pressure increased sharply, causing the market to gradually "fade". Investors quickly switched from a state of "excitement" to "panic", so they turned to sell off stocks, causing the market to fall across the board. The VN-Index went from an increase of 10 points to a close of a decrease of nearly 18 points, or 28 points in the session.

Pillar stocks such as VIC increased by nearly 4% at one point but closed the session back to the reference price, VHM decreased by 2.78%, VRE decreased by 3.04%, MSN decreased by 2.69%, HPG decreased by 2.61%... causing great pressure on the index.

Real estate stocks fell the most. In addition to the Vingroup trio, NVL hit the floor, DXG fell 6.19%, DIG fell 5.44%, PDR fell 3.52%, HDC fell 5.56%...

Banking stocks were also in the red. Except for VPB which increased by 0.46%, the rest of the major banks all decreased, such as: STB decreased by 2.77%, TCB decreased by 2.26%, VCB decreased by 1.12%, CTG decreased by 1.24%, SSB decreased by 1.82%, ACB decreased by 1.76%, VIB decreased by 1.94%, MBB decreased by 1.83%, BID decreased by 1.06%...

Although the securities group increased strongly during the session, due to massive selling pressure, at the end of the session, VCI increased by 1.3%, CTS increased by 1.2%, and AGR increased by 1.1%.

Many other stocks turned to decrease quite strongly such as: SBS decreased by 3.2%, SSI decreased by nearly 1%, VDS decreased by 2.7%, FTS decreased by 2.6%, VND decreased by 1.06%...

Steel stocks are also not out of the general trend with NKG down 3.89%, HSG down 3.18%, HPG down 2.61%...

At the end of the trading session, VN-Index decreased by 17.85 points (1.44%) to 1,223.63 points with 446 stocks decreasing, only 85 stocks increasing and 39 stocks remaining unchanged.

At the end of the session at Hanoi Stock Exchange, HNX-Index also decreased by 4.87 points (1.9%) with 157 stocks decreasing, 54 stocks increasing and 56 stocks remaining unchanged.

Liquidity increased sharply, total transaction value in the whole market was nearly 36,100 billion VND, of which HOSE alone accounted for nearly 32,200 billion VND.

Not only domestic investors sold off, but foreign investors also sold a record net of nearly VND1,062 billion on the HOSE. Previously, in August 2023, foreign investors net sold VND4,079 billion, up 112% compared to the previous month. In the first week of September, foreign investors continued to net sell VND1,305 billion on the HOSE.

Source

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)